FX Daily Strategy: Europe, September 26th

Risk positive tone may be overdone, downside risks on US data

JPY consequently has scope for recovery on the crosses

SNB rate cut likely but CHF decline more dependent on a risk positive environment

SEK still vulnerable to weaker data

Risk positive tone may be overdone, downside risks on US data

JPY consequently has scope for recovery on the crosses

SNB rate cut likely but CHF decline more dependent on a risk positive environment

SEK still vulnerable to weaker data

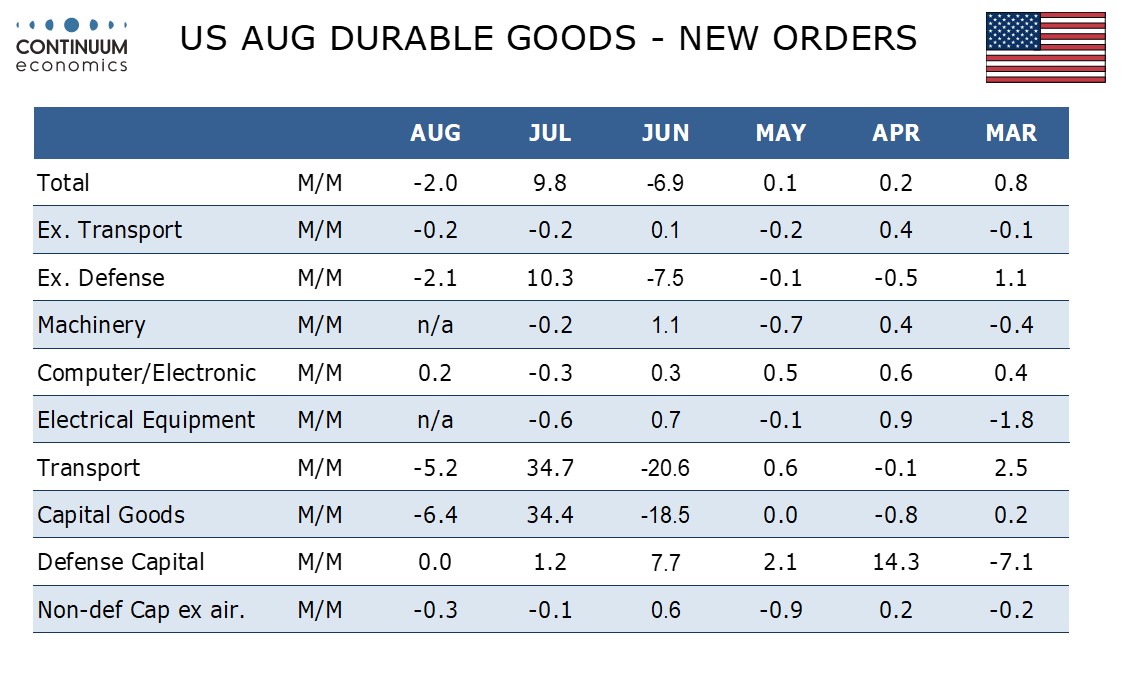

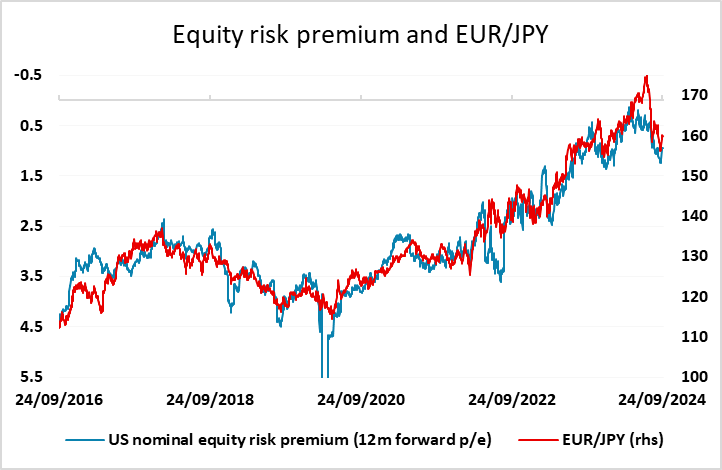

Thursday sees US durable goods orders data for August, revised Q2 GDP data and the latest jobless claims numbers. There hasn’t been a lot of significant data since the FOMC meeting, but the market has taken the view that a Fed willing to cut rates means the risks of a hard landing are low, so the equity market has moved steadily higher, with the S&P 500 making new all time highs. The nominal equity risk premium (equity earnings yield minus bond yield) has also fallen, with both equities and 10 year bond yields moving higher since the FOMC. While this has not reached the lows seen earlier in the year before the decline in bond yields and the equity sell off in the summer, it remains at very low levels historically. This still seems hard to justify in a slowing US economy where growth is expected to be sub-trend (unemployment is expected to rise). So the market seems optimistically priced, and consequently vulnerable to any weaker data.

The risks do seem to be on the downside for the US numbers. We expect only a marginal downward revision to 2.9% in the third (final) estimate of Q2 GDP from the second (preliminary) estimate of 3.0%. However, the data will include historical revisions for the last five years, and they should be closely watched. We expect August durable orders to fall by 2.0% overall as aircraft return to more normal levels after an extremely weak June was followed by a strong July. Ex transport we expect a second straight 0.2% decline, which would imply some loss of underlying momentum. Both of these are slightly below consensus, and there is also an upside risk to initial claims after an unexpected dip last week. This suggests some downside risk for the risk sensitive currency pairs – primarily the JPY crosses, which have seen a long period of gains over the last couple of weeks. GBP/JPY, for instance, saw its eighth consecutive day of gains on Wednesday.

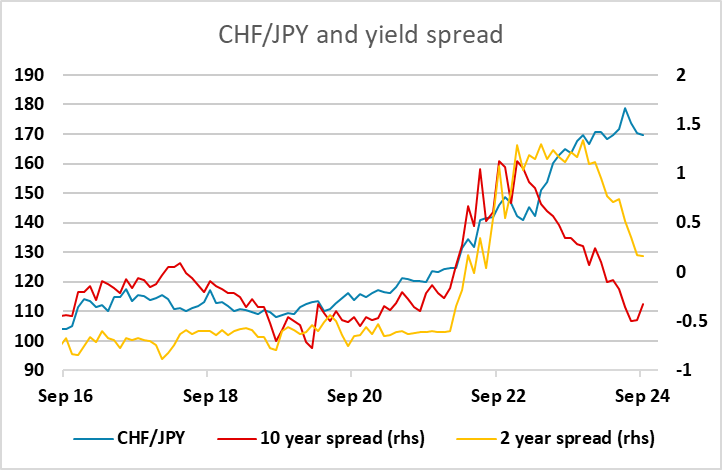

Before the US data we have the SNB monetary policy decision, which is widely expected to produce a further 25bp rate cut, taking the policy rate to 1%. As usual, the main interest will likely be in any indications of future policy. We would expect the very clear below-target inflation picture in both recent actual numbers and the outlook flagged by the SNB in June to lead them to signal further easing ahead. The CHF fell back fairly sharply on Wednesday, reversing the losses on Monday and EUR/CHF reached its highest level for a month above 0.95. However, if risk sentiment turns weaker there may not be much more upside, although from a value perspective EUR/CHF remains at very low levels, in contrast to the high level of EUR/JPY.

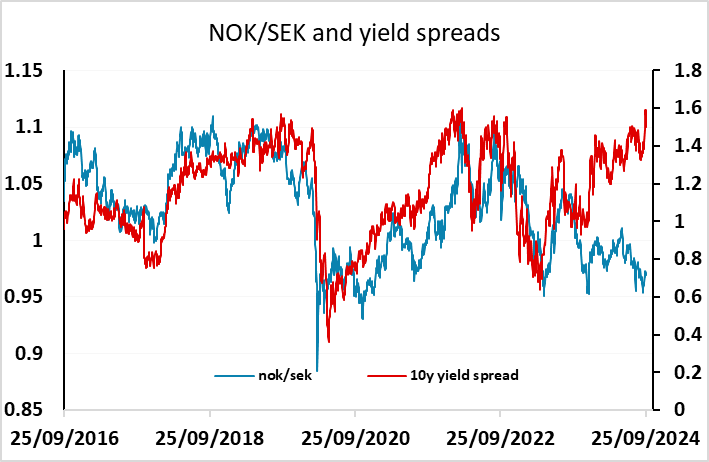

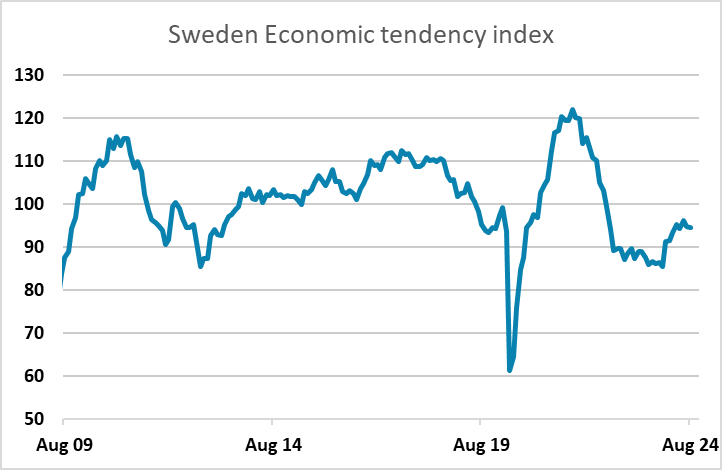

There is also the economic tendency survey from Sweden, which has managed a modest recovery in recent months, but risks may now be to the downside. The 25bp Riksbank rate cut on Wednesday was as expected, but the dovish outlook for the rest of the year may well reflect concern about a slowing economy as well as some greater confidence that inflation is declining. The SEK managed to avoid any more than modest losses after the Riksbank, but we still believe there is a risk of more to come, especially against the NOK, and a weaker economic tendency survey might trigger it.