JPY flows: JPY weakness extends toward key levels

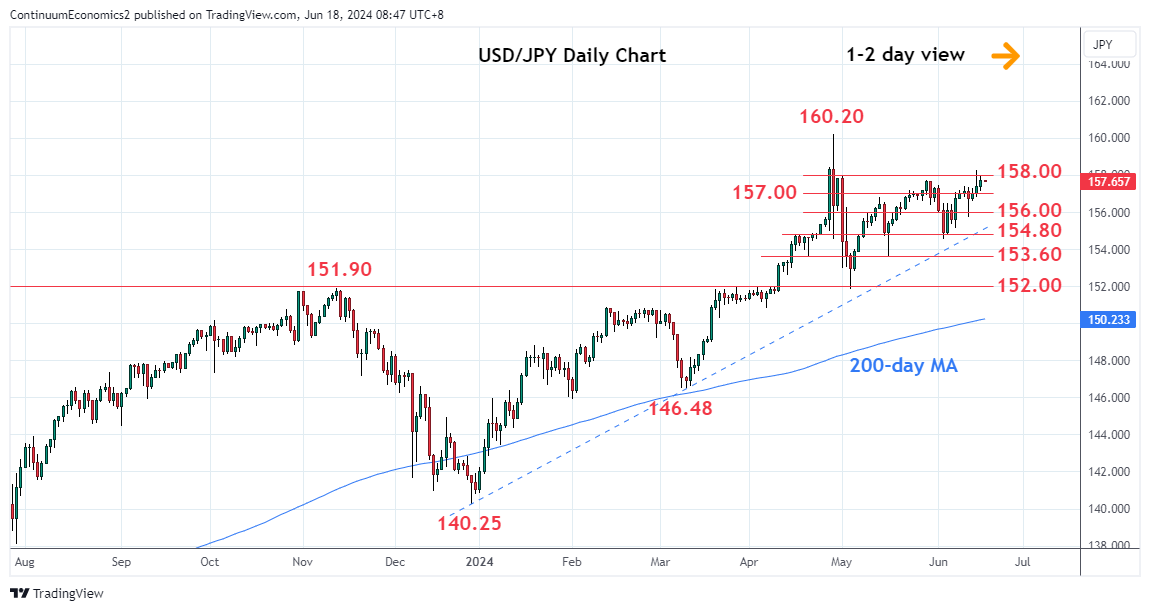

USD/JPY testing the retracement levels close to 158.30. Intervention risk rising

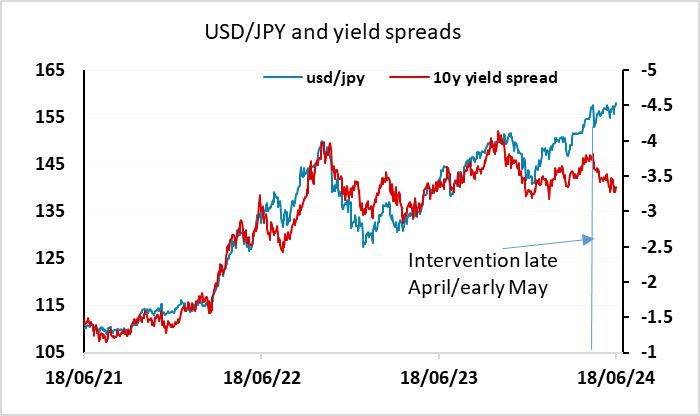

We have seen a 60 pip rise in USD/JPY this morning on no news, with the market seemingly looking to trigger stops above the Fibonacci retracement level near 158.30. As we noted in our earlier comment, the fundamental drivers of USD/JPY are no longer clear. The rise in yield spreads that drove the move from 2021 to the end of 2023 has not extended, and since the end April/early March intervention, yield spreads have dropped but USD/JPY has resumed its rise.

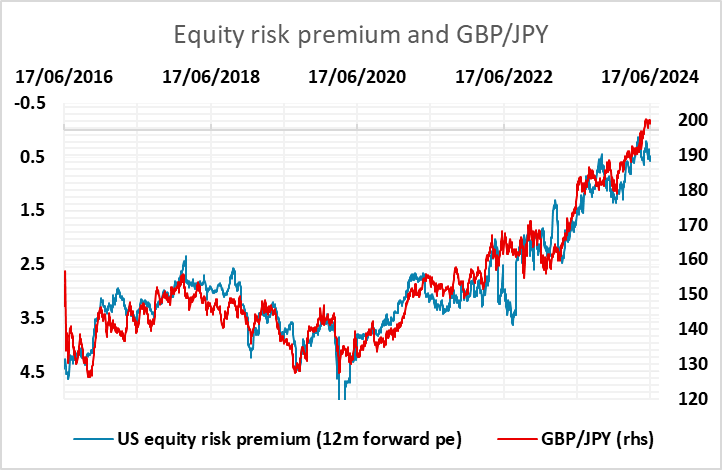

The correlation of JPY crosses with equity risk premia held up a little longer, but in the last few weeks risk premia have edged higher as yields have dropped while JPY crosses continue to test their highs. The Japanese authorities can’t be happy with the way things have gone since the intervention, and may look to hurt speculators again soon, but typically want to be sure the speculative market is overextended before acting.