FX Daily Strategy: Asia, June 26th

U.S. May New Home Sales Trend starting to slip

Australia Monthly CPI Expected to be Hot

USD/JPY Remains in the Spotlight

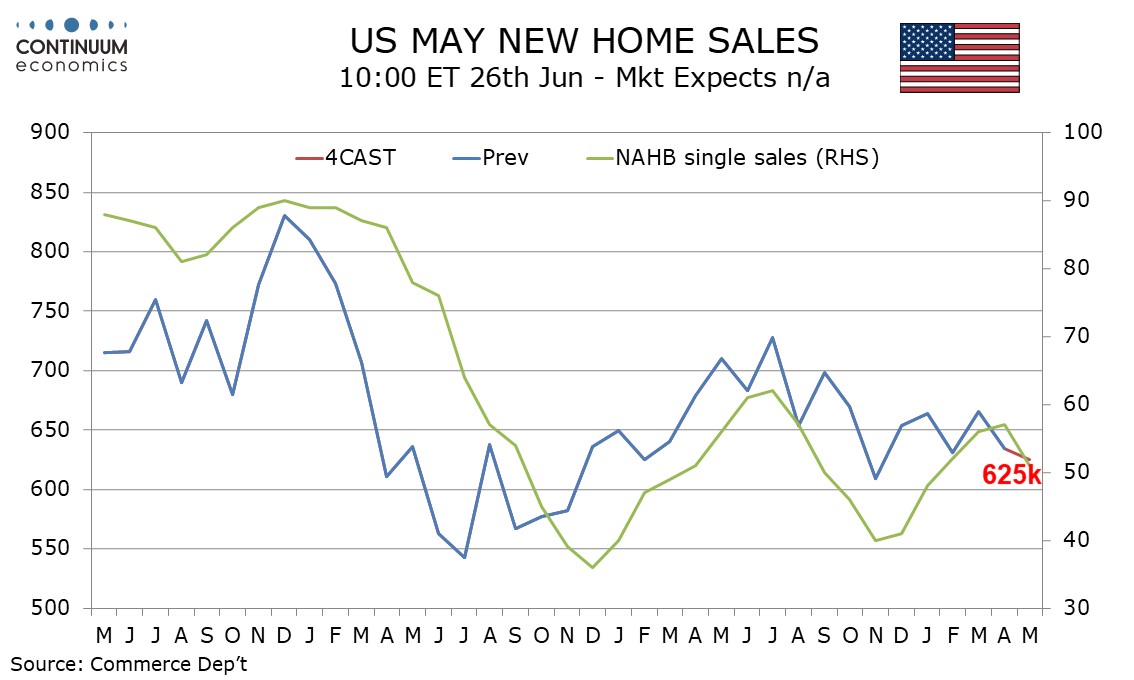

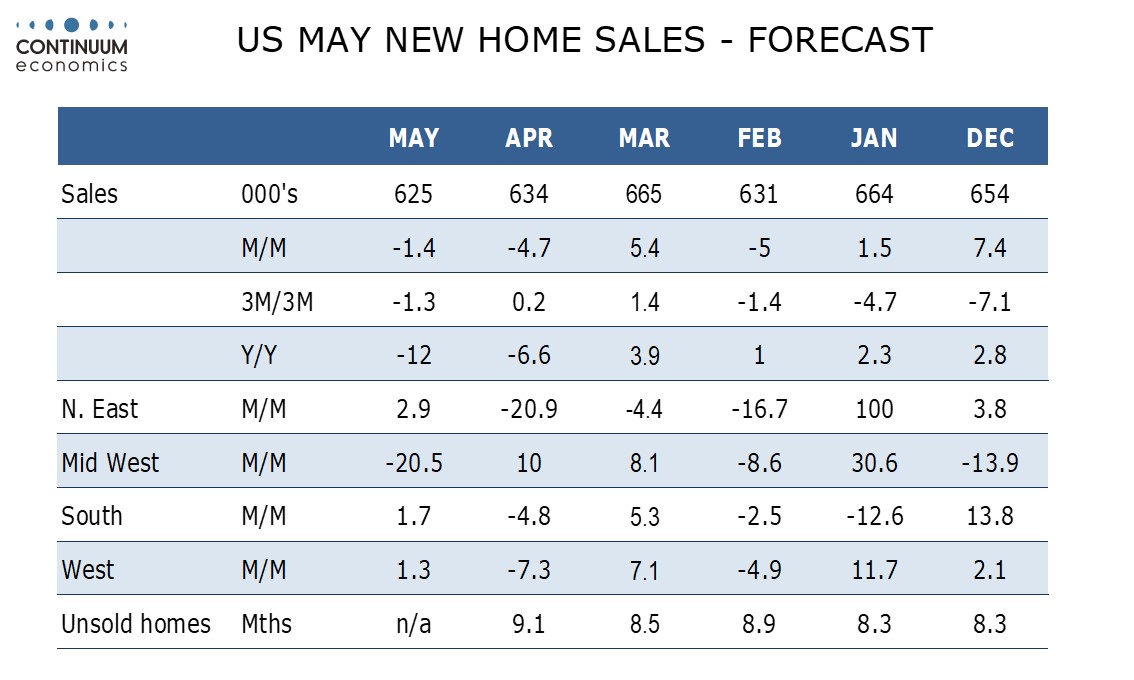

We expect a modest 1.4% decline in May new home sales to 625k, which would be the lowest since November. Survey evidence suggests the housing market is starting to weaken but after a 4.7% decline in April we do not expect a sharp decline in May. We expect only one region to report a decline in May, with the Midwest likely to see a sharp decline after two straight strong gains. We expect the other three regions to report marginal gains, in corrections from more significant declines in April.

Trend in prices looks subdued and on the month we expect no change in either the median or average. This would see the median yr/yr pace slip to 2.9% from 3.9% while the average picks up to 2.0% from 1.0%.

RBA has pushed back rate cut expectations in the past two meeting as CPI has moderated slower and showing signs of flaring up in the past months. While a part of the pressure comes from transitory items, the pace of service inflation has not been moderating as quickly as most forecast, along with the strong demand of labor and subsequent higher wage. The monthly CPi data is expected to come in higher, instead of further moderation, in sight of higher energy prices and the end of rebates. Market has priced in almost no easing in 2024 and thus the surprise lies mostly in the downside if monthly CPI shows signs of dissipation.

On the chart, there is little change as prices extend consolidation around the .6650 congestion. Mixed daily studies suggest further sideways ranging action persisting though strong support at .6600/.6580 multi-week range low seen protecting the downside. Meanwhile, break above the .6680 high is needed to open up the .6700/15 resistance to retest. Clerance here will extend the broader gains from the April YTD low and see room to extend retracement of the December/April losses to target .6750, 76.4% Fibonacci level.

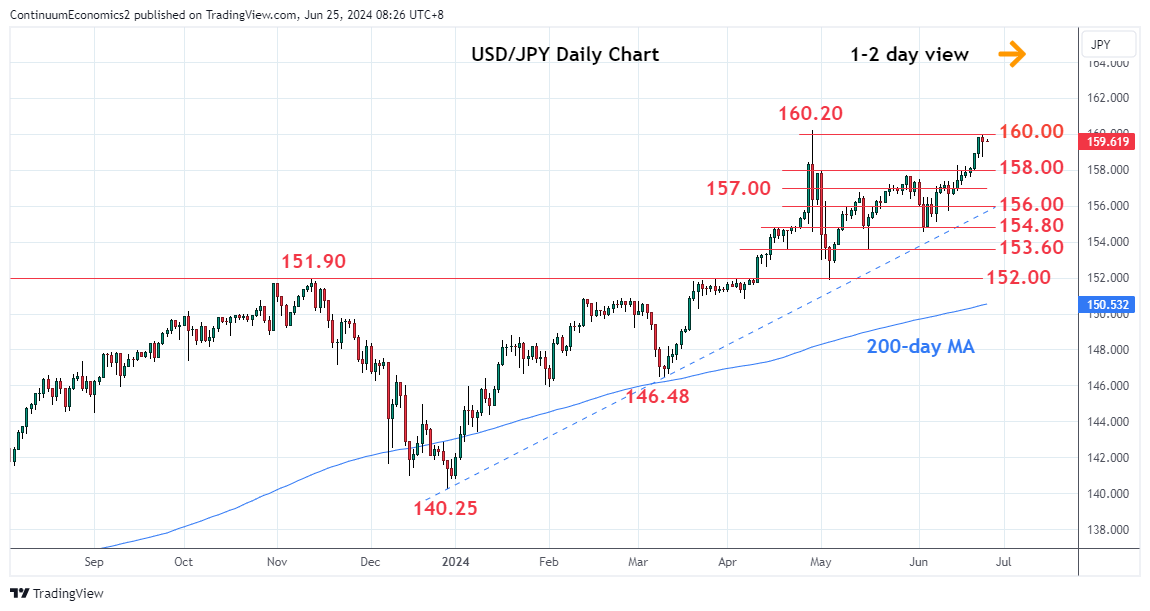

All eyes in the market will be on USD/JPY in this relatively quiet calendar week. USD/JPY is once again at intervention zone around the 160 figure. The surprising disappointment from BoJ in the June meeting seems to have taken the legs of any hawkish speculation after catching some market participants wrong footed. While BoJ has said they are going to announce plans of cutting bond purchase in the next meeting, it is hard to gauge the magnitude of such cut and its impact towards long term rates. The only hope for JPY, apart from intervention, seems to be a deep correction in equities. It is hard to see BoJ tighten significantly given the current inflation picture and the expected narrowing of yield differential between the U.S. and Japan maybe narrower than most assume. Thus, there seems to be little positioning in JPY longs for now despite we are getting ready for another step from the BoJ.

On the chart, the pair has settled into consolidation below the 160.00 level with choppy trade here leaning lower and scope seen for pullback to unwind overbought intraday and daily studies. Lower will see room to retrace the strong run-up from the 154.55 early-June low to the 159.00 level. Below this will open up deeper pullback to the strong support at the 158.00/157.70 area. Meanwhile, resistance at the 160.00/20 area and the 160.35, 1990 multi-year high expected to cap. Would take break to open up further extension to the 161.00/162.00 area.