FX Daily Strategy: APAC, June 5th

ECB to ease, but may suggest pause

Lower forecasts for inflation should still ensure the meeting is seen as mildly dovish

EUR downside risks nevertheless quite limited

SEK could soften on weaker CPI

ECB to ease, but may suggest pause

Lower forecasts for inflation should still ensure the meeting is seen as mildly dovish

EUR downside risks nevertheless quite limited

SEK could soften on weaker CPI

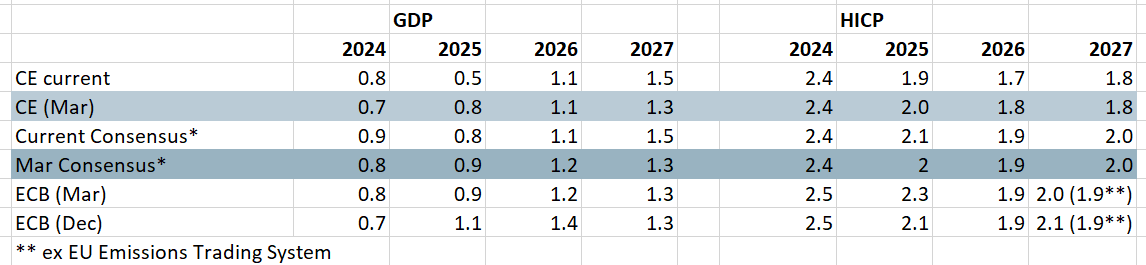

The ECB meeting will be the main focus on Thursday, but what is widely seen as an eighth 25 bp deposit rate cut in the current cycle on June 5 may be overshadowed by the ECB’s implicit if not explicit shift about the outlook thereafter. The door will be left open for a move at the July 24 policy verdict given the array of news (probably negative particularly regarding tariffs) due in the interim. But the impression may be given that a pause may be due after what have been seven successive cuts. This also reflects what seem to be clearer Council divides over the extent and direction of inflation risks.

ECB Shifts Down toward Consensus on Growth?

Source: ECB, Bloomberg, CE

On the face of it, a pause in easing might be seen by some as a less dovish ECB stance. However, the main news may be much more disinflationary assumptions about interest rates, energy prices and the euro. As a result, the ECB’s updated forecast may show a much earlier (but still sustained) drop in HICP inflation to below target than the H2 2026 timetable seen in the March forecasts. As this projection should encompass policy rate assumptions to well below the 2% rate likely to be put in place in June, it would thus support such market thinking. The market is currently pricing a base in the policy rate a little above 1.5% in early 2026, and these reductions in forecasts would if anything suggest risks to the downside, even before assuming anything about the impact of tariffs.

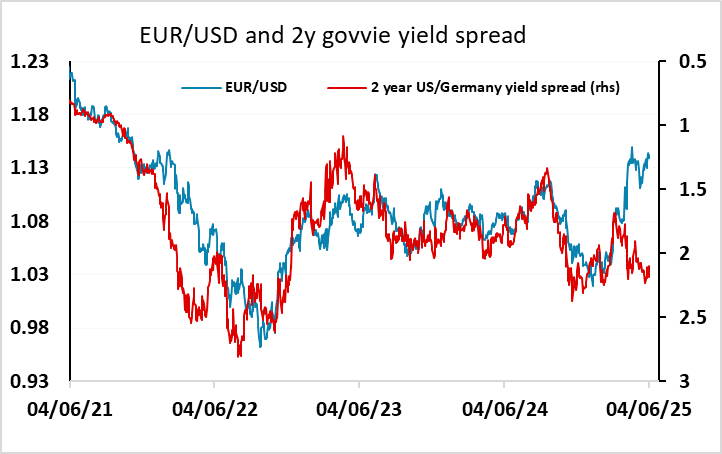

For EUR/USD, the mildly dovish risks in the meeting may be modestly negative, but we haven’t seen much correlation between yield spreads and EUR/USD in the last couple of months, so we wouldn’t expect a major EUR reaction. The EUR will be more vulnerable if there is any hit to confidence due, for instance, to an announcement of a big tariff on pharma.

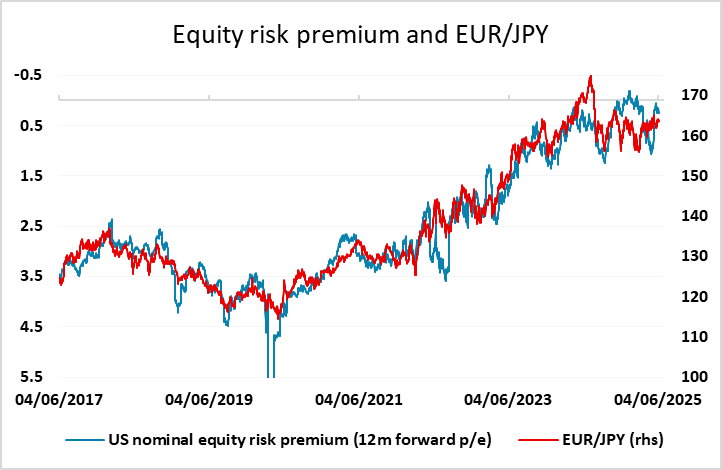

The EUR underperformed the JPY somewhat on Wednesday after the weaker ADP and ISM data led to a decline in US yields and an implied rise in US equity risk premia. But equities were resilient, propped up by lower US yields, and as long as this is the case EUR/JPY looks unlikely to fall far. A more general weakening in growth prospects may be necessary to undermine the riskier currencies in general.

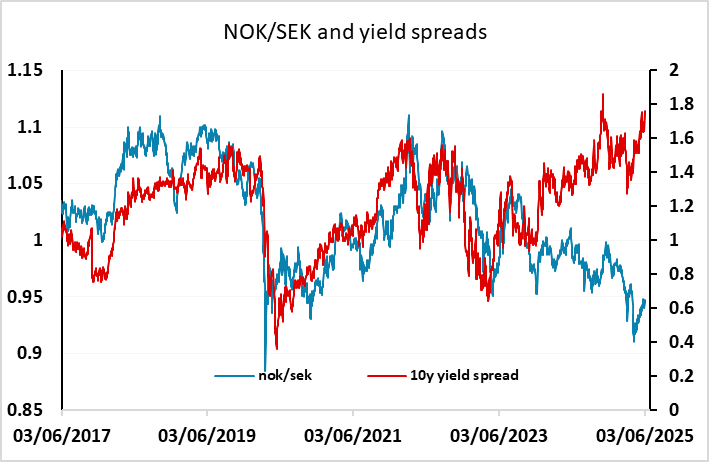

Ahead of the ECB meeting there is flash CPI data from Sweden, which is expected to see a modest rise in the targeted CPIF measure to 2.5%. A Riksbank easing this month is seen to be in the balance, with around a 60% chance of a 25bp cut priced in for the June 18 meeting, so this data could be crucial. We see risks to the downside, which should increase the chances of a cut and put some downward pressure on the SEK. As usual, we see NOK/SEK as the best way to exploit any SEK weakness.