FX Daily Strategy: Europe, December 4th

US data risks on the strong side…

…but data unlikely to significantly affect Fed policy views

AUD sunk on Q3 GDP data

EUR likely to be held back by French confidence vote

US data risks on the strong side…

…but data unlikely to significantly affect Fed policy views

AUD sunk on Q3 GDP data

EUR likely to be held back by French confidence vote

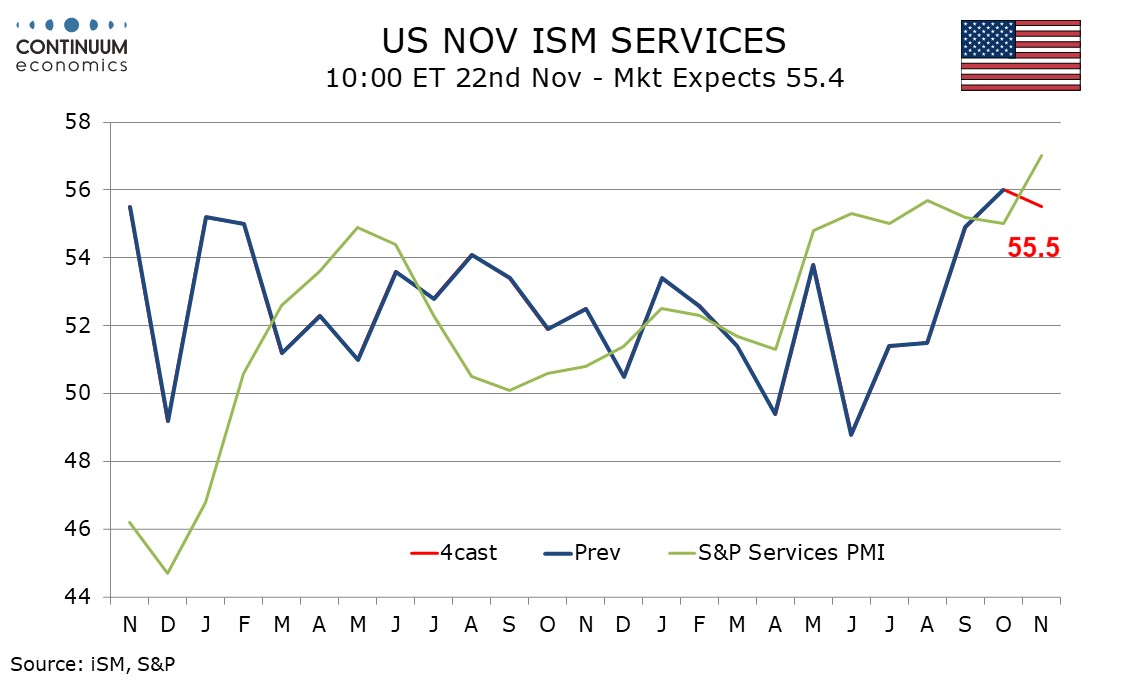

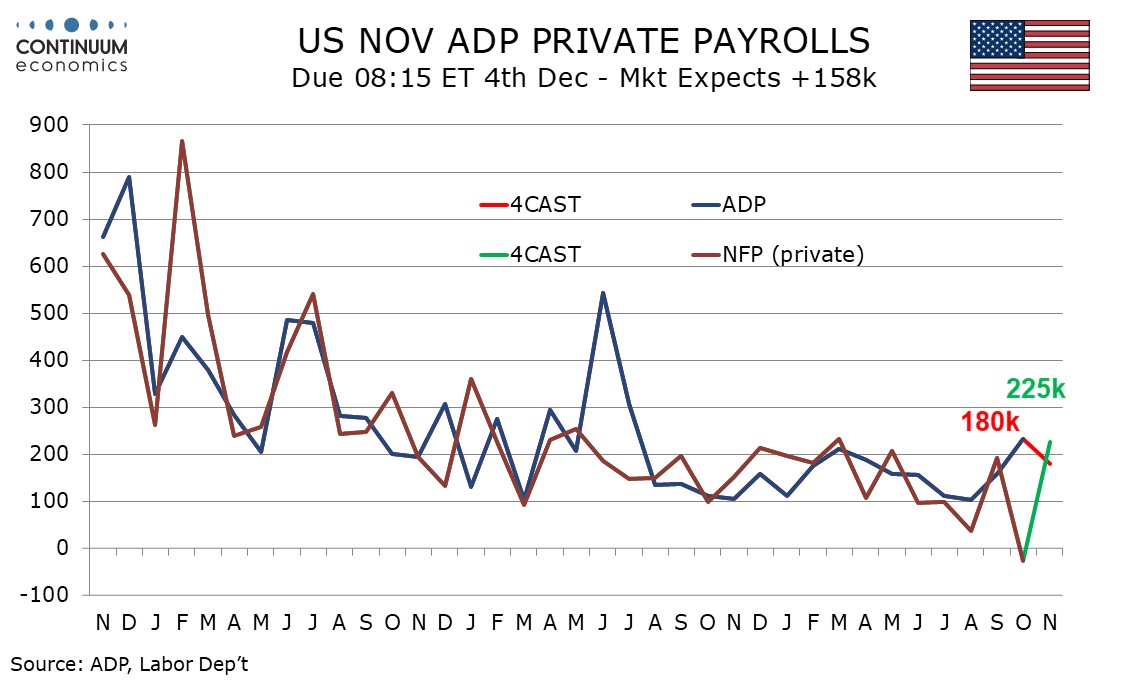

Wednesday’s US data includes the ADP employment survey and the ISM services survey. Both could have some market impact, but neither are likely to significantly change market expectations of Fed policy. ADP has too inconsistent a correlation with the official employment report and the ISM services survey has to compete with the S&P PMI survey which has already been released. Still both can have an impact at the margin.

We expect a 180k increase in November’s ADP estimate for private sector employment growth, which would underperform our 225k estimate for private sector payrolls (we expect overall payrolls to rise by 260k), but is still slightly stronger than consensus. ADP data was strong at 233k in October, sharply outperforming a 28k decline in private sector payrolls with payrolls apparently more sensitive to weather than the ADP data. Historically ADP data has tended to be less sensitive to weather than the non-farm payroll, which was depressed by the impacts of Hurricanes Helene and Milton in October, and consequently has more scope to rebound. The market may be more sensitive to a strong than a weak ADP number, as there should be scope for a payroll rebound even if the ADP data disappoints.

We expect November’s ISM services index to correct lower to a still strong 55.5 from October’s 56.0 outcome that was the highest since August 2022. The S and P services PMI was stronger at 57.0, but regional service surveys were mixed, with the Philly Fed’s weaker but Dallas and Richmond Fed data stronger. After the strong S&P index, once again a strong number would be more significant than a weak one. Our forecast is in line with consensus.

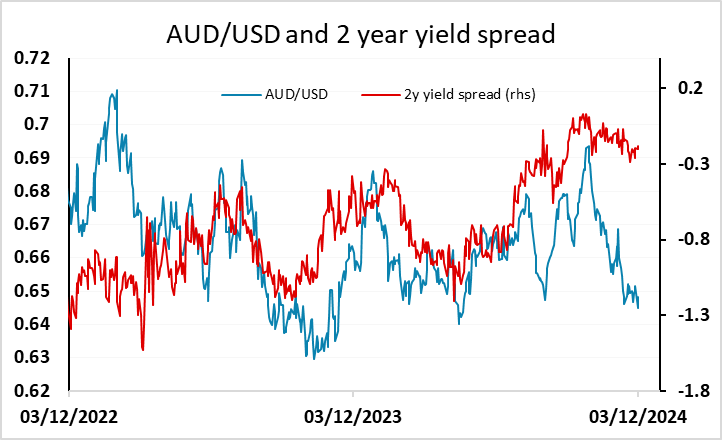

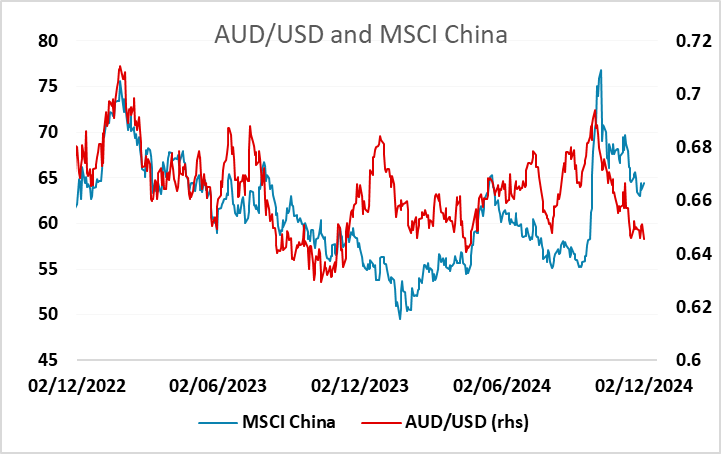

Ahead of the US data we have Australian Q3 GDP numbers. The 0.4% q/q gain expected is solid enough, and might allow some AUD recovery after recent softness. Yield spreads continue to suggest AUD/USD has potential for gains, and even though it has to some extent been undermined by concerns around China of late, it even looks low relative to its correlation with Chinese equities. It may be that the softness of the AUD reflects concern about the impact of Trump tariffs on world trade, but given the uncertainty about the size and timing of the tariffs, we would see AUD weakness as premature.

However, the Q3 GDP for Australia is a miss at 0.3% versus 0.4% expected. Household spending is a laggard as Australians deal with high inflationary pressure. The poor consumption sentiment shall drive the inflationary pressure lower in a near term and could lead to the RBA easing earlier than their current forecast and see Aussie softer.

The main focus in Europe will be on France, with the government expected to face a vote of no confidence. If they lose it Macron has a range of choices. But he is constitutionally constrained by the fact that, because he dissolved parliament in June, he cannot do so again until June 2025. However, a loss of the vote would mean the Budget bill wouldn’t go through, and this could maintain the upward pressure on France/Germany spreads and downward pressure on the EUR. There is still a slim chance that the RN won’t vote against the government, but even then this might only be a temporary stay of execution, so it’s hard to see much EUR upside.