FX Daily Strategy: APAC, Oct 17

SEK risks on the downside on CPI

EUR support from French pension delay unlikely to extend

JPY still has significant scope for recovery

Fed Beige Book a greater focus given the lack of US data

EUR recovery unlikely to extend

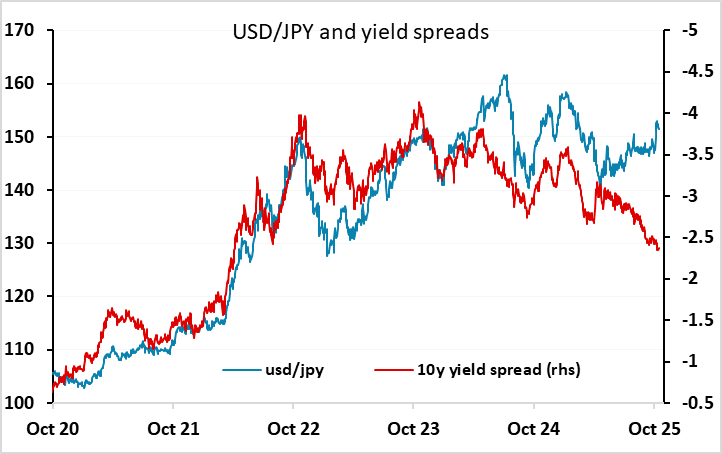

JPY weakness has scope to reverse as Japanese political uncertainty is resolved

EUR/GBP to hold close to 0.87

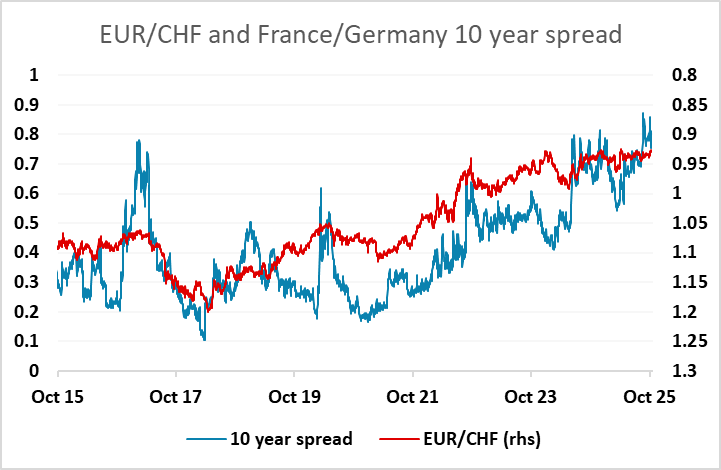

EUR/CHF ought to recover back above 0.93

There’s not a great deal on Friday’s calendar, suggesting a quiet end to what has been a fairly quiet week. There was a mildly positive EUR reaction on Thursday to the French government managing to survive its votes of confidence, as survival had been expected, but it has come at the cost of pension reform and means there will be a lot of work to do to secure a workable budget. The underlying weakness of the French fiscal position and the sogginess of some of the recent Eurozone data suggests the EUR risk is on the downside despite its modest recovery in recent days.

The Japanese political situation remains fluid, with LDP leader Takaichi now seeking an alliance with the right leaning Innovation party after the exit of previous coalition partners Komeito. A coalition with the Innovation party would come close to a majority, but is unlikely to be tied up until next week. Such a coalition would produce a right-wing government, but wouldn’t have obvious new implications for economic policy. We continue to expect monetary policy to be largely unaffected by the new government, so that a rate hike this year remains on the cards. The new government is still unlikely to be formed until next week, but we see scope for the sharp JPY decline seen after Takaichi’s victory to be reversed as the market comes to realise that the new government is unlikely to derail Ueda’s plans for gradual tightening.

In the UK, there is a speech scheduled from arch-MPC hawk and chief BoE economist Huw Pill, which will be of greater interest after the mildly dovish comments from governor Bailey earlier in the week following the UK labour market data. However, Pill seems unlikely to soften much after the IMF called for the BoE to be very cautious on future rate cuts due to persistently high UK inflation. Mild GBP strength seen after the UK monthly GDP data on Thursday didn’t really persist, and EUR/GBP looks likely to hold close to 0.87.

EUR/CHF continues to trade below 0.93 despite a recovery in equities following the dip after Trump announced the tariffs on China, and a narrower Franc/Germany yield spread with the government surviving the vote of confidence. Moves below 0.93 this year have generally been short lived, and the better risk tone should allow a recovery back above 0.93.