FX Daily Strategy: N America, June 20th

Geopolitical concerns likely to dominate on Friday

Scope for a JPY recovery on the crosses

USD to hold firm even if Philly Fed weak, especially versus EUR and scandis

Geopolitical concerns likely to dominate on Friday

Scope for a JPY recovery on the crosses

USD to hold firm even if Philly Fed weak, especially versus EUR and scandis

Friday looks like providing a relatively quiet end to the week, with only second tier data due and little reason for any major FX movements following this week of central bank meetings. The focus remains primarily on geopolitics, with the possibility of US involvement in the Israel-Iran war looking like the most likely market mover into the weekend. Trump hasn’t ruled this in or out, but his suggestion that it is possible looks like an attempt to get Iran to halt its attempts to develop a nuclear weapon. While Trump is reluctant to get the US directly involved, an Iranian refusal to halt its program may trigger a response.

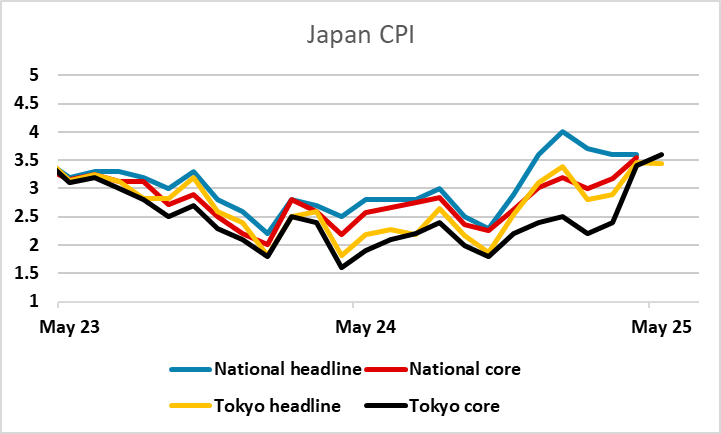

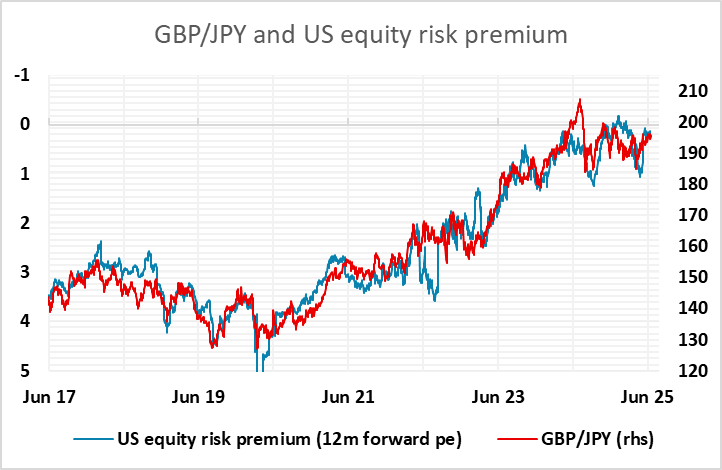

This suggests that we may see a more risk negative tone going into the weekend. Thursday saw some weakness in equity markets and some strength in the USD, but the JPY underperformed in spite of the more negative risk tone. This may be corrected on Friday, with JPY crosses in particular looking overextended in this environment. Friday kicks off with Japanese national CPI data, with the Tokyo data already released suggesting there is a mild upside risk to the consensus forecast of a rise in core CPI to 3.6% y/y, which would also suggest some JPY upside risk.

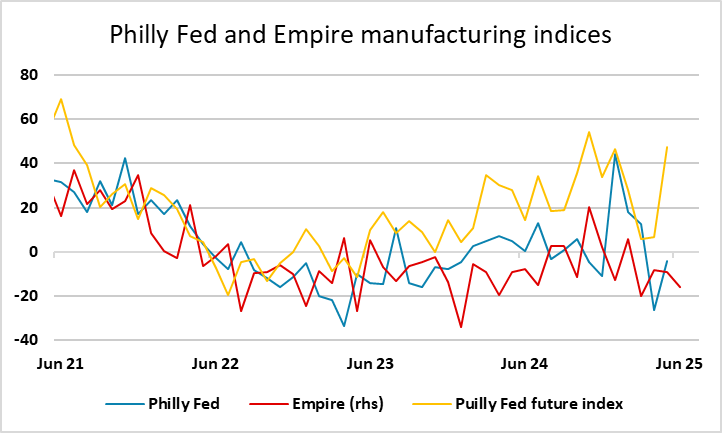

In the US there is only the Philadelphia Fed survey, but this could attract some interest after the weaker Empire manufacturing survey earlier in the week. Last month’s survey showed a recovery after a sharp dip in April, with the future index particularly strong. This time around the consensus is for a further modest recovery, so there may be some USD vulnerability if we see weakness similar to that seen in the Empire survey. However, the underlying USD tone is likely to be strong due to geopolitical concerns, with the EUR and the scandis perhaps the most vulnerable given their strength in recent months.