USD, CAD, JPY flows: US employment weak, Canadian weaker

USD lower after weaker employment data, Canadian data much weaker still

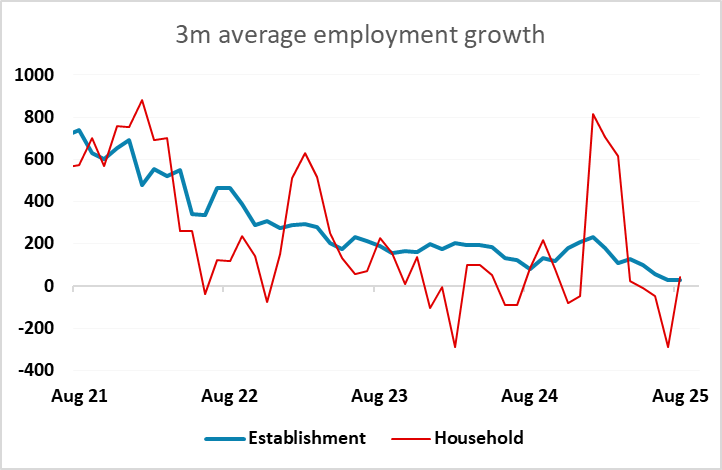

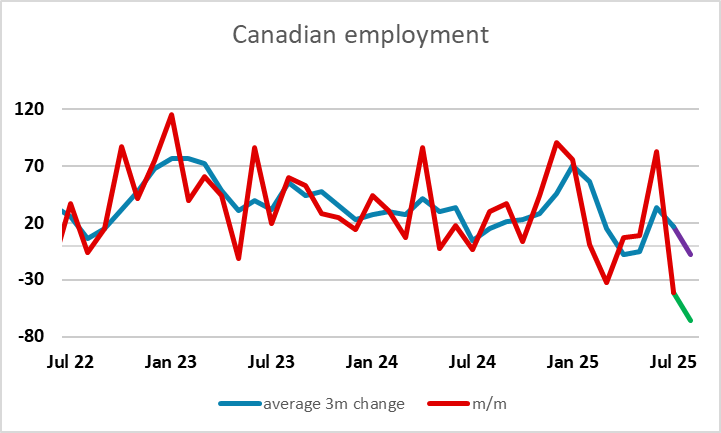

US non-farm payrolls rose less than expected at 22k in August, and revisions were also net negative by 21k, with June at -13k. Even so, 22k is not hugely weaker than expected – 50k is not a large miss in an economy of 160 million workers. By comparison, the 65.5k decline in Canadian employment following a 40.9k decline in July is huge in an economy one tenth of the size of the US. However, with unemployment also rising to 4.3%, the US data is clearly on the weak side.

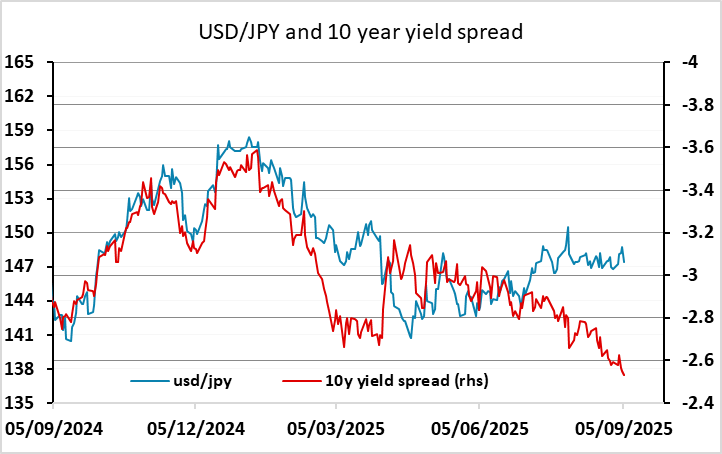

The initial market reaction has been clearly USD negative with the JPY leading the way, but the USD decline is still fairly modest. USD/CAD is slightly higher, but may have further to go given the extreme weakness in the Canadian data which can be expected to force the BoC to cut more aggressively than previously expected. As it stands, US yields have actually fallen more than Canadian yields, which looks out of line with the data, especially since the Fed was already priced to cut 100bps more than the BoC over the next year. Equity markets have not shown much reaction, with lower yields offsetting any concerns about weaker growth. The numbers should be supportive for the JPY both against the USD and on the crosses, but USD losses elsewhere are unlikely to extend far.