FX Daily Strategy: APAC, November 6th

GBP might recover slightly if the BoE MPC leave rates unchanged as expected…

…but GBP is still likely to weaken in the coming months

JPY weakness on Thursday may alert the Japanese authorities

SEK risks may now be on the upside

GBP might recover slightly if the BoE MPC leave rates unchanged as expected…

…but GBP is still likely to weaken in the coming months

JPY weakness on Thursday may alert the Japanese authorities

SEK risks may now be on the upside

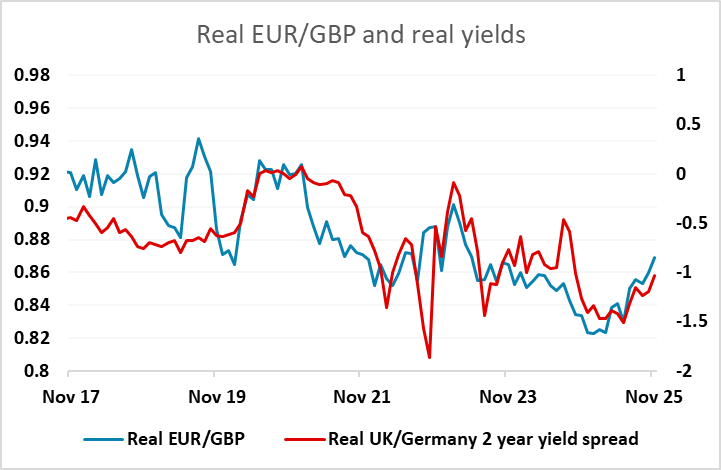

The BoE MPC meeting is the main event for Thursday. Ahead of the meeting, the market is pricing a 25bp rate cut as a 30% chance – a much bigger risk than a few weeks ago due to the softer CPI and labour market data, while there is also some impact from the increased anticipation of fiscal tightening in the Budget on November 26. However, the MPC is unable to take the Budget into account until they see the details, so we doubt they will be prepared to cut rates this time, although there are likely to be at least a couple of votes for a cut. Indeed the market median expectation is for a 6-3 vote for no change, up from 7-2 at the September meeting. Clearly, a rate cut would be significantly GBP negative, but if rates are left unchanged, the initial market reaction will focus on the vote split. GBP might still decline on a 5-4 vote for a cut, but would likely rise modestly if the vote is 6-3.

We continue to expect a rate cut in December, and given that the MPC can’t take the Budget into account at this meeting, there is a possibility that they will even contemplate a larger cut of 50bps if they leave rates unchanged this time if the Budget produces a substantial fiscal tightening. So while unchanged rates might see some mild corrective gains for GBP, we would still see potential downside for the pound by the end of the year, as substantial tax increases do seem near certain in the Budget following Chancellor Reeves’ speech this week. We continue to expect EUR/GBP to edge towards 0.90 in the coming months as real front end yield converge with EUR yields.

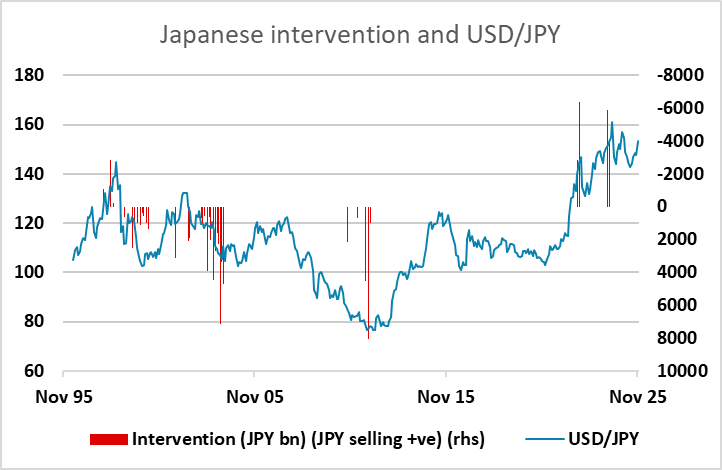

Otherwise, the USD remains firm after the strong ISM services survey on Wednesday. USD/JPY saw the most significant rise, threatening the resistance area at 154.40/50. Higher US yields provide little reason for renewed JPY weakness given that the sharp narrowing of spreads we have seen in recent months failed to push the JPY higher. Rather, JPY weakness, particularly on the crosses, continues to move with equity market gains, and equity indices all recovered well after the ISM release. A break of the 154.40/50 resistance could trigger stops and more JPY losses, but could also be expected to attract the attention of the Japanese authorities, as Finance Minister Katayama has already called the recent JPY decline “rapid and one-sided”. We are definitely in the area where the Japanese authorities will be considering intervention. If they do take action we would expect it to be quite effective given the JPY’s underperformance of all the normal metrics in recent months which suggests speculative positioning has led the JPY decline.

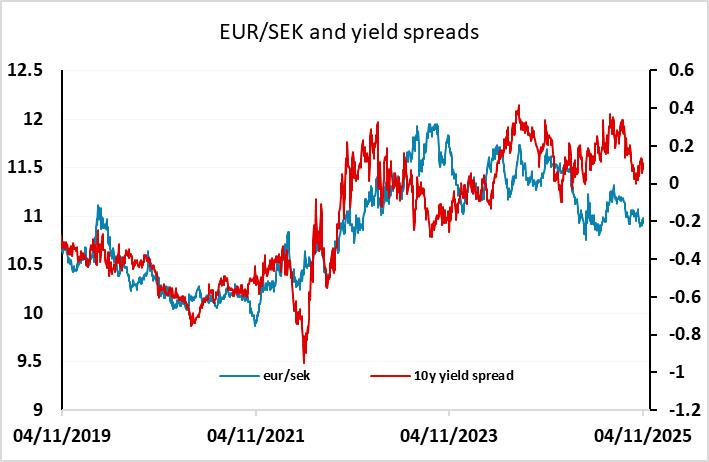

In Europe there is preliminary Swedish October CPI and German September industrial production. With both the Riksbank and the ECB expected to keep rates on hold for the foreseeable future, neither of these releases is likely to have too much impact. While the SEK has somewhat outperformed yield spreads this year, the recent data has been quite encouraging and we wouldn’t expect too much weakness in the SEK even if CPI were to undershoot. If anything, the SEK risks could start to turn to the upside if the Swedish data continues to show some strength.