USD, AUD, EUR flows: USD softer, AUD gains

USD generally lower, AUD strong as market prices in next RBA move as being a hike with Q3 Australian GDP stronger than the q/q headline data suggests.

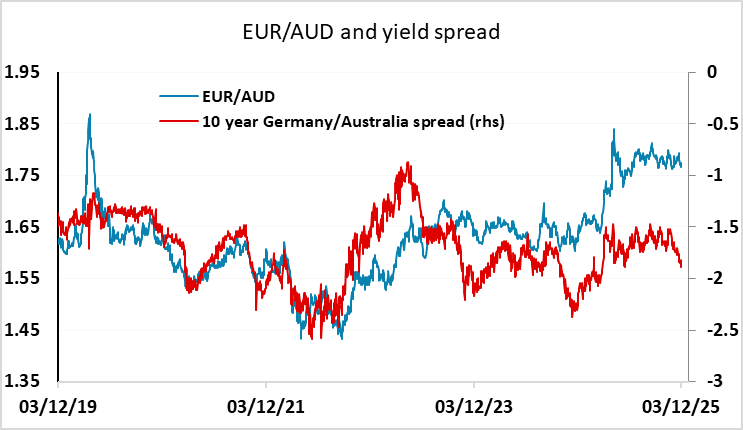

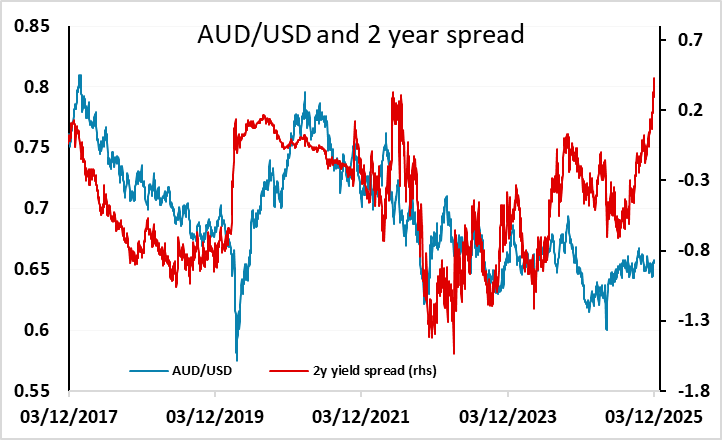

The USD is generally a little softer overnight, even against the AUD despite Q3 Australian GDP data coming in below consensus at 0.4% q/q. This did trigger an initial AUD sell-off, but there was a quick rebound, helped by the fact that the y/y numbers were only marginally below consensus at 2.1% due to revisions, and by the fact that the miss was due to weak inventories, with domestic final demand up 1.1% q/q. AUD yields were higher on the day after the data, with the market now pricing the next move in rates as being up, with a hike priced in by the end of 2026. The AUD was also helped by a modestly positive risk tone, with global equities generally firmer. Yield spreads continue to point significantly higher for AUD/USD and lower for EUR/AUD. The focus on Wednesday should be on the US ADP data. We see risks of a negative number which could put further pressure on the USD.