FX Daily Strategy: APAC, Sep 11th

US CPI risks slightly to the upside

USD impact likely to be modest, but JPY favoured

ECB meeting a damp squib

US CPI risks slightly to the upside

USD impact likely to be modest, but JPY favoured

ECB meeting a damp squib

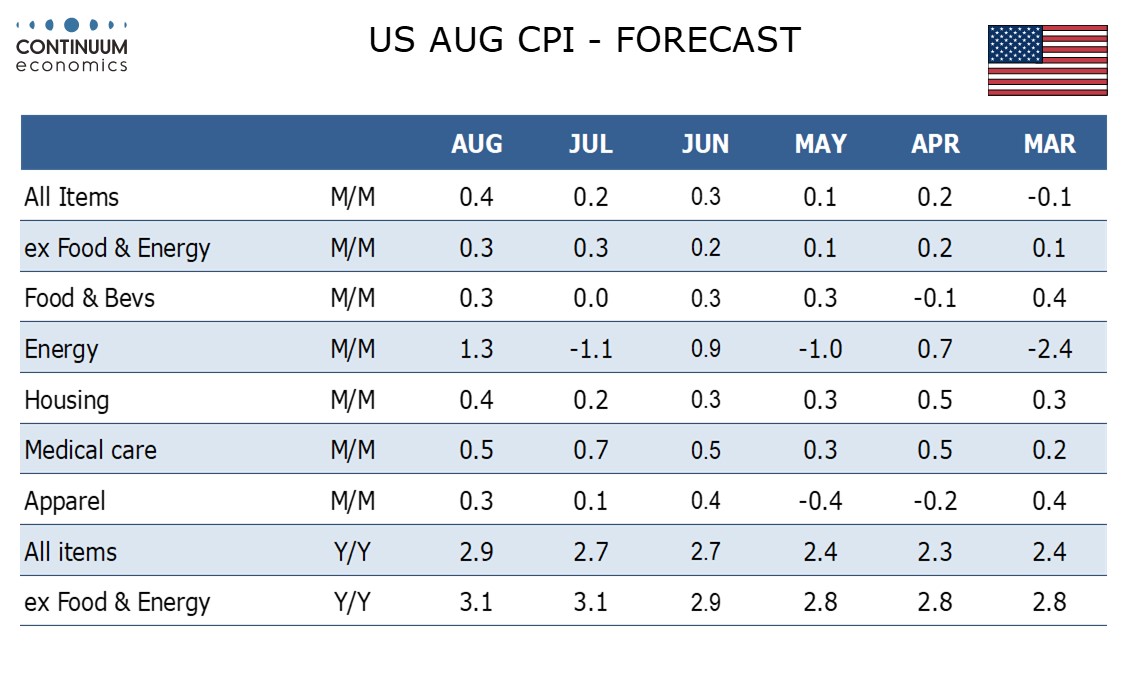

US CPI will be the main focus on Thursday. We expect August CPI to increase by 0.4% overall and by 0.3% ex food and energy, with the respective gains before rounding being 0.37% and 0.31%. This would be the second straight gain slightly above 0.3% in the core rate with the impact of tariffs starting to escalate. We don’t make any change to our view after the weaker than expected August PPI data. Our forecast for the headline rate is slightly above the consensus 0.3%, although our core rate forecast is in line. After US yields dropped slightly following the PPI data, our forecast would suggest they will rebound after CPI. However, there was no USD impact from the drop in yields post-PPI, partly because weaker price data is seen as suggesting limited tariff impact and consequently less effect in real growth. Conversely, higher CPI might reignite concerns about slowdown, and may consequently be USD negative. While there might be some paring back of expectations of near term Fed easing, higher CPI would likely lead to a flatter curve.

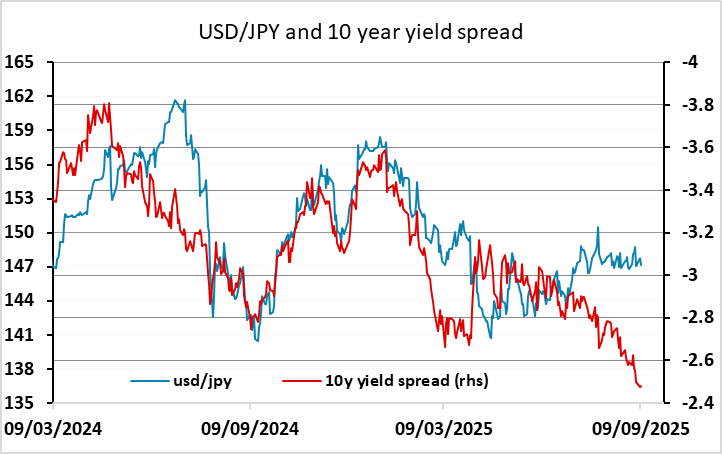

The implications for the USD are therefore not entirely clear. Higher CPI might lead to a knee-jerk positive impact, but this might not last. Equities might suffer if Fed easing expectations are pared back, and a flatter curve would tend to favour the JPY over the riskier currencies as well, with the JPY tending to be more responsive to longer dated yields (at least until recently). There is a risk of overanalysing here, as our forecast is only 0.025% away from being 0.3% and in line with consensus, but on balance the data might be mildly USD/JPY negative.

The EZ Economic Outlook – Alternative Perspectives

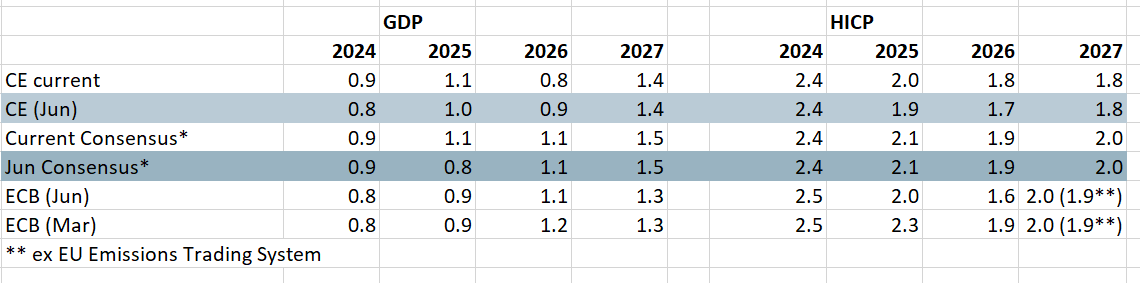

Otherwise we have the ECB meeting, but this looks like being one of the least notable meetings of recent times, with no expectation of any policy change and a very neutral statement also likely. After all, in July the Council suggested it would be ‘deliberately uninformative about future interest rate decisions’. Little may be gleaned either from updated economic projections which may see little impact from what has been both a higher tariff outcome than was assumed three months ago and what are still tight, if not tighter, financial conditions. Instead, data dependence will remain the main message. We still expect headwinds facing the EZ economy will eventually trigger two more 25 bp cuts, probably late this year and early next, but don’t expect this to emerge from the ECB.