USD flows: Still soft despite strong PPI

PPI came in stronger thna expected, but the market mood is still dominated by yesterday's CPI

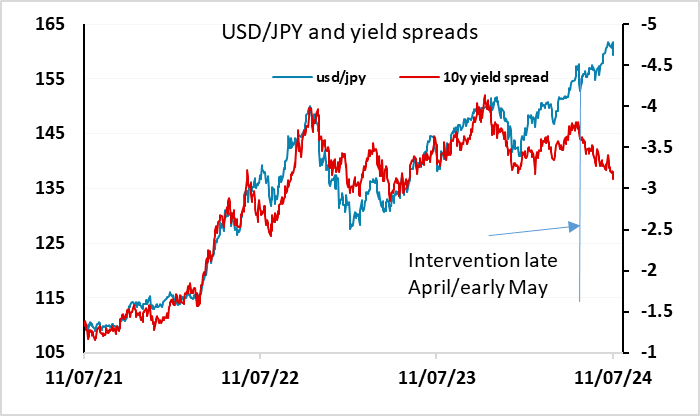

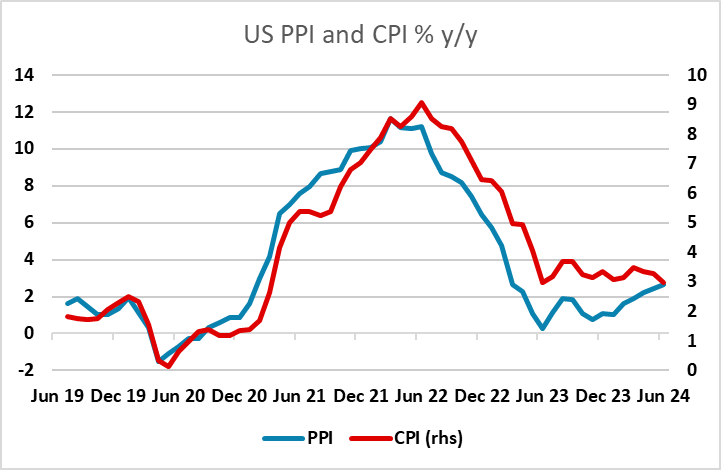

The US PPI data are on the strong side of expectations, with headline up 0.2% and core 0.4% against 0.1% and 0.2% expected. There were also significant upward revisions to the May data, so the y/y rate for the core was up to 3%. There hasn’t been much market reaction, with US yields nearly unchanged, but it may be a concern for the Fed ahead of the September FOMC if they see the PPI as potentially leading CPI. Nevertheless, after an initial bounce the USD has slipped back, and now that the market has priced in three Fed cuts by year end it will probably require either labour market or CPI data or a Fed statement for the market to price these out. The USD downside is consequently still favoured.