FX Daily Strategy: N America, June 28th

CPI data in focus on Friday

Japanese authorities under pressure on JPY weakness

Eurozone CPI data could impact July ECB expectations

Some upside risk in US PCE

CPI data in focus on Friday

Japanese authorities under pressure on JPY weakness

Eurozone CPI data could impact July ECB expectations

Some upside risk in US PCE

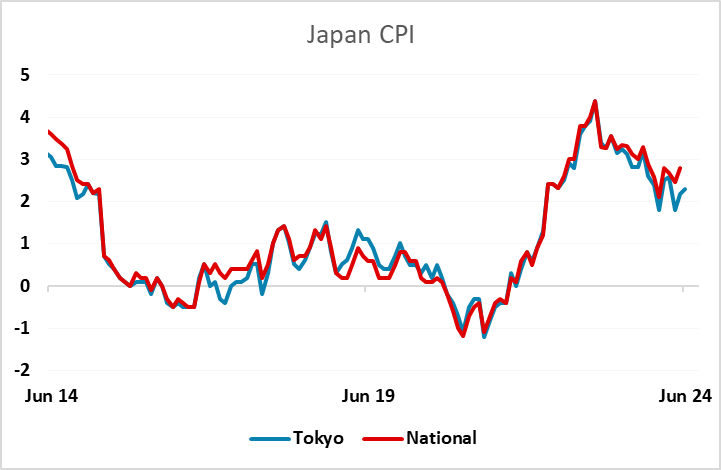

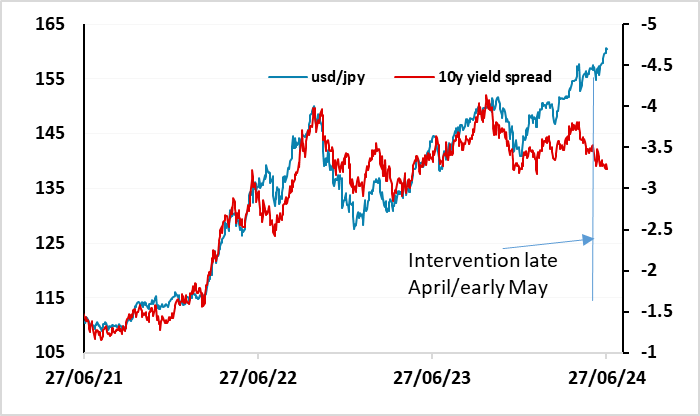

JPY weakness continued overnight in spite of a slightly stronger than expected Tokyo CPI report and more complaints from the Japanese authorities. But with no intervention the market thinks it has a green light to follow the trend, and it is liekly to continue to press the upside until there is some official action.

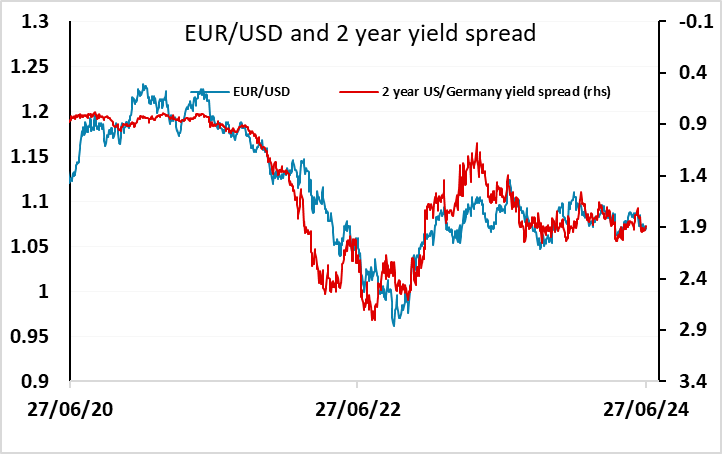

French and Spanish June preliminary CPI were essentially in line with expectations, while German unemployment rose slightly more than expected with the unemployment rate reaching 6.0% for the first time since March 2021. EUR/USD is marginally firmer on the morning but there has been no significant movement away from 1.07. Focus still very much on the French election at the weekend, with the US PCE data later having some potential to trigger some USD action.

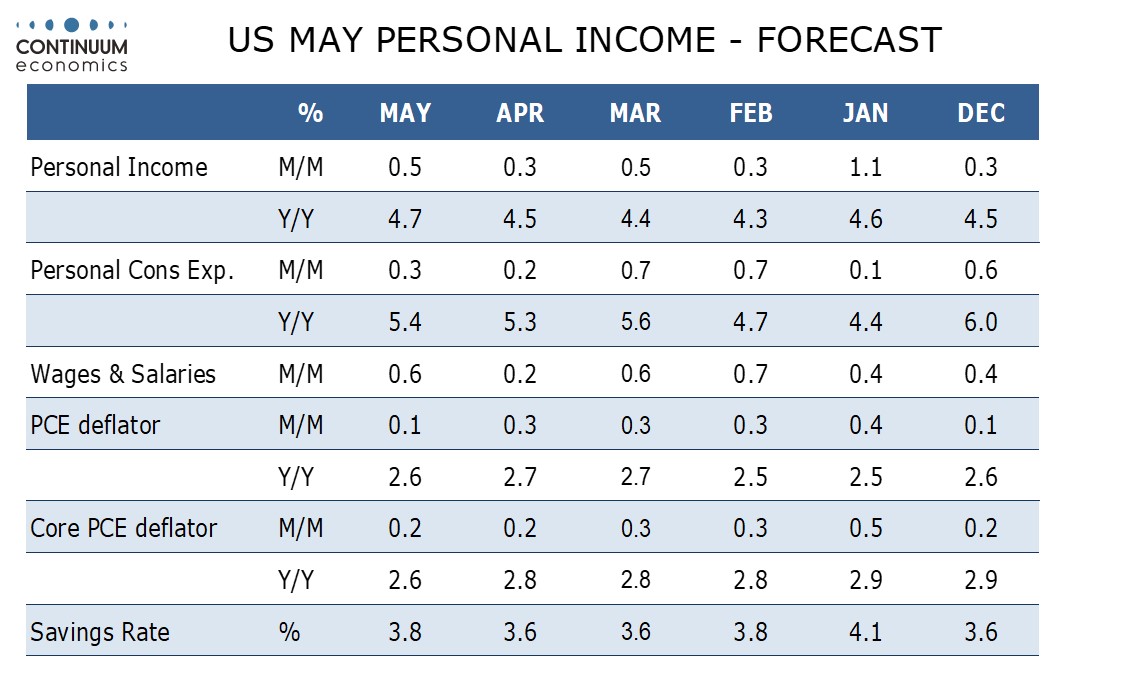

We expect a 0.2% increase in May’s US core PCE price index, consistent with the core CPI though like the CPI we expect the gain to be on the low side of 0.2% before rounding. We expect a 0.3% rise in personal spending, underperforming a 0.5% rise in personal income. The market consensus is for a 0.1% rise in the PCE price index, so we are slightly on the high side of expectations, and our numbers could provide some support for the USD. However, Thursday’s US data was on the weak side, with the trade data particularly notable, so we wouldn’t expect any major USD reaction.