USD, JPY, CHF flows: Safe havens firm on Middle East tension

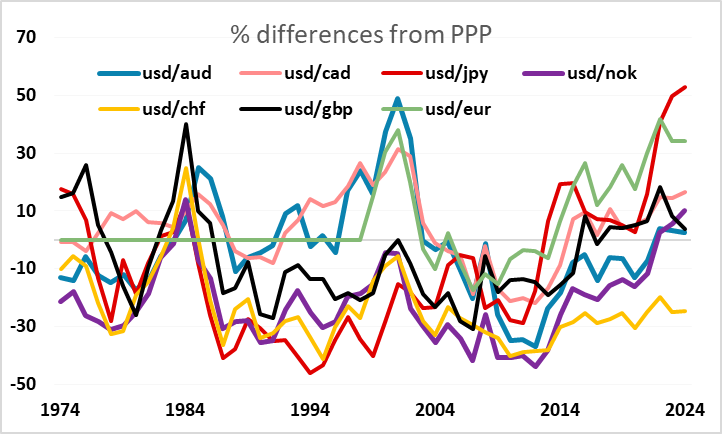

Safe havens remainign strong as Middle East tension rises. Oil price move thus far is modest, but fears of escalation remain. JPY the best value of the safe havens.

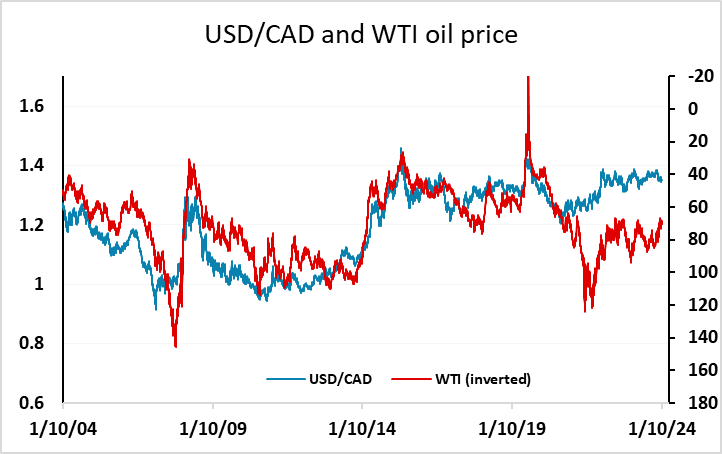

The situation in the Middle East is dominating the markets at the moment, but in general the FX moves have been fairly modest, with mild USD, JPY and CHF strength as risky currencies generally fall back, although the NOK and CAD have outperformed on the crosses helped by their traditional benefit from a stronger oil price. However, at this stage the oil price rise has been quite modest. Despite the sharp one day gain, it is little changed from a week ago and 10% lower than it was in late August. The market is functioning more on fears of what might happen than what has currently happened. If we have seen the last of the Iran attacks on Israel, and Israel refrains from attacks on Iran and only attacks very specific targets in southern Lebanon, we may see the markets calm. But it seems likely that Israel will respond with attacks on Iran, and this is the prime market concern, as this or the Iranian response could lead to disruption of oil supply. For now, the tension will persist and we would expect the USD, JPY and CHF to remain well bid.

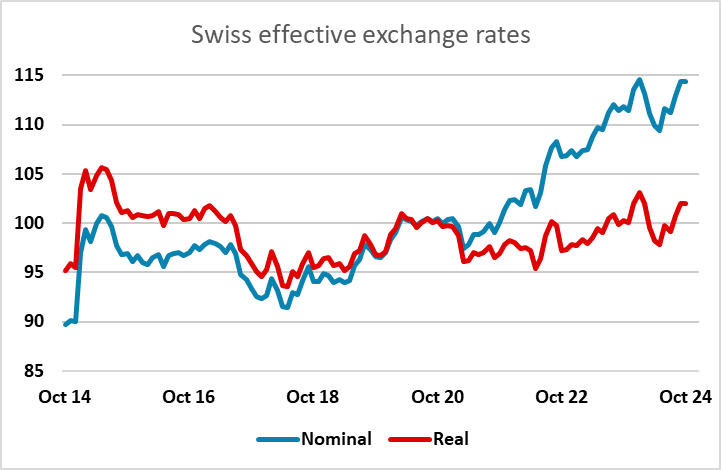

Valuewise, it remains clear that the JPY offers by far the best value of the safe havens. EUR/CHF is approaching the year’s lows and in real effective terms is challenging the post-2015 highs. Even so, the real effective CHF (narrow basis) has traded a fairly tight range in the last 9 years since the spike higher in 2015. The nominal index has risen strongly, but the real CHF has been comparatively steady due to the relatively low level of Swiss inflation. Even so, the SNB will see the latest strength as unwelcome given their current easing mode, and we may see some touches on the brakes in the form of intervention. The USD in general remains at high levels against most currencies, while the JPY remains extremely cheap by historic standards. While the US economy would be more resilient to a higher oil price than Switzerland or Japan, the JPY still looks like it should be the favoured safe haven.