Published: 2025-03-12T13:10:35.000Z

Preview: Due March 13 - U.S. February PPI - Similar to January, upside risk in core goods

3

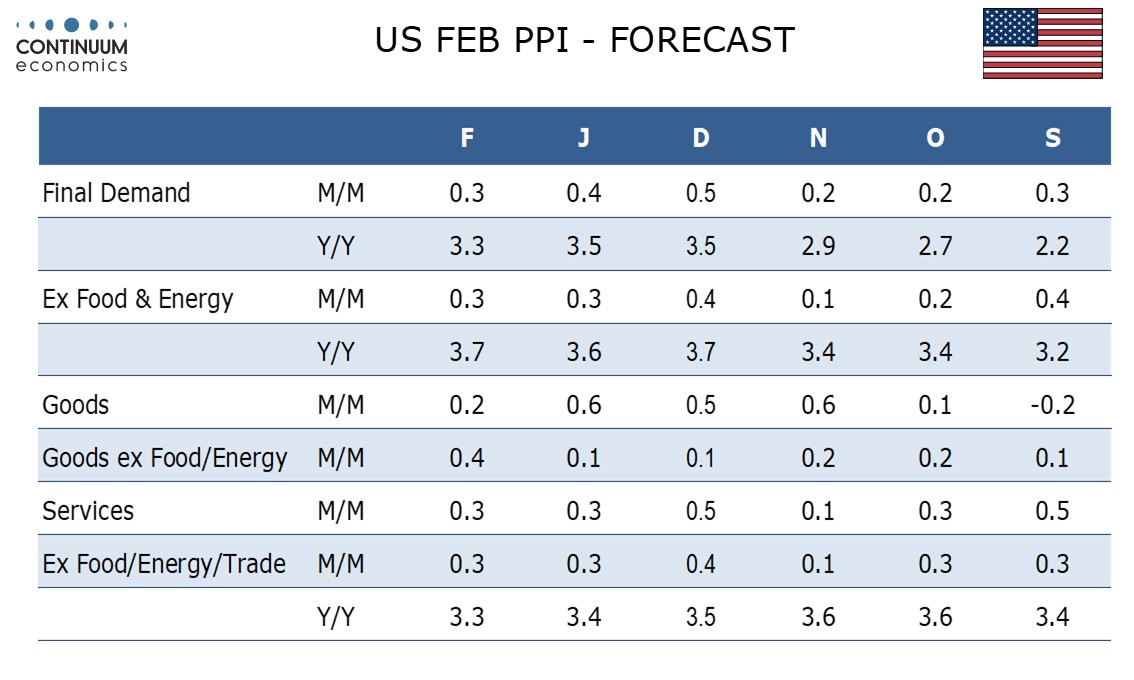

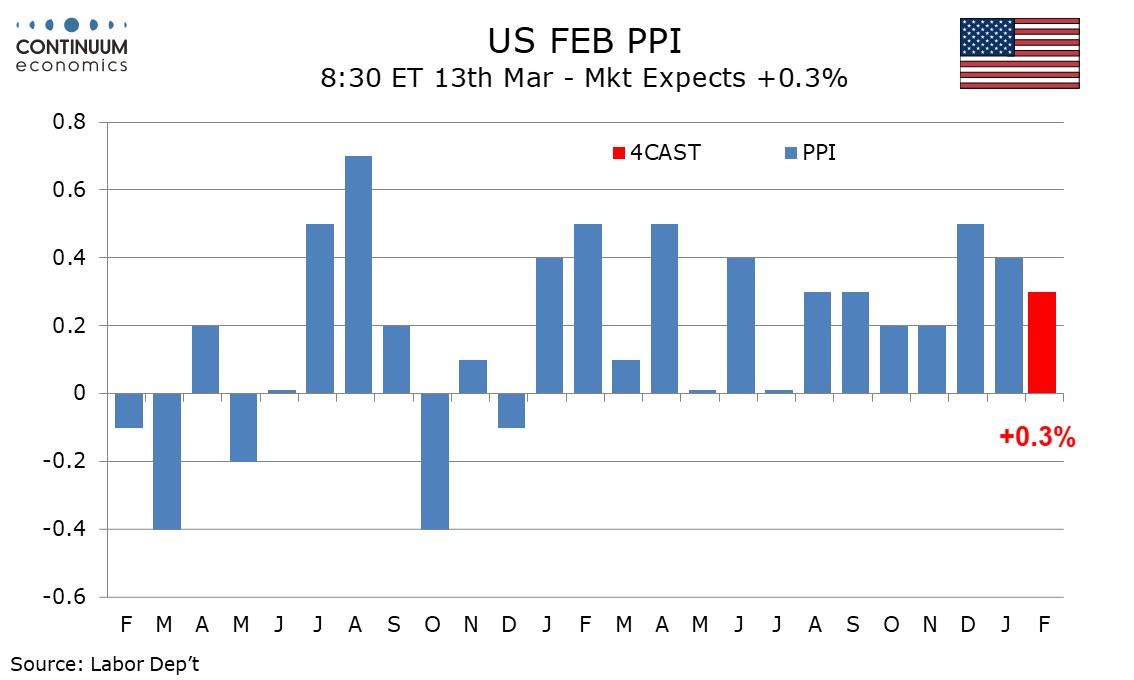

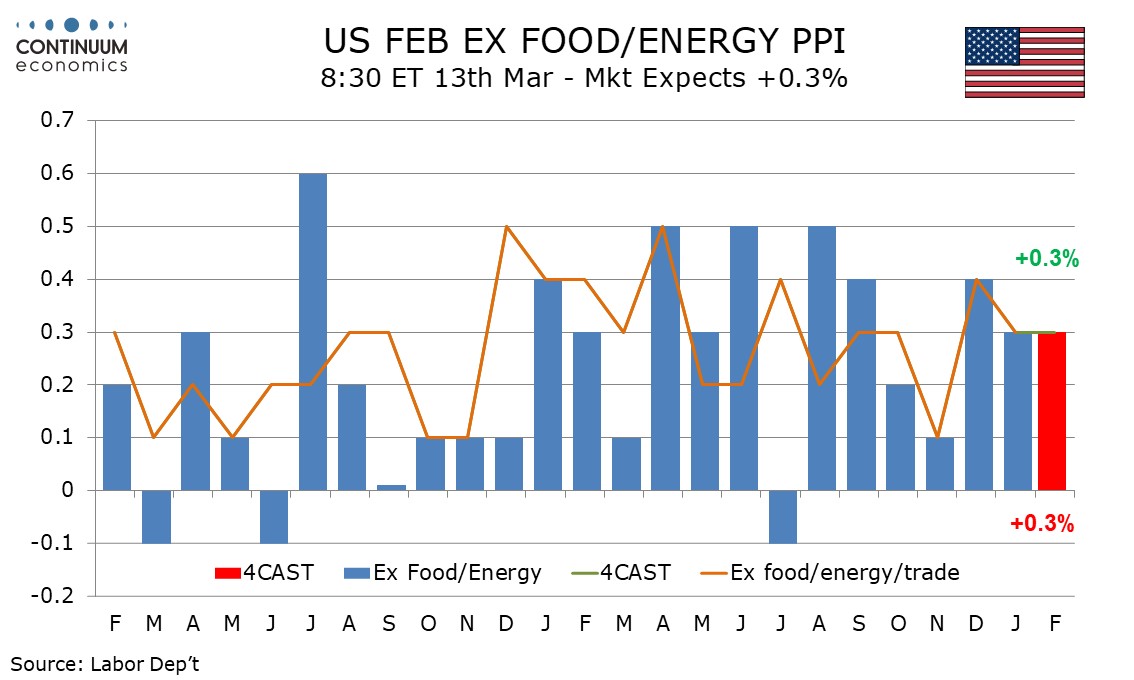

We expect February PPI to increase by 0.3% overall, and in the core rates ex food and energy and ex food, energy and trade. This would be a slowing from a 0.4% January increase overall, but each core rate would match their January outcomes.

The headline rise will see some moderation from January due to energy seeing a modest dip after increasing in January. Food is likely to remain firm, led by eggs.

Stronger price indices in most recent manufacturing surveys suggest some upside risk in goods ex food and energy. Here we expect a 0.4% increase, the strongest since January 2023. However, in looking for an in line with trend 0.3% increase in services, we do not expect the core rates to accelerate this month.

We expect yr/yr growth to slip to 3.3% from 3.5% overall, and the 3.3% from 3.4% ex food, energy and trade. However, we expect the ex-food and energy rate to pick up to 3.7% from 3.5%.