FX Daily Strategy: N America, September 20th

BoJ keep rates unchanged…

…but hawkish tone should help cap USD/JPY gains

Risk positive tone may be overdone, but there is value in NOK

GBP strength may be overdone but can hold near term on solid retail sales

BoJ keep rates unchanged…

…but hawkish tone should help cap USD/JPY gains

Risk positive tone may be overdone, but there is value in NOK

GBP strength may be overdone but can hold near term on solid retail sales

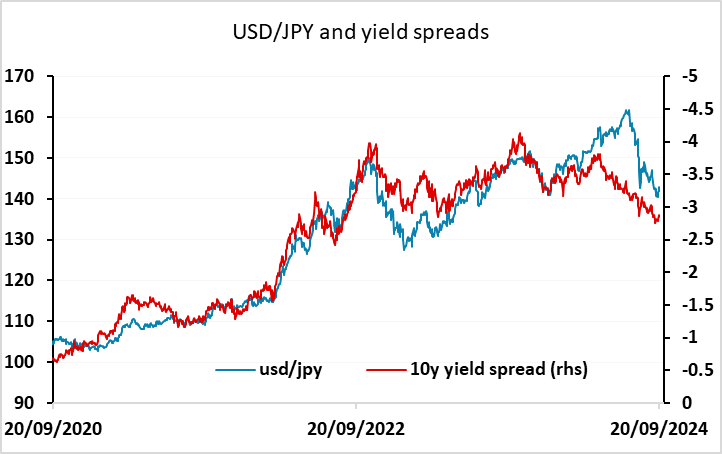

Friday sees the last central bank meeting of a week of central bank meetings. There are only 7bps of tightening priced in for the rest of the year for Japan, and rates are only seen at 0.5% by the end of 2025 – 25bps of tightening from here. This is despite fairly persistent hawkish comments from the BoJ suggesting that rates would go to 1% or more. But old habits die hard, and markets have been here before, awaiting a BoJ tightening cycle that never came. In an environment where rates elsewhere in the G10 are coming down, and China is struggling against an overhang of housing debt causing deflation, it is understandable that the market doesn’t really believe in the BoJ tightening cycle.

At the September 20 meeting, the BoJ keep rates unchanged at 0.25% and guide there will be more tightening by suggesting the current inflationary trajectory aligns with BoJ's economic forecast in July 2024. The BoJ has taken a hawkish tilt in the July meeting by providing a hawkish forward guidance "If outlook for economic activity and prices are realised, will continue to raise policy rates and adjust degree of monetary accommodation accordingly" and did not repeat this line in the September statement. Instead, BoJ highlighted global economic development and domestic business' wage & price setting behavior as critical area to watch. They also mentioned that the impact of foreign exchange development towards domestic prices is increasing. Europe has taken USD/JPY higher after Ueda's press conference. The trigger seems to have been Ueda’s indication that market remain unstable, in reference to a question about deputy governor Uchida’s remark that the BoJ would not raise rates while markets remain unstable. Markets are also reacting to the comment that there is some time to make decisions on monetary policy because upside price risks have decreased given recent FX moves. But other than that, Ueda’s comments remained broadly hawkish.

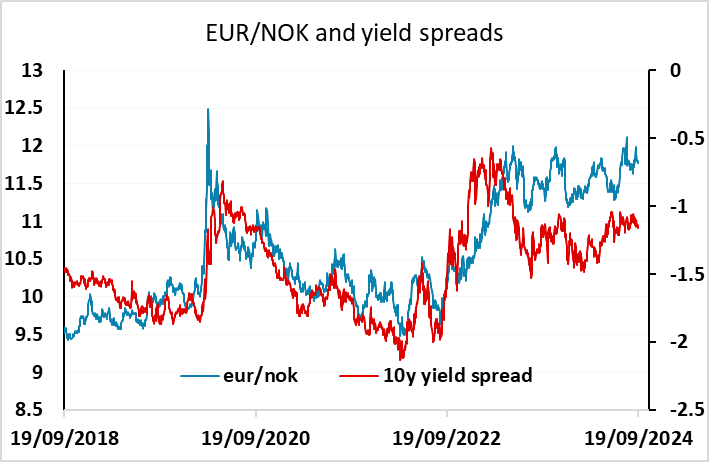

Certainly, Thursday saw a generally risk positive market tone, with GBP, NOK and AUD doing well helped by more hawkish central banks and a solid employment report respectively, as well as the strong equity market performance seen post-FOMC. The S&P 500 made another new all time high, and after the wobble seen in the summer the market seems prepared to accept the view that we are getting a soft landing, with any concerns about the profitability of AI no longer weighing on the market. But valuations are certainly stretched, and we would be wary of buying in wholeheartedly to an extension of equity gains. Nevertheless, many of the riskier currencies do represent good value based on yield spreads and longer-term valuation. The NOK in particular continues to look to have scope to extend the recovery seen on Thursday. However, the AUD may still need better news from China to convincingly break to new highs for the year.

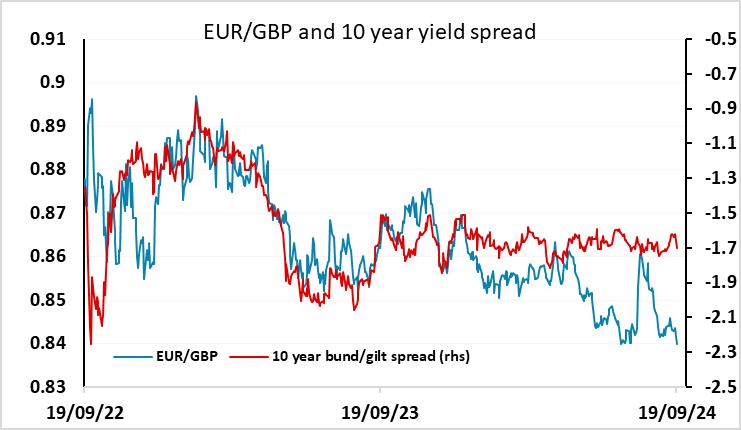

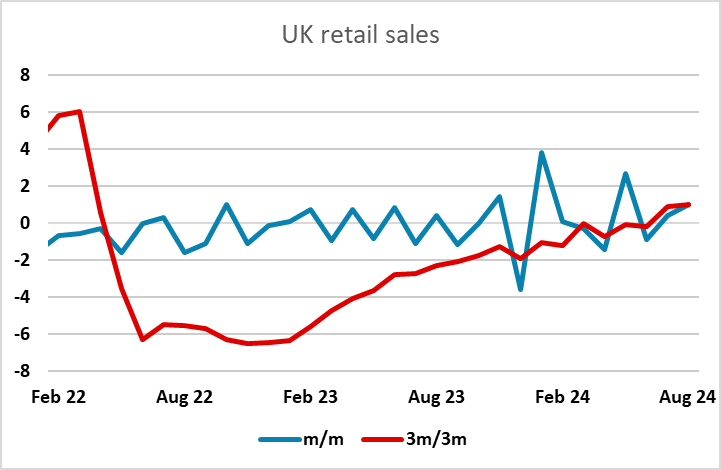

UK retail sales continued their improvement, with the 3m/3m trend now above 1% for the first time since the post-pandemic recovery. While some of the strength might have been weather related due to late summer sales, the data supports the more positive narrative around UK growth that has developed this year. EUR/GBP is testing the July low of 0.8382, which was the lowest since August 2022. Nevertheless, we remain wary of GBP strength, which has come in spite of little movement in yield spreads and has taken the pound to its highest level in real terms since before the Brexit referendum in 2016, both against the EUR and on a (narrow) effective basis. While the improvement in retail sales is encouraging, it is still not particularly strong by longer historic standards, and the recent growth numbers have suggested a slowdown from H1. We would therefore be wary of looking for much extension of GBP strength, although a break to new lows for the year looks likely.