FX Daily Strategy: Europe, May 20th

Focus on PMIs, USD needs stronger data to extend recovery

RBA Cut by 25bps

EUR/GP downside risks look very limited below 0.84.

AUD can rise even if RBA cut

CAD continues to hold firm relative to yield moves

General USD underperformance similar to first Trump presidency

Tuesday is another quiet US calendar, with the highlights elsewhere being the RBA meeting and the Canadian CPI data. A 25bp rate cut from the RBA is essentially fully priced in, so it would be a major surprise if they don’t cut, although the last couple of data points do argue for a less dovish stance. The wage and price index surprised on the upside, and the employment data showed a sharp rise in April which reversed the impression of a significantly weaker trend that was due to the employment decline in February, which now looks to have been an anomaly.

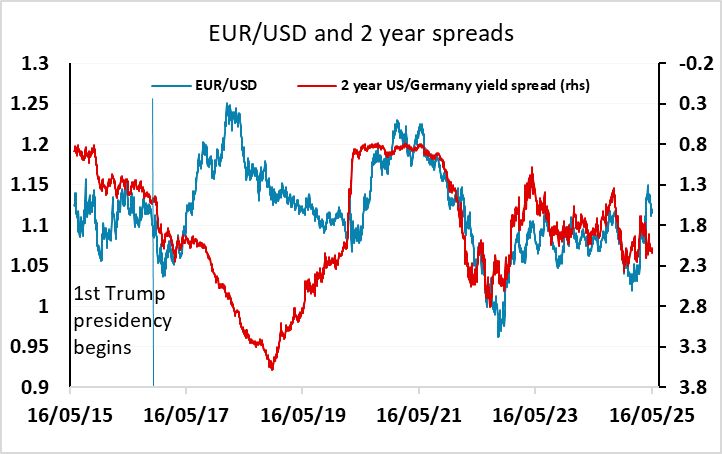

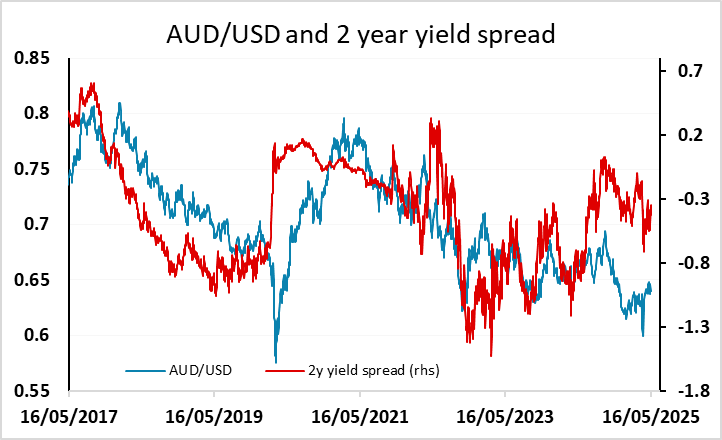

So while it seems unlikely that the RBA will refrain from a cut this time around, there will be interest in the statement and any commentary in the press conference that provides any forward guidance, With three 25bp cuts priced by year end (including this month), we see the risks as being on the hawkish side, and the AUD risks as being on the upside. The AUD in any case has substantially underperformed the normal relationship with yield spreads in the last year and has also lagged its usual correlation with the performance of the Chinese equity markets in recent months. With the worst fears about the impact of tariffs on the Chinese and Australian economies having faded, the 0.64 area still offering good support, and a generally more negative USD tone after the Moody’s downgrade, AUD/IUSD risks look weighted to the upside.

The RBA has cut the cash rate to 3.85% in the May 20 meeting as they revised their forecast of trimmed mean CPI to 2.6% y/y throughout mid 2026. They now see terminal rate to be at 3.2% till June 2027. Their forward guidance did not change by indicating data dependency approach and being cautious towards the future uncertainty. Our central forecast see two more cuts in 2025 to 3.35% and 3.2% in 2026. Given the cautious take of RBA, we are unlikely to see consecutive cut for now.

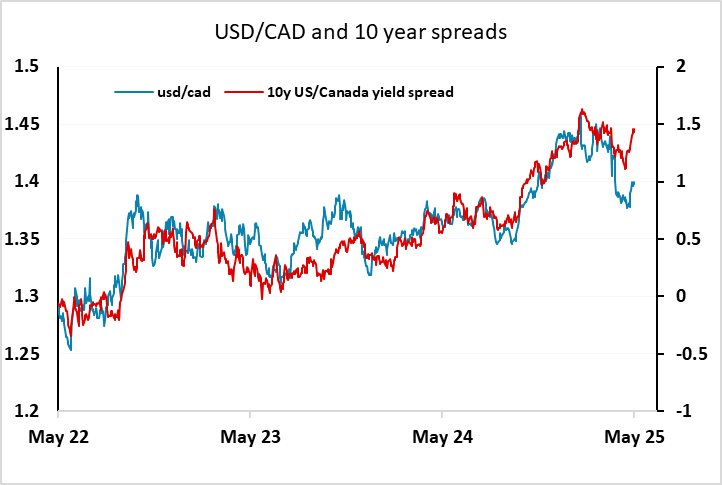

We expect April Canadian CPI to fall to 1.6% yr/yr from 2.3% with the fall entirely due to the April 1 removal of a carbon tax which the Bank of Canada estimates will reduce inflation by 0.7%, largely in gasoline. We expect the Bank of Canada’s core rates to be unchanged from March. Our forecasts are in line with the market consensus, although the consensus does see some modest risk of slightly firmer core rates in the common and trimmed CPI. The CAD has somewhat outperformed its normal relationship with yield spreads since the tariff announcement, in line with the generally weaker USD tone, so wouldn’t expect a significant reaction to the CPI data. As long as the USD continues to trade generally weak relative to yield spread movements, USD/CAD should continue to hold below 1.40.

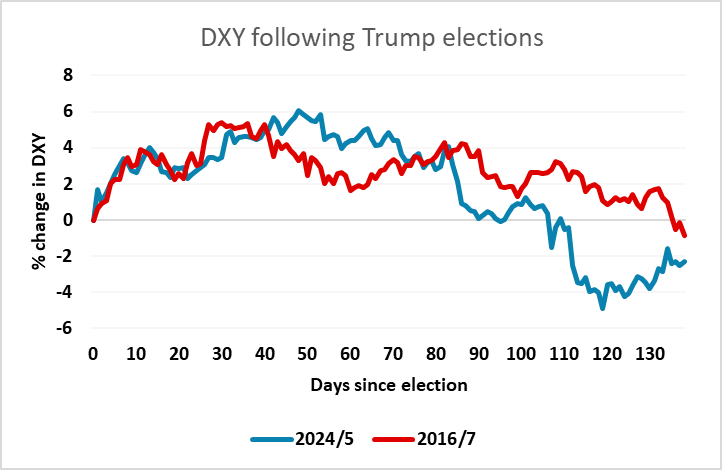

The USD decline in response to the Moody’s downgrade was perhaps a little larger than might have been expected, given that it wasn’t a major surprise as it just brings the Moody’s rating in line with S&P and Fitch, who has already acted. But it is another example of USD underperformance relative to the yield spreads relationship that has dominated in recent years, suggesting some fundamental loss of confidence or some introduction of a risk premium. It’s similar to the way the USD behaved in the first Trump presidency, when it significantly underperformed yield spreads in 2017 after an initial rally. Then, the USD weakness lasted into 2018, and the first presidency was much milder in terms of policy action, so at this stage it seems USD underperformance may well continue, even if the usual drivers move in its favour.