FX Daily Strategy: Asia, June 11th

UK GDP Still Overstating Activity

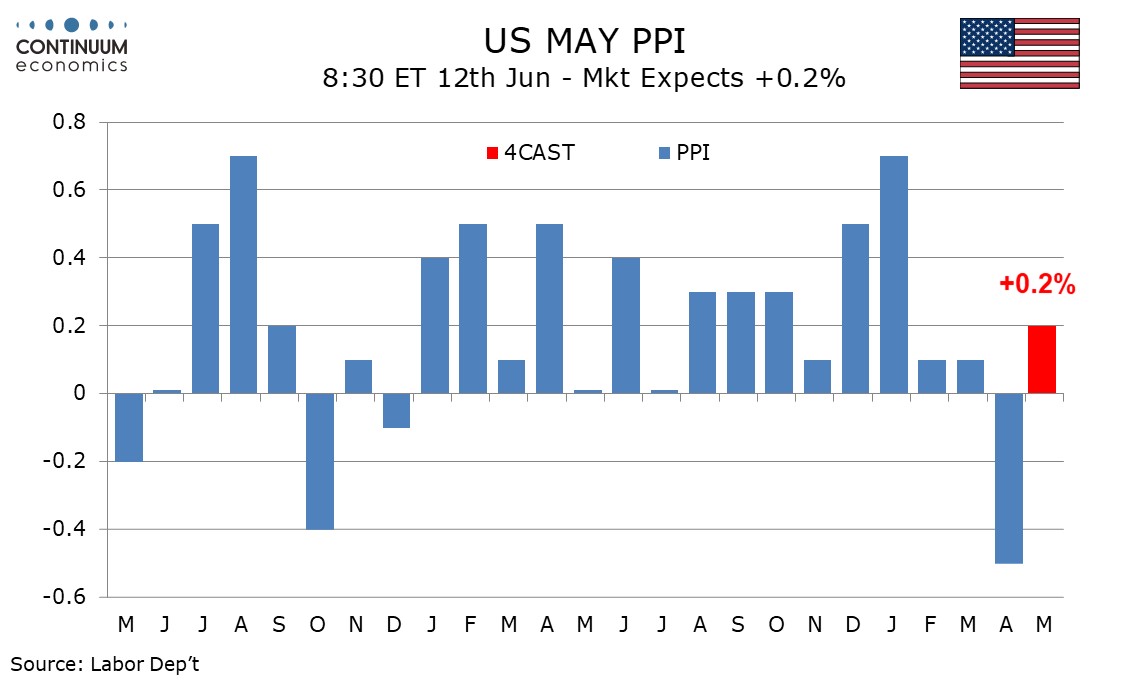

A correction from a weak April for U.S. May PPI

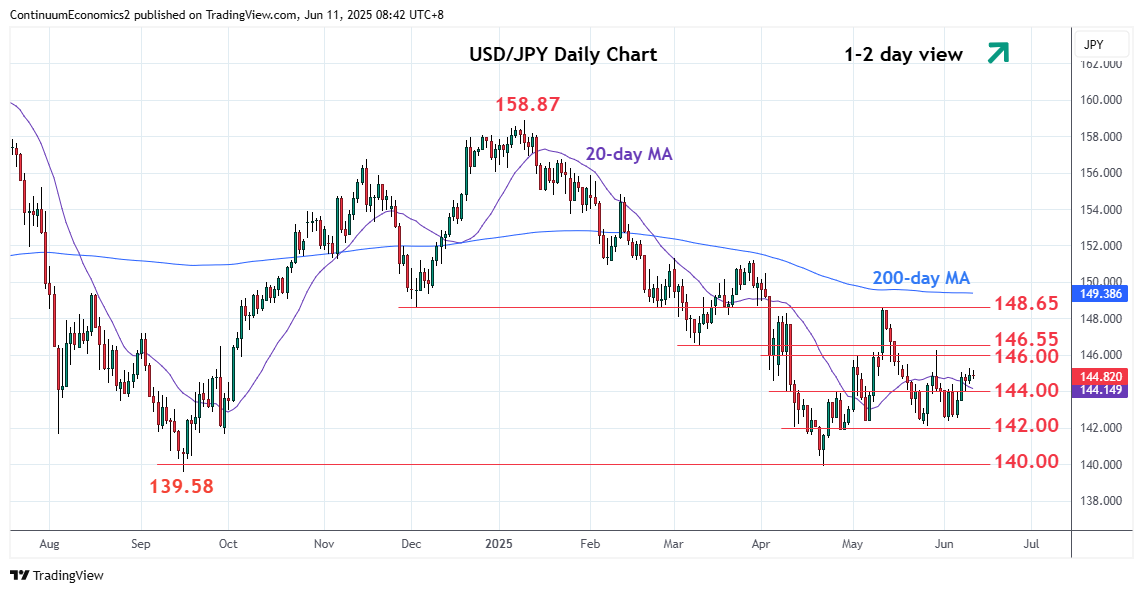

USD/JPY Stays in Consolidation zone

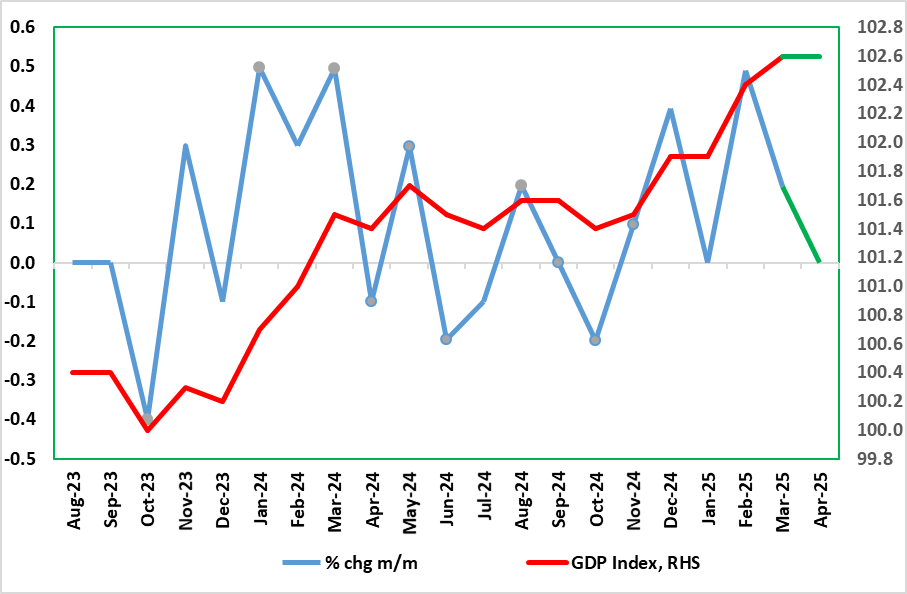

Figure: Actual GDP Looking Far Better into Early 2025 as in Early 2024

After two successive monthly upside surprises, a correction back in GDP could be expected for the upcoming April data, especially as Q1 numbers may have been boosted by added production destined for the U.S in anticipation of tariffs. In addition, real estate activity seems to have slumped after the raising of effective stamp duty in April. But we already know that retail sales rose clearly in the month and it is hard to see GDP moving dramatically in the opposite direction as a result. Moreover, activity (at least outside of utilities) may have been boosted elsewhere by record sunshine and temperatures during April, this the likely reason behind the retail sales jump. Combining these factors, we see a flat m/m April GDP outcome, enough to pull the 3-mth rate to an 11-month high of 0.8% (Figure) and where it may be difficult for Q2 GDP to be negative. But we remain suspicious of any such strength, not least given anecdotal and survey evidence increasing to the contrary which suggest an even weaker picture than the BoE acknowledges.

First some recent perspective. National account data delivered yet another upside surprise both in terms of the latest monthly figure and also the associated Q1 update. Indeed, February GDP, rather than consolidating in the March GDP release with a flat m/m reading, instead grew by 0.2% (Figure 1), a fifth successive non-negative outcome, led this time by services. Partly as a result, Q1 GDP rose by 0.7%, boosted both by exports and business investment. Notably, consumer spending rose a tame 0.2%, possibly a result of higher household inflation in the quarter, this worrying given the more marked rise seen through this and the coming quarter in regard to price pressures. The data is unlikely to make any difference to BoE thinking which foresaw a 0.6% Q1 rise and one that still led to a marginal emergence of an output gap, this reflecting a (very justifiable) BoE view that the official data are overstating actual activity which is more likely to have been near zero last quarter with a similar, if not weaker, picture envisaged for the current quarter.

We expect May PPI to see a modest bounce from a weak April with a 0.2% rise overall and a 0.3% increase ex food and energy. Ex food, energy and trade, we expect a rise of 0.2%. April fell by 0.5% overall and ex food and energy, but by only 0.1% ex food, energy and trade. A weak March was revised up with April’s report so April revisions should be watched this month. Recent months have seen strength in core goods prices, with gains of 0.3% in February and March and 0.4% in April, but weakness in services, which rose by 0.1% in March and 0.4% in April, followed by a 0.7% plunge in May. Core goods are being lifted by tariffs and should continue to be so, and we expect a 0.4% rise in May. We however expect overall goods prices to fall by 0.1%, with energy to fall on gasoline and food to fall on a continued reversal from recent highs in eggs.

Services are getting hit by weak demand with weakness also being seen in intermediate service prices. We expect May services to see only a modest bounce of 0.3%, led by trade. Ex food, energy and trade we expect PPI to see a 0.2% increase, which would follow a 0.1% decline in April and a 0.2% increase in March. With December, January and February all having seen gains of 0.4%, trend ex food, energy and trade has lost momentum in recent months. We expect yr/yr growth rates of 2.5% overall, up from 2.4% in April, 3.0% ex food and energy, unchanged from April, and 3.0% ex food, energy and trade, up from 2.8% in April, though this assumes no revisions to April. Without revisions to April, yr/yr rates will be well below those of March, at 3.3% overall, 4.0% ex food and energy, and 3.5% ex food, energy and trade.

The USD/JPY has been in consolidation zone since April as the push and pull of BoJ's hike expectation and U.S. tariff limits aggressive speculation. The broad consolidation is roughly eight figures, down from the eighteen figures since the start of 2025. The next leg in USD/JPY will unlikely to arrive until the trade deal between U.S. and Japan are partially done. Our central forecast sees the earliest such to be done around July and thus the July 31st meeting would be the a potential timeframe to changed rates. There is little expectation of a rate change for the whole year of 2025 and an indication of rate change could trigger significant positioning.

On the chart, the pair edged higher above the 145.00/08 resistance as prices extend gains from the 142.10/00 support. Both daily and weekly studies continues to track higher and suggest room for stronger gains to retest strong resistance at 146.00/146.55 congestion and March low which is expected to cap and give way to renewed selling pressure later. Break here, if seen, will open up room for stronger gains to retrace the January/April losses and see room to retest 148.00/148.65 resistance. Meanwhile, support is raised to the 144.00 congestion which should underpin.