JPY flows: New one year high in USD/JPY

JPY weakness continues to break records. Intervention likely necessary to turn the trend

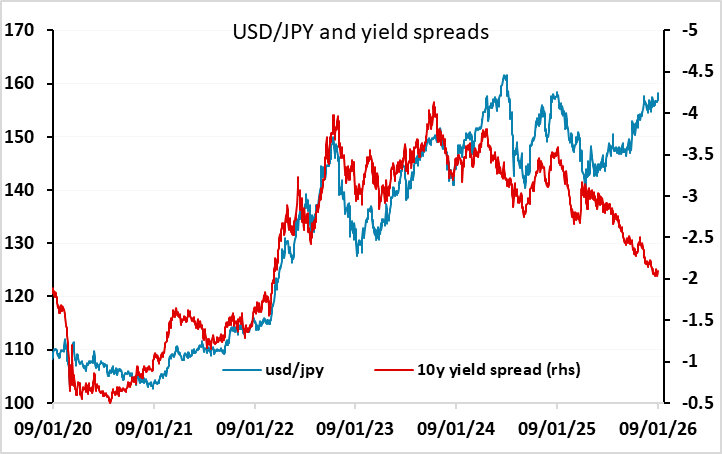

USD/JPY hitting its highest for a year in the wake of the US employment data, helped by a report that Japanese PM Takaichi is considering calling a Lower House election in February. Why this is perceived as JPY negative is, however, unclear. JPY weakness continues to be more a consequence of benign risk conditions and momentum, with the break of the December 19 high seen on the day of the last BoJ rate hike likely a trigger for gains.

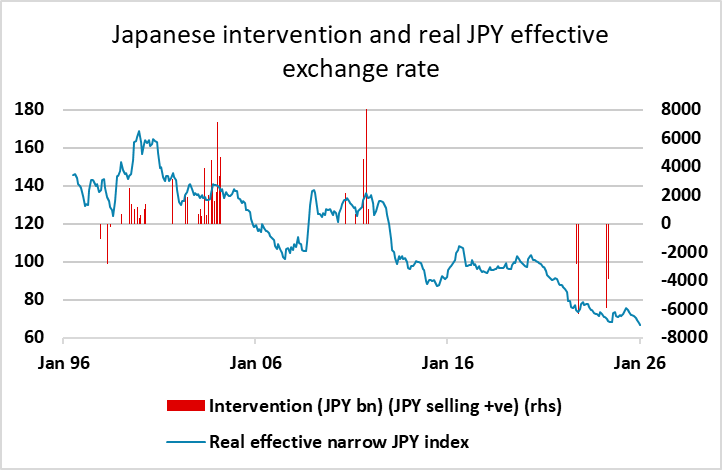

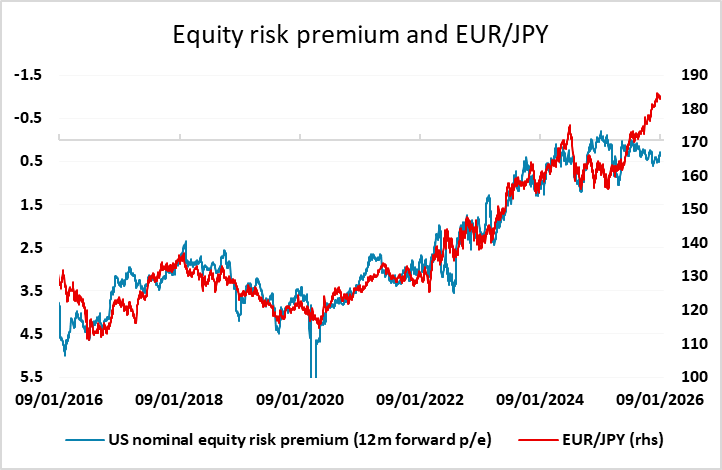

We continue to expect BoJ intervention to be needed to turn the trend, which isn’t supported by the usual metrics of yield spreads or lower risk premia. As we approach 160, and the real JPY effective rate continues to hit new all time lows, the likelihood of intervention continues to increase, but we are at the stage where it is necessary rather than possible if the JPY downtrend is to be halted.