U.S. April Personal Income and Spending - PCE Prices close to 0.25% headline and core

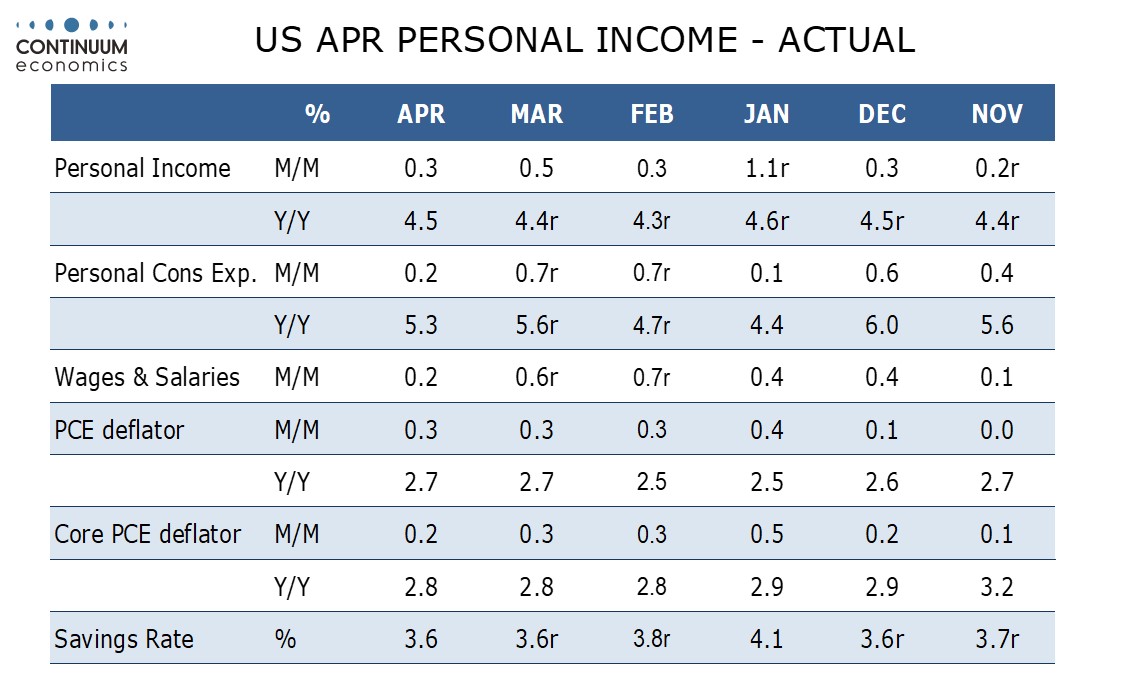

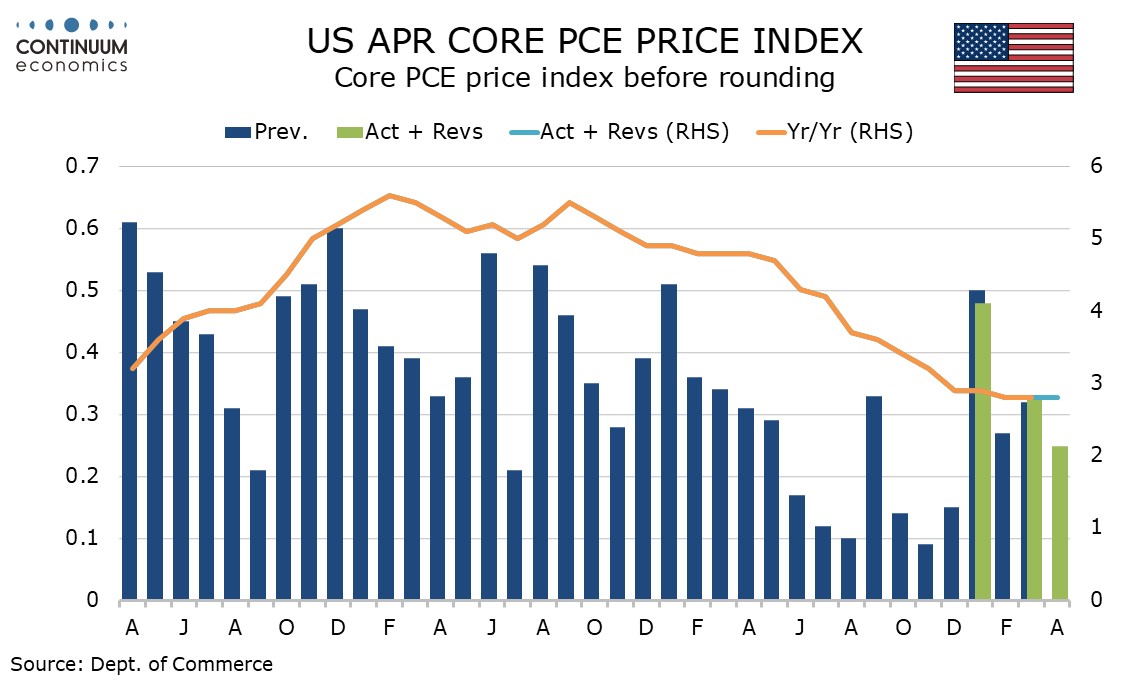

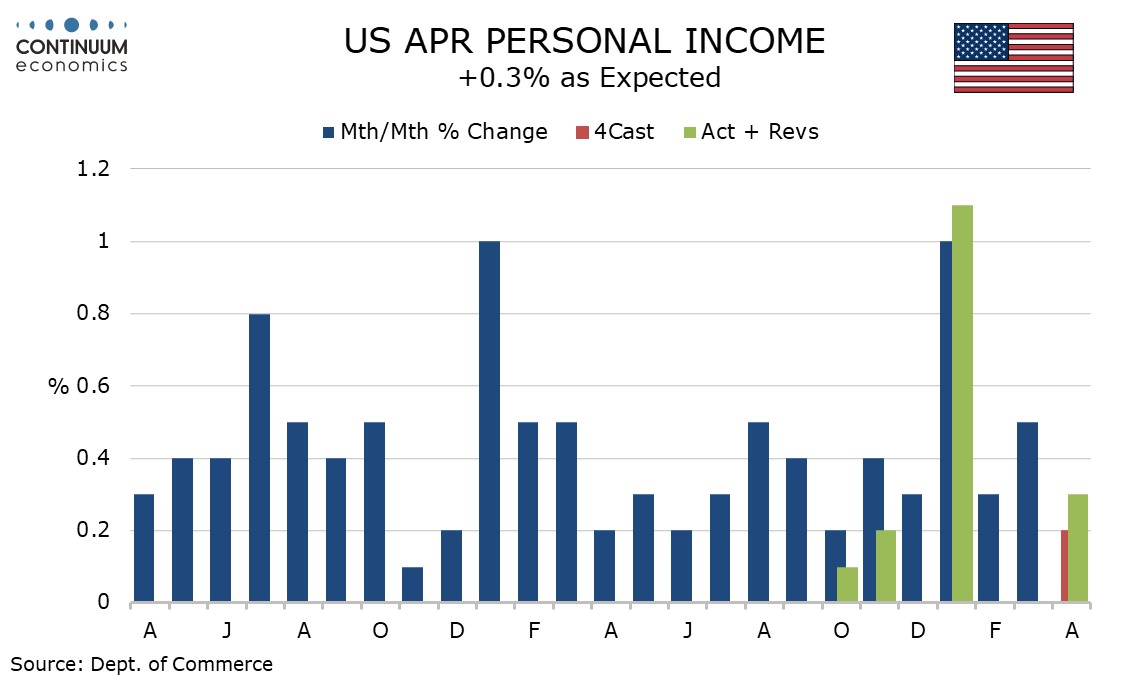

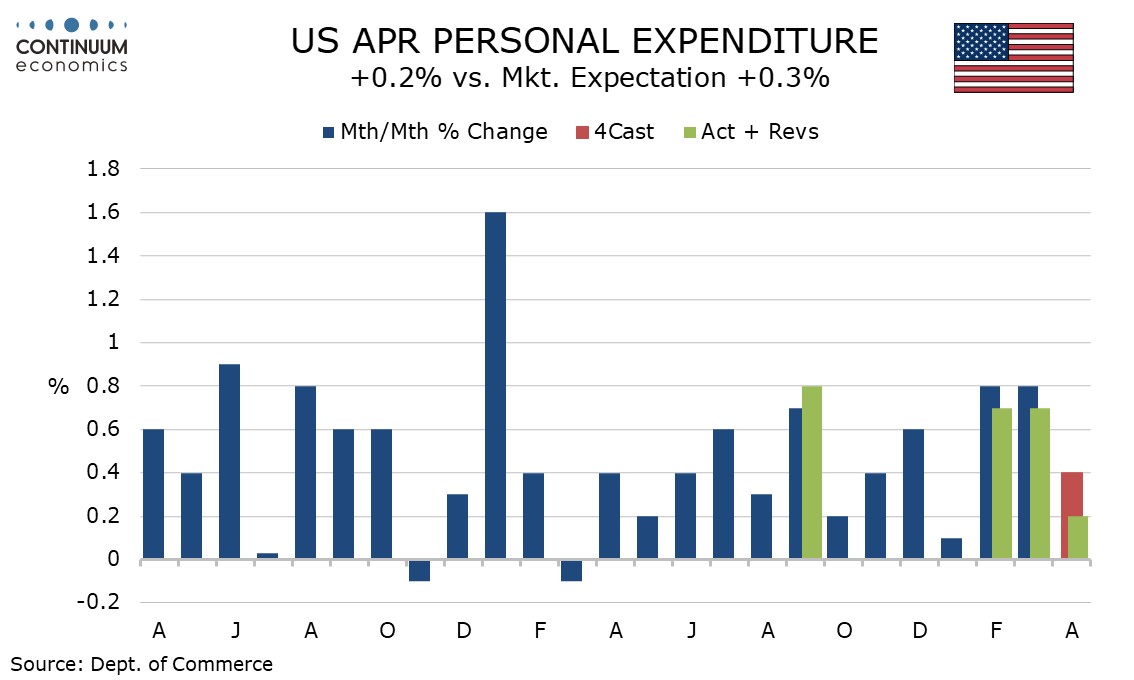

April’s personal income and spending data is subdued, if in line with expectations, with the core PCE price index up by 0.2%, overall PCE prices up by 0.3%, with personal income up by 0.3% and spending up by 0.2%. Before rounding core PCE prices were up 0.249% with overall PCE prices at 0.257%, so there is no significant downside surprise on core PCE prices.

The PCE price data, as is usually the case, is slightly softer than the CPI, which rose by 0.313% and 0.292% ex food and energy before rounding in April. Core PCE prices are looking fairly similar to year ago data with 2023 also seeing strong data in Q1 before gradually slowing, and 2023 data suggests the slowing seen in April will extend further in coming months. Yr/yr PCE price data is unchanged from March, overall at 2.7% and the core rate at 2.8%.

Personal income saw wages and salaries up only 0.2%, consistent with subdued details in April’s non-farm payroll. Other components of personal income got a lift from interest and dividends. With tax payments higher disposable income rose by only 0.2% and real disposable income fell by 0.1%.

Spending also rose by 0.2% with a 0.1% decline in real terms. Retail data was soft as the retail sales report had implied while services rise by 0.4% in nominal and 0.1% in real terms, slower than recent trend and suggesting tend is losing momentum as we enter Q2.

The savings rate was unchanged at 3.6% but March was revised up significantly from 3.2% reflecting upward revisions to income and downward revisions to spending seen with yesterday’s Q1 GDP revisions.