Canada November CPI - Worrying underlying resilience

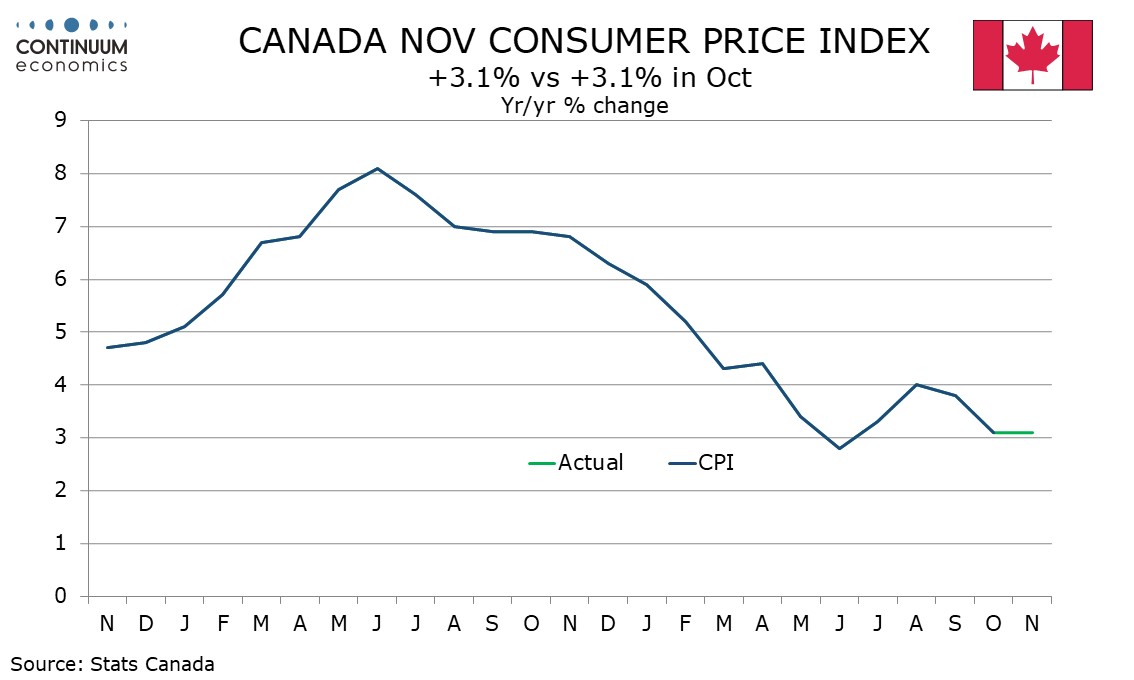

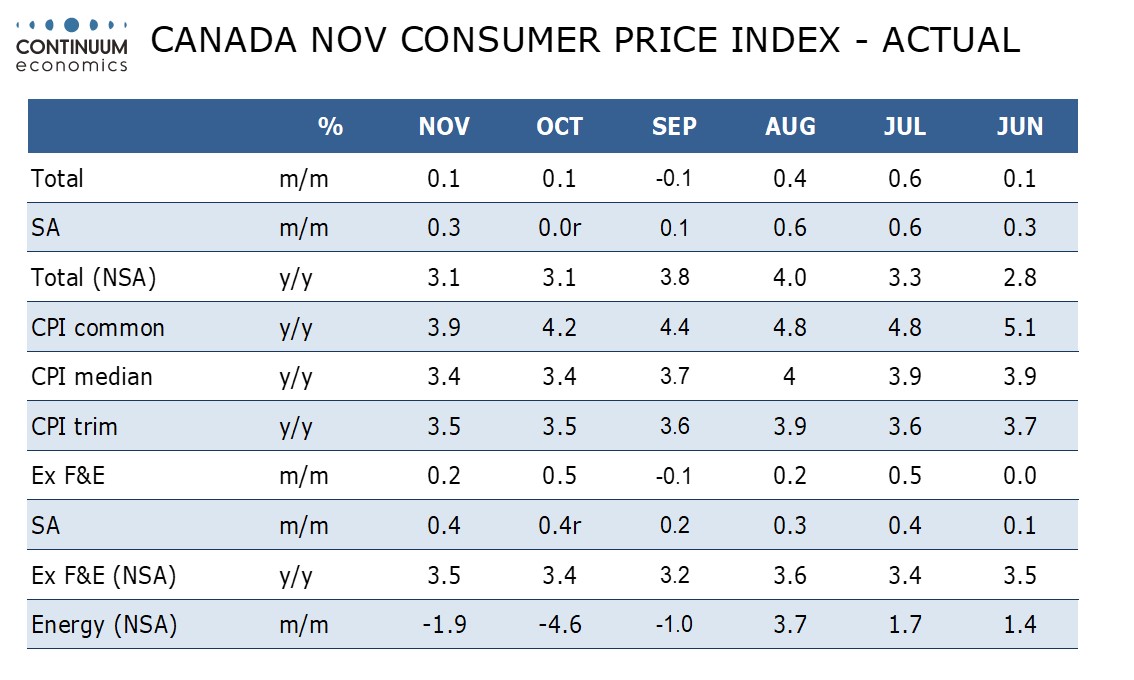

November’s Canadian CPI is a clear disappointment, with the yr/yr pace holding steady at 3.1% with two of the three Bank of Canada core rates also unchanged. While ex food and energy data is not one of the BoC’s core rates, a 0.4% seasonally adjusted rise on the month is concerning.

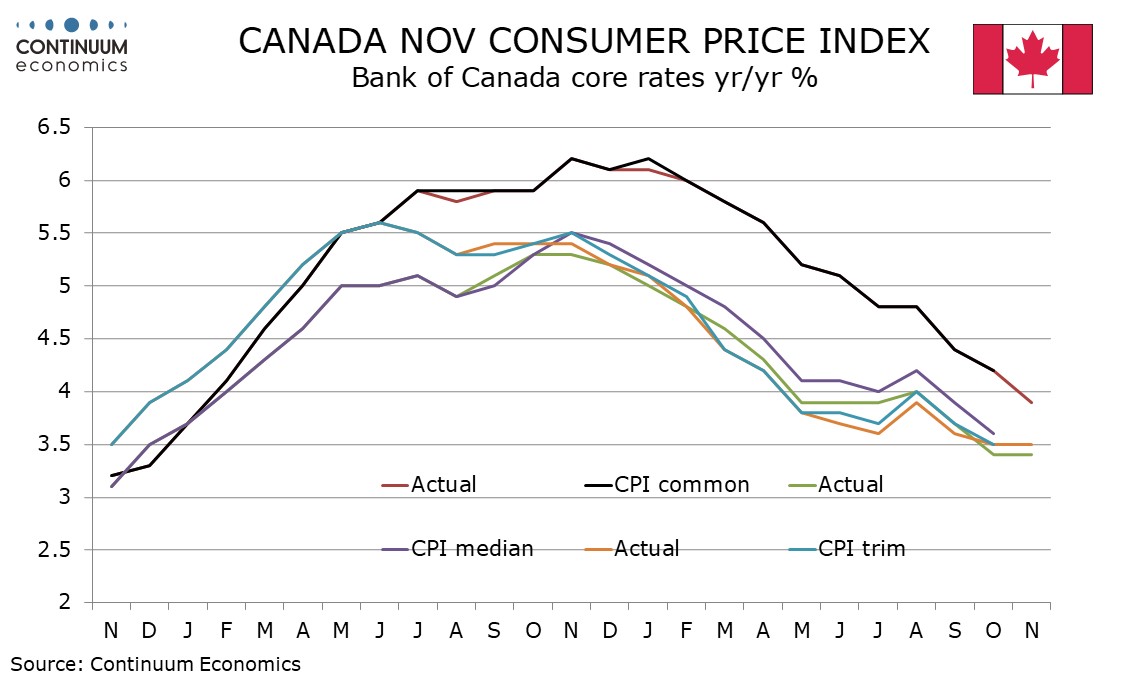

The BoC’s core rates show CPI-median unchanged at 3.4% yr/yr and CPI-trim unchanged at 3.5%, both above consensus though CPI-common did slip to 3.9% from 4.2%. The average of the three at 3.6% is the lowest since December 2021 but still well above the BoC’s 2.0% target.

On the month CPI rose by 0.1% unadjusted and 0.3% seasonally adjusted, with ex food and energy CPI rising by 0.2% unadjusted and 0.4% seasonally adjusted. This is the second straight 0.4% seasonally adjusted rise and shows Canadian CPI is not matching the downwards progress seen in the US.

The data is likely to ensure the BoC will not be talking about rate cuts and time soon and even raises the risk that a further tightening could be debated in early 2024, although that remains unlikely with the economy clearly having lost momentum, another way Canadian data contrasts unfavorably with that in the US.