FX Daily Strategy: APAC, January 9th

US employment report may support recent USD strength

Supreme Court ruling on tariffs may work against USD gains

CAD correction lower could extend on weaker employment data

NOK has potential for recovery despite CPI risks

US employment report may support recent USD strength

Supreme Court ruling on tariffs may work against USD gains

CAD correction lower could extend on weaker employment data

NOK has potential for recovery despite CPI risks

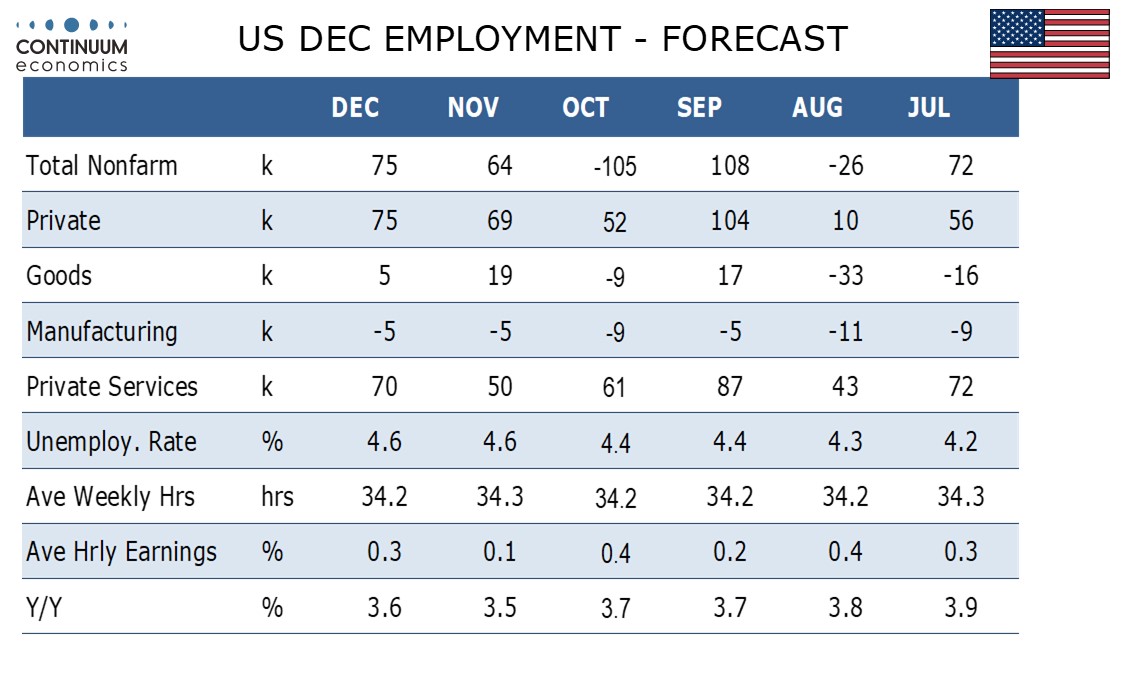

The US and Canadian employment reports are both due on Friday, with the focus naturally more on the US numbers. We expect December’s non-farm payroll to rise by 75k both overall and in the private sector, up from 64k and 69k respectively in November. We expect unemployment to be unchanged at 4.6% and a modest 0.3% increase in average hourly earnings. Our forecasts are marginally higher than the market consensus for payrolls, but the consensus anticipates a decline in the unemployment rate to 4.5%. We therefore wouldn’t expect a significant market reaction if the data comes in in line with our forecasts, but the USD has shown a mildly positive tone in the last couple of days, and the modest pressure on the USD upside may persist.

However, as well as the employment report we may get a Supreme Court ruling on the legality of the Trump tariffs. It is probable that the Supreme Court will rule that at least some of the tariffs are illegal, and this is anticipated by the majority in the market. In practice, the majority of the tariff increases are no longer significant as they have been superceded by trade deals, which the administration has the legal right to make. Even so, it may cause a few ripples if the Supreme Court rule that some of the tariffs have to be rescinded, and may help curtail any USD strength.

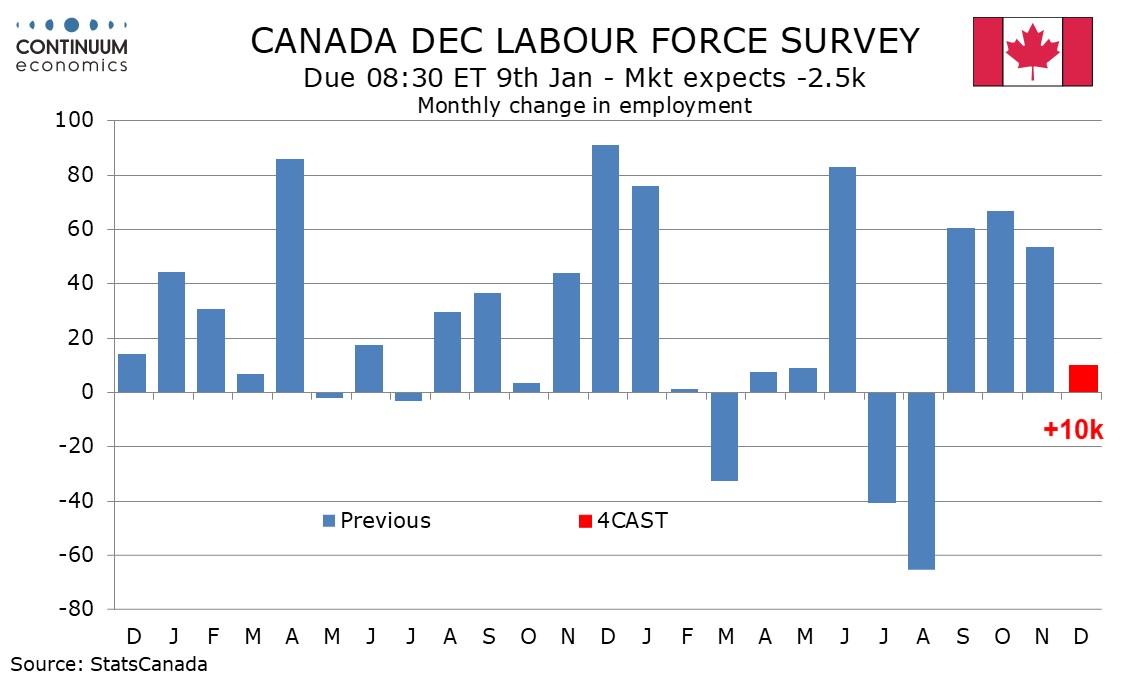

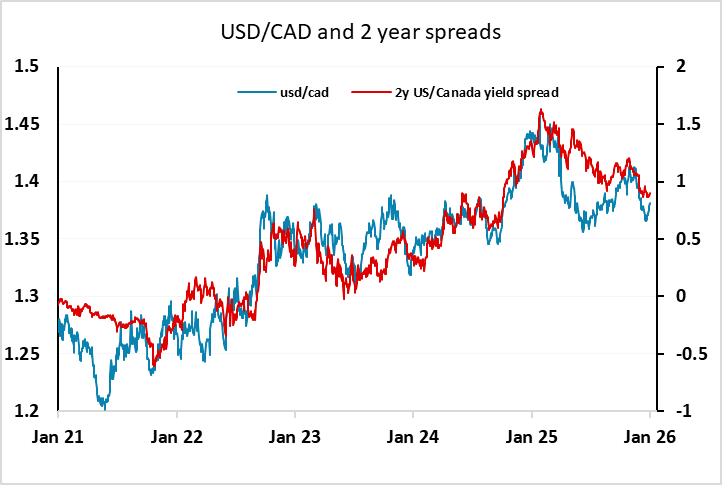

We expect Canadian employment to increase by 10k in December, a number that is probably closer to trend than the three straight strong gains averaging close to 60k. We expect unemployment to correct higher to 6.7% from 6.5% in November, still below October’s 6.9% and the 7.1% highs of July and August. Again, our forecasts are close to consensus, although the market anticipates a small drop in employment, Nevertheless, this wouldn’t be too significant after the recent strong gains, and the CAD ought to hold fairly steady, although there is still scope for the recent USD/CAD correction higher to extend towards 1.3950 in a strong USD environment.

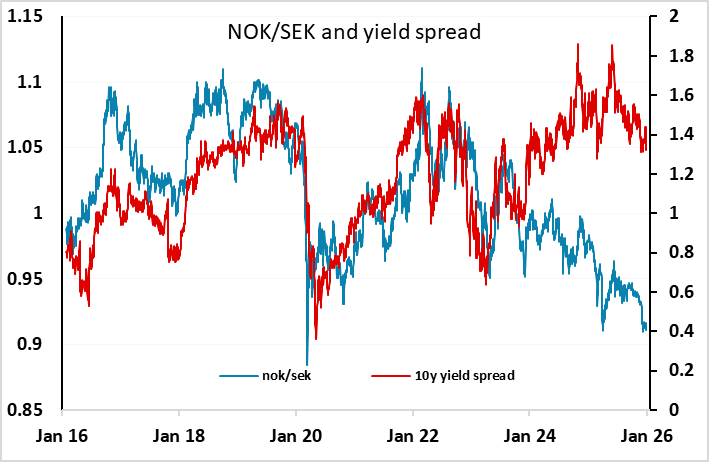

Before the North American data there is German industrial production and Norwegian CPI data. The EUR didn’t react to the very sharp rise in German orders reported on Thursday, so seems unlikely to respond to the less volatile production data. The NOK may, however, have potential to react to the CPI data. Risks may be to the downside of the 3.0% y/y market consensus. There is no Norges Bank rate cut priced in until August, and weaker data may bring expectations forward a little. However, the NOK is already trading at very weak levels relative to yield spreads, so NOK risks are more to the upside, with NOK/SEK at 0.91 looking particularly cheap.