FX Daily Strategy: Asia, June 17th

BoJ meeting offers no chance of a rate hike…

…but there is some possibility of an adjustment to QT

US retail sales may be mildly USD supportive

Recent GBP weakness may fade near term

BoJ meeting offers no chance of a rate hike…

…but there is some possibility of an adjustment to QT

US retail sales may be mildly USD supportive

Recent GBP weakness may fade near term

Tuesday kicks off with the BoJ monetary policy meeting. No-one expects any change in the policy rate, or any real signals about future changes given the uncertainty around the impact of tariffs on the economy in the coming months. However, there will be interest in whether the BoJ adjusts its quantitative tightening (QT) program. Any increase in the scale of QT would put more upward pressure on long term yields and provide some support for the JPY. However, an unchanged pace is the most likely outcome and a slowdown in the pace of QT is perhaps seen as more likely than an acceleration, but this would increase the recent downward pressure on the JPY.

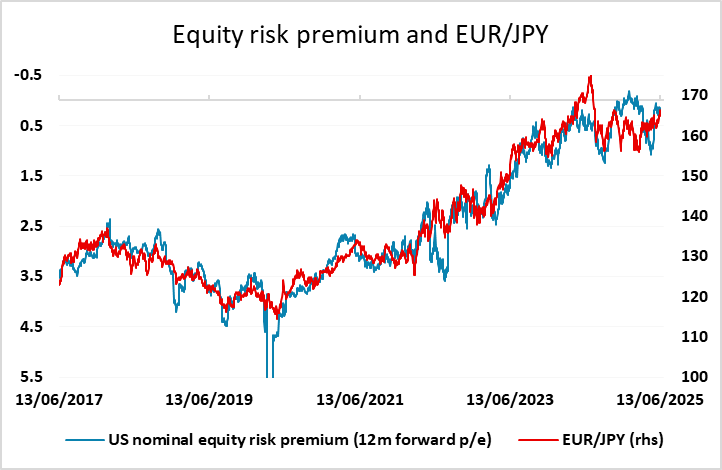

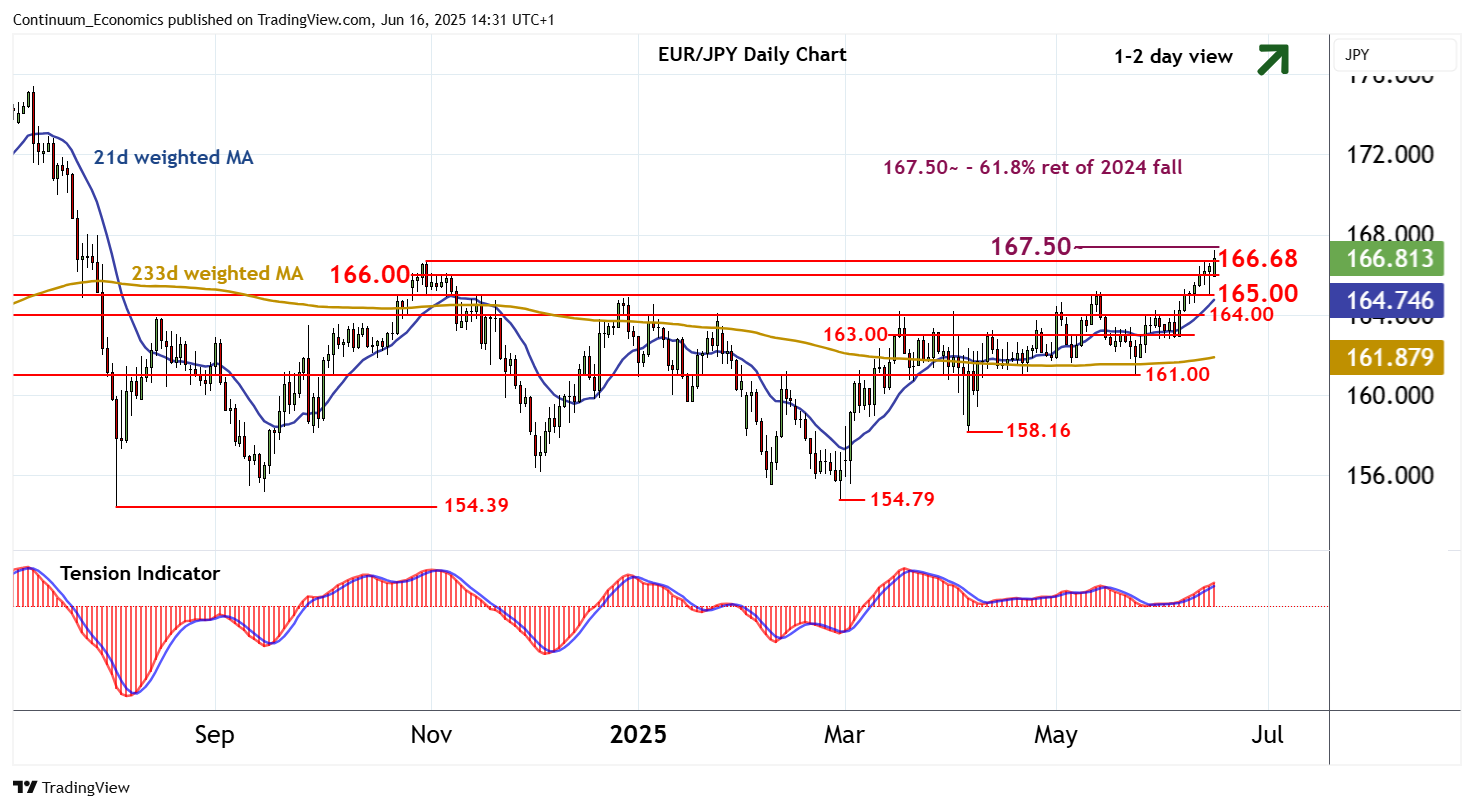

The JPY has remained weak on the crosses over the last few weeks, despite a brief rally last week on the initial Israeli attack on the Iranian nuclear facilities. The underlying story is still that risk assets remain well supported and risk premia very low by historic standards, and this typically translates into a weak JPY, particularly on the riskier crosses. However, we are approaching a significant technical resistance area in EUR/JPY at 167.40 and GBP/JPY at 196.40. Recent JPY losses have moved these crosses into line with the historic correlation with the US equity risk premium, and with US equities looking very stretched at current valuations, given the tariff and geopolitical risks, JPY risks should now be on the upside.

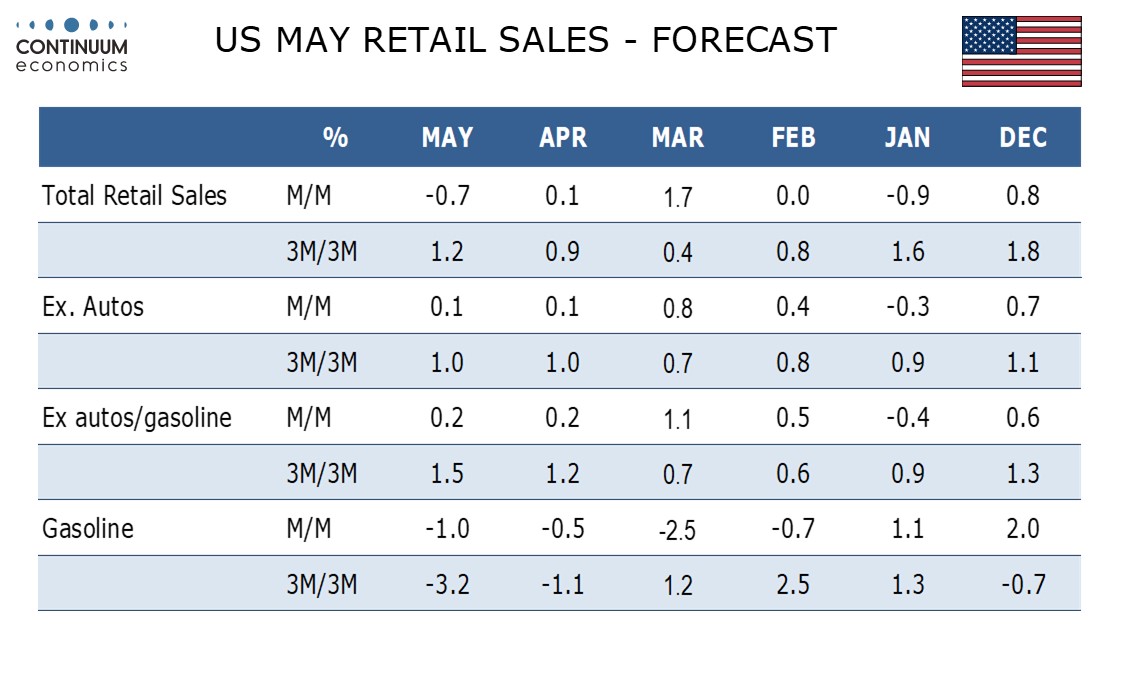

There isn’t much of interest scheduled in Europe, but the US has retail sales and industrial production data. We expect a 0.7% decline in May retail sales as auto sales show a sharp reversal from recent strength. Ex autos we expect a subdued 0.1% increase, with a 0.2% rise ex autos and gasoline. Both of these outcomes would match those of April, and would still be consistent with a solid underlying growth picture, with the 3m/3m trend picking up due to the very sharp 1.7% March increase, and the ex-autos pace still hovering near 1% on a 3m/3m basis. Our forecasts is broadly in line with consensus, so we wouldn’t expect much USD reaction, although another solid number would tend to be mildly supportive for the USD against the safer havens.

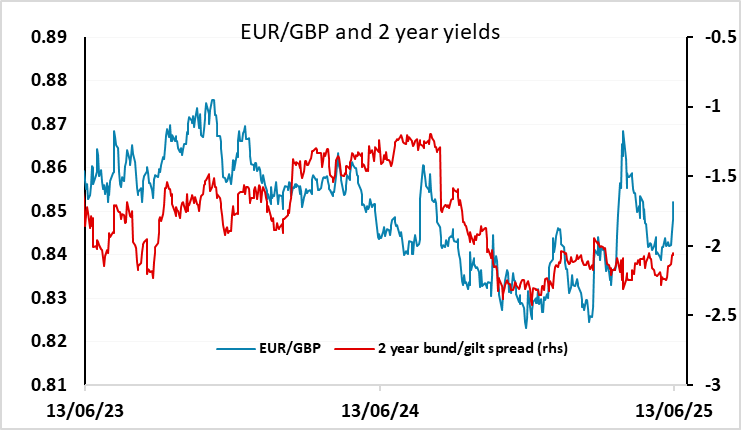

The general risk positive tone in the markets is helping most of the higher yielders, but GBP has underperformed in the last week after the weaker than expected UK labour market data earlier in the week. This still hasn’t been enough to convince the market that there is a real chance of easing at this week’s UK MPC meeting, with a cut still only seen as a 13% chance. But we would assess the risk of a cut as somewhat larger, as the hawks have generally been focusing in the strength of the labour market as a barrier to easing, and their case has been significantly damaged by last week’s labour market data. Even so, the rise in EUR/GBP has moved somewhat ahead of yield spreads, and has gone against the general risk positive market tone, so the near term risks may be to the EUR/GBP downside.