FX Daily Strategy: N America, May 13th

US CPI the main focus, but implications less clear

Weaker data might be seen as USD positive

GBP little changed after mixed labour market data

JPY weakness reaching extremes

US CPI the main focus, but implications less clear

Weaker data might be seen as USD positive

GBP little changed after mixed labour market data

JPY weakness reaching extremes

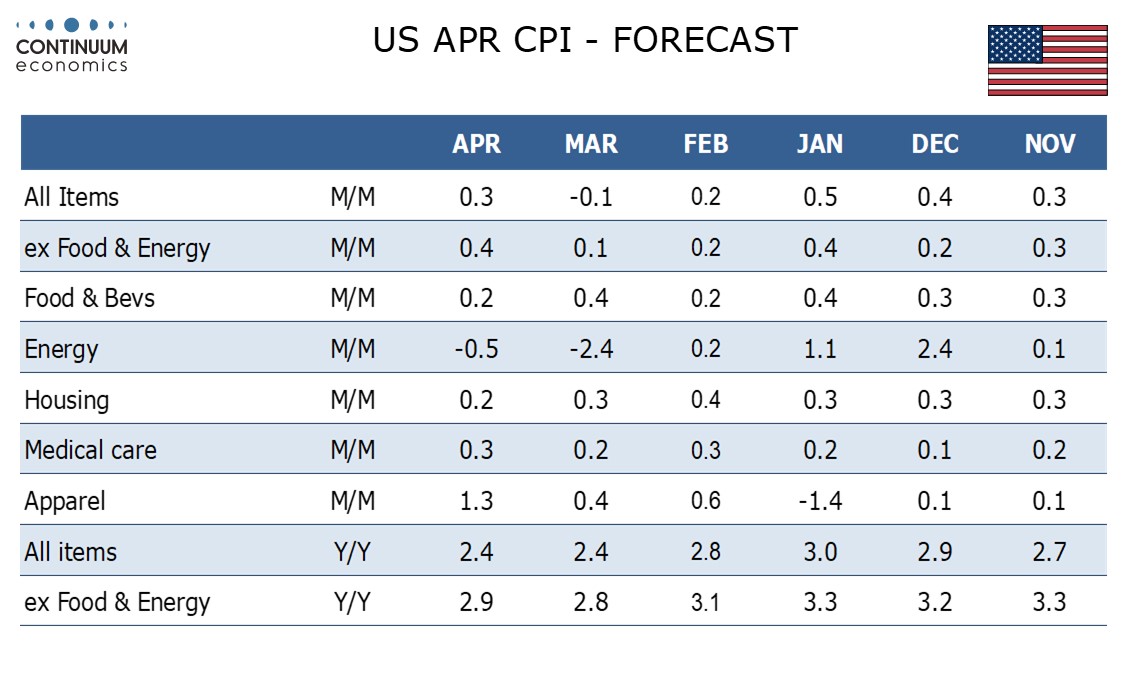

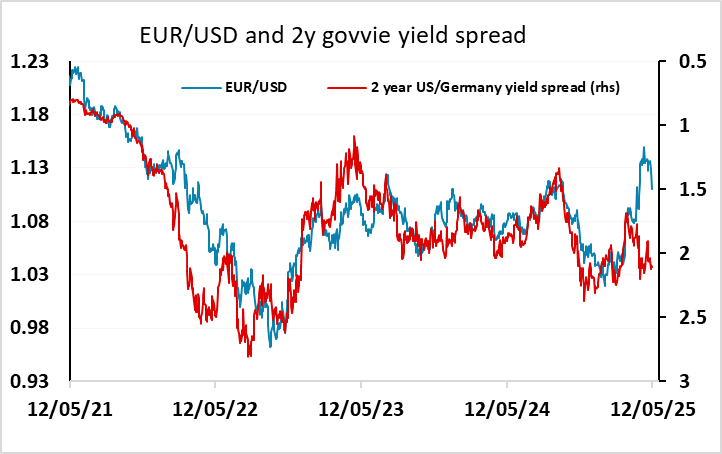

Tuesday sees the main data of the week in the shape of US CPI. We expect April CPI to increase by 0.3% overall and by 0.4% ex food and energy, the core rate reflecting a rebound from a below trend March as well as some impact from tariffs, though the extent of the tariff impact is highly uncertain. We see the core rate at 0.38% before rounding. Our forecast is slightly above the market consensus of 0.3% for the core, but it’s unclear what the market reaction would be to a stronger number. The last few years have tended to see higher inflation numbers leading to a stronger USD due to expectations of tighter Fed policy. But the last few months have seen the USD less sensitive to Fed policy expectations if inflation is rising due to tariffs, both because of the negative growth implications of higher prices and because confidence in the USD has been hit by the uncertainty surrounding the impact of tariffs. The picture is all the more uncertain with the latest reduction in US/China tariffs, but even with this, there is likely to be a significantly positive impact of tariffs on prices in the next few months.

In practice, this probably all means that the CPI data is less important than it was in the past, with more of a focus on the growth numbers going forward. On balance, the fact that EUR/USD remains a lot higher than suggested by the yield spread correlation of the last few years suggests to us that weaker CPI may be better for the USD, as it will support the view that the tariff concerns are overblown. Of course, the main impact of tariffs on CPI are unlikely to be seen until the May and June data, so this month’s numbers only seem likely to have an impact if they are on the strong side, and in that case they will likely be negative for the USD.

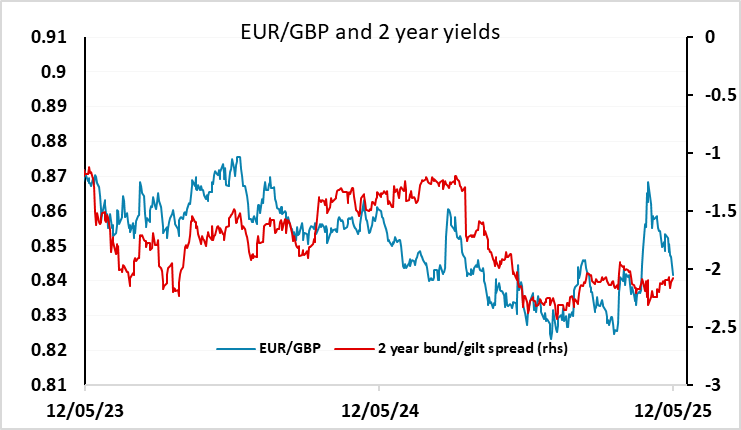

EUR/GBP is not much changed in response to mixed UK labour market data this morning. The employment data was on the weak side of consensus, both in the ONS and HMRC measures, but the earnings data was slightly on the strong side in both measures, although excluding bonuses, earnings on the ONS measure were slightly below expectations at 5.6% in March, down from 5.9% in February. The HMRC measure showed earnings growth rise to 6.4% in April from 5.9% in March, but payrolled employment continues to fall on the HMRC measure, down 33k in April after a 47k fall in March and a 27k fall in February. The ONS measure still shows employment rising 112k in the 3 months to March (this includes self-employment).

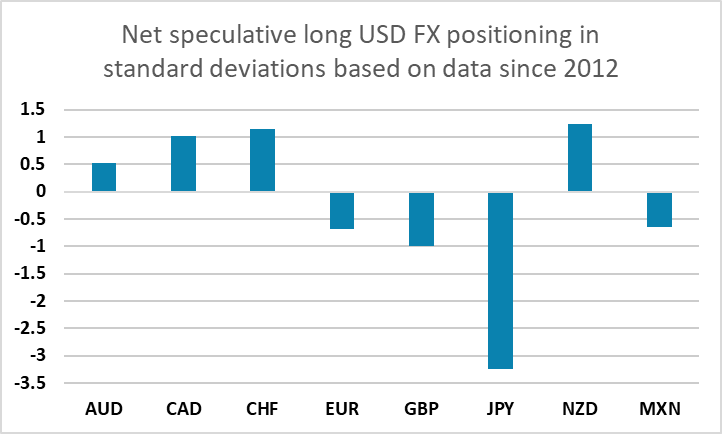

The main FX move in the last week has been the weakening of the JPY, which has not only fallen to its lowest since April 2 against the USD but has also made new highs for the year against the EUR. This relates almost entirely to the strength of the equity market, with EUR/JPY and other JPY crosses still tending to benefit from any decline in the implied US equity risk premium. But with the S&P 500 now having retraced more than 75% of the decline from the highs, and trading above the level seen when reciprocal tariffs were announced, there doesn’t loom to be much more upside for equities near term, and the risks may be shifting to the JPY’s upside, even though the CFTC data still showed a very large long JPY position as of a week ago.