FX Daily Strategy: Europe, Sep 3rd

AUD mildly favoured on GDP data

Some scope for JPY to sustain late recovery seen Tuesday

GBP may reverse some of Tuesday’s losses on MPC testimony

AUD mildly favoured on GDP data

Some scope for JPY to sustain late recovery seen Tuesday

GBP may reverse some of Tuesday’s losses on MPC testimony

Wednesday sees Australian Q2 GDP data, with the market consensus anticipating a 0.5% q/q gain. The AUD remains confined to a 0.64-0.66 range, and it’s hard to see this data changing expectations of RBA policy sufficiently to break this range. While the recent momentum is a little AUD positive having rejected the latest test of 0.64 in response to some stronger data, it’s hard to see the top end of the range being tested without a generally weaker USD, and this is only likely to come if we see a clearly weak employment report on Friday. However, we would expect to see mild AUD gains if we see a number in line with the 0.5% consensus.

The Australia Q2 GDP came in at +0.6% q/q, slightly higher than estimate, so as the 1.8% y/y growth. Consumption is showing some signs of picking up, which is favorable as RBA will be comfortable in cutting rates but no hurry in doing so.

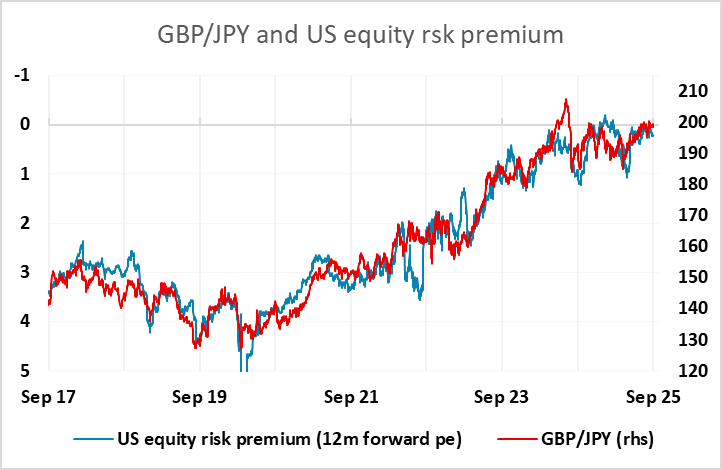

Otherwise, there is only US factory orders and JOLTS on the data calendar, with the ADP employment data coming on Thursday due to the Labor Day holiday. Neither seems likely to be notably market moving. The USD was firm on Tuesday due to a rise in yields from the open, although it fell back after the slightly weaker than expected ISM data. The highs seen on Tuesday look unlikely to be broken in Wednesday’s trading. If anything, we would see some USD downside risks against the JPY, as a weaker equity market tone favours the JPY on the crosses.

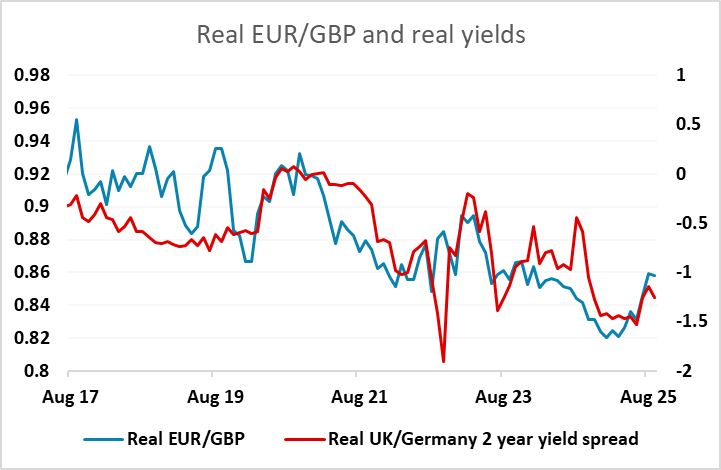

We do have BoE testimony to the Treasury select committee on Wednesday afternoon, which may attract more attention than usual after the 5-4 vote. The hearing is being attended by Lombardelli, Taylor and Greene. Taylor is the mega-dove who wanted to cut y 50bps, while Greene and Lombardelli both voted to leave rates unchanged. The bias may therefore favour the hawkish side (2 to 1), although the dove may be more convinced and convincing. GBP was under some pressure on Tuesday helped by a risk negative tone and a new 27 year high in 30 year yields, with EUR/GBP breaking above 0.87 for the first time since August 7th. However, spreads with the EUR up to the 10 year area didn’t move much. We still see long term GBP weakness, but this is likely to require more declines in real UK yields and a narrowing of the spread with the Eurozone, so unless the MPC testimony leads to increased BoE easing expectations, we may see EUR/GBP drop back.