FX Weekly Strategy: Oct 6-10

LDP election could set the JPY tone

Still scope for substantial JPY recovery

NZD may manage correction higher on a 25bp RBNZ cut

European currencies largely rangebound

Strategy for the week ahead

There was never a lot of significant data out of the US due this week, and with the government shutdown there is no w nothing that is likely to move the market. Indeed, there isn’t a great deal globally on the calendar, with the Japanese LDP leadership election on the weekend perhaps the most significant event. There is also an RBNZ meeting on Wednesday that could have an impact, with the market split between expecting a 25bp and a 50bp rate cut.

Most of the media view Japan's Liberal Democratic Party leadership election – effectively an election of the next Prime Minister - as a contest between Shinjiro Koizumi and Sanae Takaichi, but there is also growing support for dark-horse candidate Yoshimasa Hayashi. Betting odds have Koizumi as a hot favourite, and should he win, it will likely be seen as JPY positive, as he favours some fiscal expansion but is not of the Abenomics school which also favours easy monetary policy. Easier fiscal policy would encourage the hawks at the BoJ to act at the October 29 meeting, although last week’s comments from BoJ governor Ueda suggested he was in no hurry. As it stands, a hike is only around 35% priced in, so there is scope for JPY gains if the market starts to see a move as more likely than not.

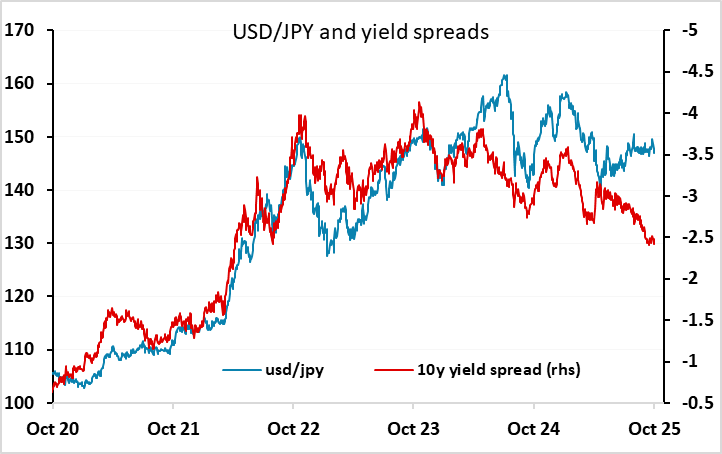

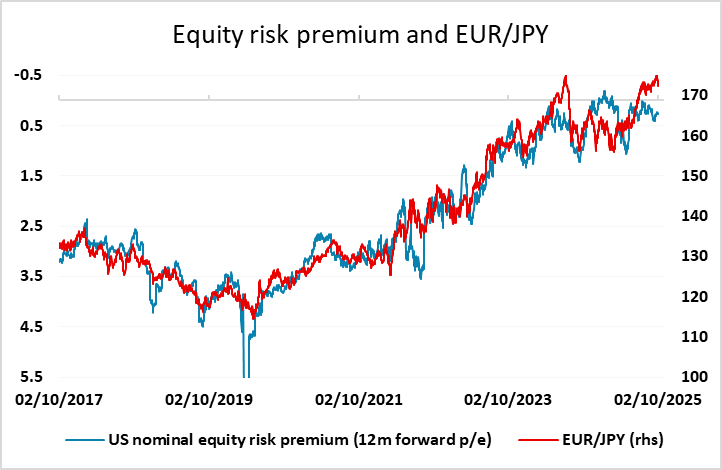

The JPY strengthened through much of last week before falling back on Friday after the comments from Ueda that indicated he saw little risk from delaying a hike in rates. JPY strength had been based not on any expectation of BoJ action, but on some easing in risk sentiment due to the US government shutdown and the weaker than expected ADP employment data. The ISM services survey on Friday was also weaker than expected in the activity indices, but the price index remained stubbornly high, which may have been partly responsible for the lack of market reaction. USD/JPY remains stuck in a 146-149 range, but we see the risks as being on the downside, both because it is already well above the levels suggested by yield spreads, and because JPY crosses also look overextended relative to their usual correlation with equity risk premia. The strength of US equities has helped to prevent any JPY breakout to the upside, but the equity market looks increasingly frothy and overvalued, with the S&P 500 making new highs on little news for the last three days. Risks of a sharp JPY break to the upside are mounting, and the LDP election is one potential trigger, although a US equity market correction looks necessary for any sustained turn in the weak JPY trend.

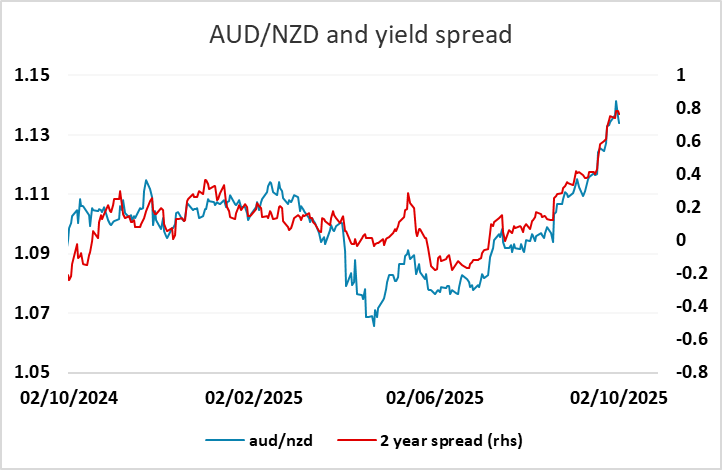

All forecasters expect a rate cut at the RBNZ meeting, but are split on the likely size, with 15 of 26 in the Reuters survey going for a 25bp cut and 11 looking for 50bps. Market pricing suggests it is close to a 50-50 call between 50 and 25. While it is a close call, we would expect a 25bp cut which might allow a modest NZD recovery. AUD/NZD has been in a strong uptrend for the last couple of months as the market has priced in relatively more aggressive RBNZ easing, and the NZD could manage a fairly sharp corrective rally if the RBNZ proves less dovish than expected.

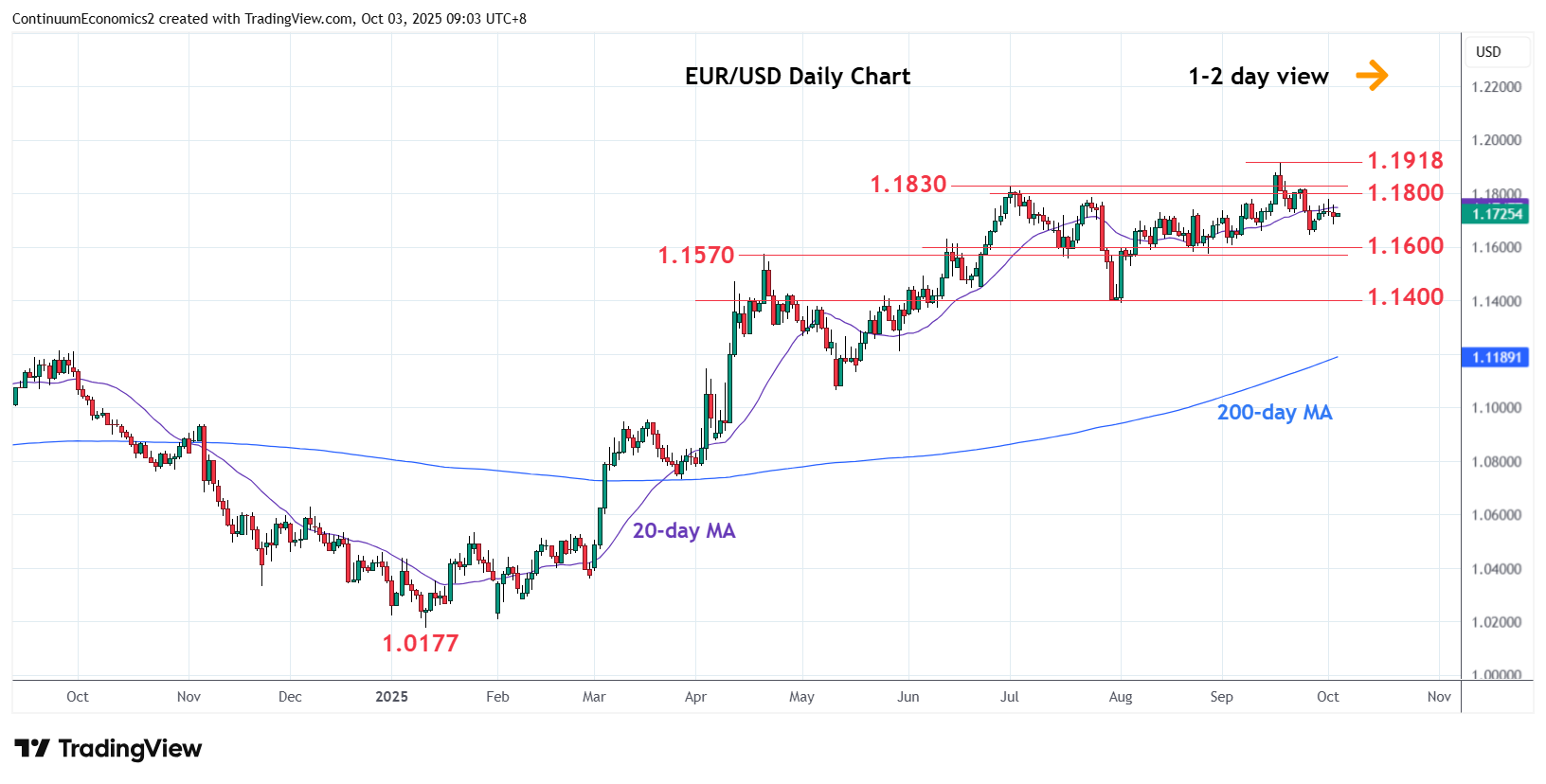

The European currencies seem unlikely to move far form established ranges, with EUR/USD 1.17-1.18 and EUR/GBP 0.87-0.8750. EUR/CHF has a strong base at 0.93, but upside progress is likely to be slow in the absence of positive economic news from the Eurozone. We continue to see scope for NOK strength, especially if the lack of US data maintains quiet markets.

Data and events for the week ahead

USA

Even before the government shutdown, the US economic calendar for the week was a light one. Still on the calendar are August consumer credit on Tuesday and October’s preliminary Michigan CSI on Friday. August’s trade balance, where we expect a decline in the deficit to $60.2bn from $78.3bn is scheduled on Tuesday, but is likely to be postponed. If the government shutdown ends, recently postponed data will be rescheduled, including September’s non-farm payroll. Despite the negative ADP report, we continue to expect a modest increase of 45k.

FOMC minutes from September 17 will be released on Wednesday. These are likely to show a clear consensus for the 25bps easing that was delivered at the meeting but significant differences of opinion about the appropriate path going forward. This will be seen as data-dependent, showing that its absence while the shutdown persists will be a problem for the Fed. Fed speakers during the week include Bostic, Miran and Kashkari on Tuesday, and Barr on Wednesday. Kashkari speaks again on Wednesday and Thursday, and Barr speaks again on Thursday. Goolsbee is scheduled on Friday.

Canada

Canada sees August trade data and September’s Ivey manufacturing PMI on Tuesday. The most significant Canadian release will be September employment on Friday, coming after a weak August report.

UK

Minor but still important data are the focus this coming week, starting with the construction PMI which has been very weak and may remain so – in August, it reported that business activity fell for the eighth month in a row, but at slower pace than in July. Intertwined with this partly housing-related weakness will be the RICS housing survey numbers (Thu), again likely to show some overall softening. Finally, REC labor market data (Fri) may show more signs of spare capacity coming through. As for the BoE, the Financial Policy Committee Record will be published on Wednesday with monetary policy related updates due from Chief Economist Pill (Wed) preceded by comments from Governor Bailey (Mon)

Eurozone

The week starts with what may be a bounce in German orders data (Tue) but with industrial production correcting back probably (Wed). The week starts, however, with what may be still sideways-moving EZ retail sales numbers, with Monday also seeing with the construction PMI which has been very weak and may remain so. As for the ECB, Chief Economist Philip Lane speaks on The Monetary Policy Reaction Function at an ECB Conference on Monday, with President Lagarde testifying to the EU Parliament Committee on Economic and Monetary Affairs later that day

Rest of Western Europe

There are quite a few key events in Sweden, most notably flash CPI data for September (Thu) important to see if all fall to 3.0% does occur for the CPIF rate and the ex-energy measure down to 2.7%. Friday sees output/orders numbers and the monthly GDP indicator, the latter having proved far from authoritative of late. Otherwise, in Switzerland, come FX reserve data, perhaps more important of ate after the SNB have been pushed in to backing away from intervention – NB SNB has pledges to avoid Franc manipulation in a joint release with the U.S. And in Norway September CPI data (Fri) may see little change from the CPI-ATE 3.1% August outcome.

Japan

Overall household spending on Tuesday and Labor cash earning on Wednesday are critical. Labor cash earning in July has been slightly revised lower but we still expect wage growth above 2% as firms received more certainty after the U.S.-Japan trade agreement. Household spending should see a continuous recovery but are open to negative surprises. Ueda will be speaking on Wednesday. His rhetoric is crucial as the LDP leadership election will have their dust settled over the weekend. If he previews with a hawkish tilt, it will be more supportive of our October hike call.

Australia

Overall, it is just tier two data for Australia next week. The private inflation data will be released on Monday, ANZ Job ads & consumer confidence on Tuesday, followed by consumer inflation expectation on Thursday.

NZ

The RBNZ interest rate decision is going to be announced on Wednesday. It is a fluid decision with certain market participants anticipating a 25bps cut to 2.75%. The current inflationary dynamics support both a cut and a hold and it will remain on the balance of RBNZ’s inflation forecast.