FX Daily Strategy: N America, April 15th

GBP may recover against the EUR even if labour market data shows weakness

CAD should hold firm against the USD helped by CPI

EUR/USD strength not supported by yield spreads but could still continue

GBP may recover against the EUR even if labour market data shows weakness

CAD should hold firm against the USD helped by CPI

EUR/USD strength not supported by yield spreads but could still continue

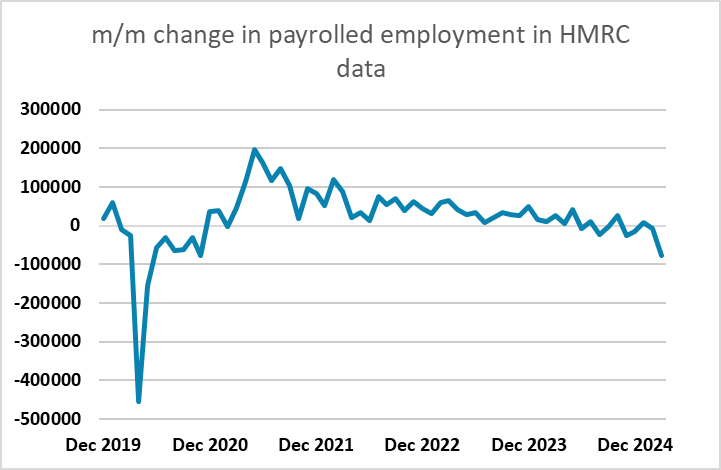

UK labour market data was on the soft side of expectations, with the HMRC data showing a m/m decline of 78k in payrolled employment, the largest since the pandemic in May 2020, and median earnings growth falling to 4.8% y/y, the second lowest since 2021. While the March data is provisional, and the ONS data for February is less weak (but with earnings still on the weak side of expectations), the numbers support a BoE easing in May, although this is already nearly 90% priced in.

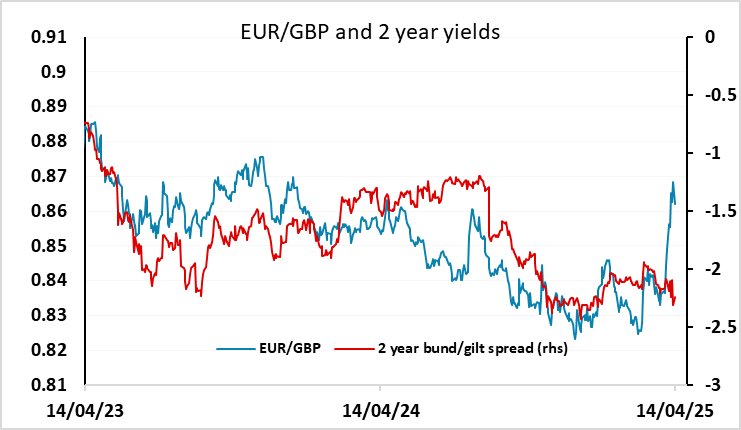

Even so, the data is unlikely to be negative for GBP, as the pound has not been moving with yields in the last couple of weeks, but has sold off against the EUR due to the general decline in risk appetite which has hurt all the higher yielders. But as the markets stabilise, albeit at lower levels, there is scope for GBP to recover, and we have seen some improvement in the last 24 hours. There is still scope for a further GBP recovery, with the latest data generally encouraging from a risk perspective, with the GDP data stronger and the lower earnings growth helping to moderate inflation concerns and allowing some easing in monetary policy. The UK policy of reducing rather than increasing tariffs is also favourable in this environment, so even though a rate cut now looks more certain, this should prove GBP supportive.

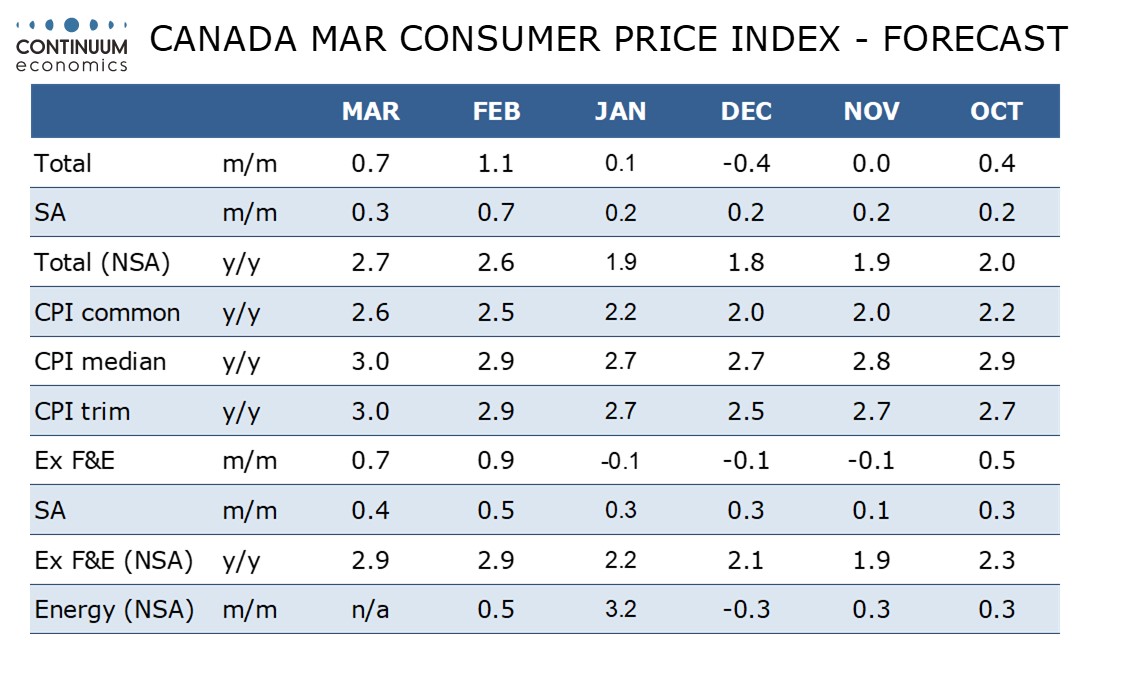

We also have Canadian CPI later on, which takes on greater significance given the BoC meeting on Wednesday. We expect March Canadian CPI to increase to increase to a 9-month high of 2.7% yr/yr from 2.6% in February. We also expect the Bank of Canada’s core rates to move higher, moving further above the 2.0% target. These forecasts are above consensus, so may be slightly CAD positive with the market currently divided on whether to expect a BoC rate cut on Wednesday. A 25bp cut is priced as around a 40% chance, and we are in line with the majority in expecting no change, but the CPI data could influence our and the market’s view. We do not expect that a pause at this meeting will mark the end of the easing cycle, but our view of firmer CPI should be mildly CAD supportive.

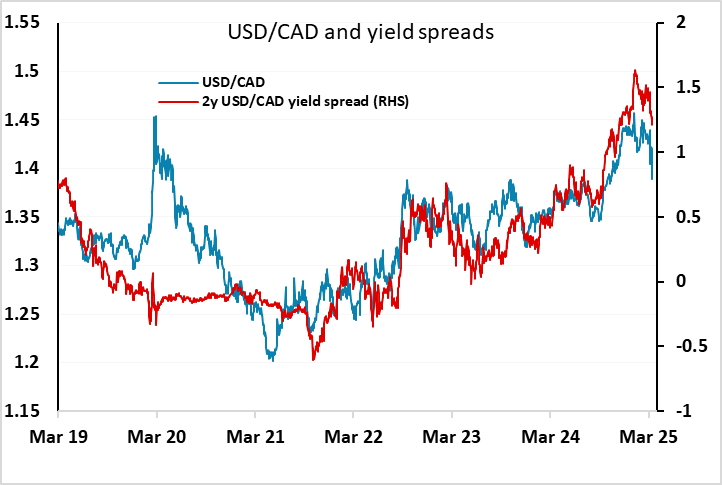

The CAD has broadly continued to follow moves in front end yield spreads with the USD, at least directionally, even if the CAD has somewhat outperformed in scale as the USD has generally struggled. The market may be overestimating the scope for Fed easing judging by recent Fed comments, and there may be scope for US front end yields to edge higher this week if Powell sounds hawkish relative to the market. But for now we would expect USD/CAD to remain biased slightly lower.

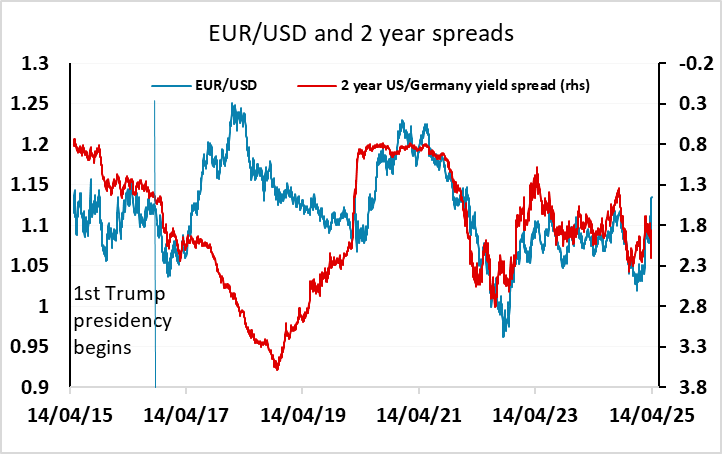

The USD’s weakness against the EUR isn’t showing the same sort of correlation with yield spreads as the USD/CAD move, with EUR/USD very much moving in the opposite direction to yield spreads in the last couple of weeks. This was a phenomenon that was very much in evidence in Trump’s first term, so although there is scope for some correction to recent EUR/USD strength if we see a stabilisation in equity and bond markets, we wouldn’t look to oppose EUR strength on the basis of the yield spread moves at this stage.