FX Daily Strategy: N America, June 19th

Australia May Employment Missed

CHF unlikely to suffer much from SNB rate cut

GBP may recover slightly unless BoE sounds surprisingly dovish

Australia May Employment Missed

CHF unlikely to suffer much from SNB rate cut

GBP may recover slightly unless BoE sounds surprisingly dovish

The US is on holiday so the USD may well be quieter than usual.

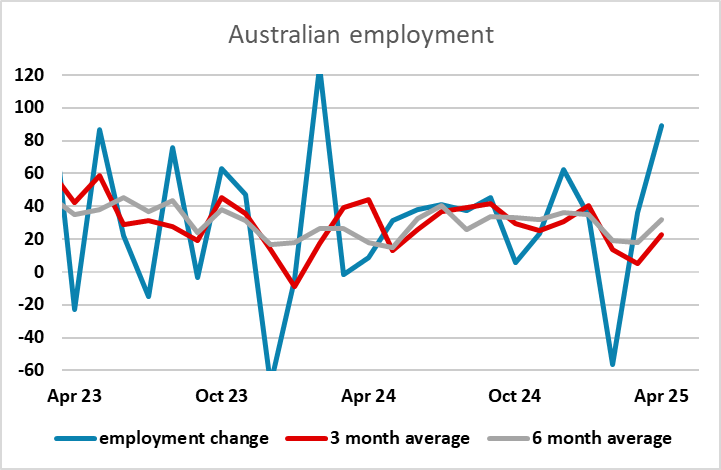

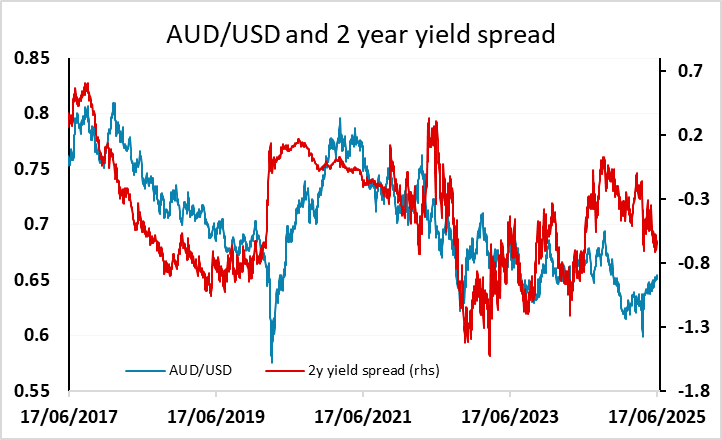

While the May Australia unemployment rate is steady at 4.1% y/y, headline employment change missed and dipped into negative territory but not deep. participation rate is slightly off historic high at 67%. The data did not give Aussie the boost it needed, especially when USD got haven bids by its side.

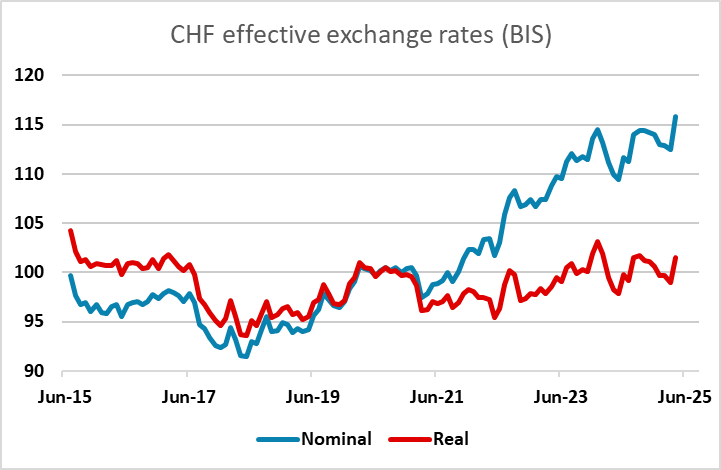

The SNB and BOE monetary policy meetings are the European highlights for Thursday. There is nothing particularly surprising in the SNB decision to cut rates to zero. Some were suggesting the possibility of a move to negative rates, so EUR/CHF has dipped around 20 pips in response, but the majority view was always that rates would be cut to zero. There is always the possibility of a move to negative rates in the future, and the SNB once again highlighted their willingness to intervene in the FX market if necessary. But the CHF isn’t ruinously strong at this point, with the low Swiss inflation rate meaning that the CHF has only gained fairly modestly in real trade-weighted terms, so for now EUR/CHF looks likely to continue to hover close to 0.94.

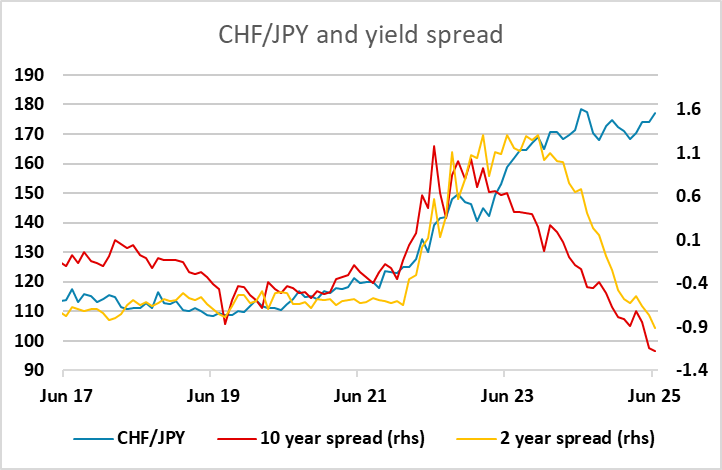

In general, the CHF shows little sensitivity to yield spread moves, being driven more by general risk sentiment, so rate cuts are not usually terribly effective in weakening the currency. However, currencies with similar risk characteristics could benefit from a larger yield pick up against the CHF. The obvious case is the JPY, which suffered against the CHF when yield spreads widened in the early part of this decade, but now offers a yield pick-up, and CHF/JPY remains 50% below the level seen pre-pandemic.

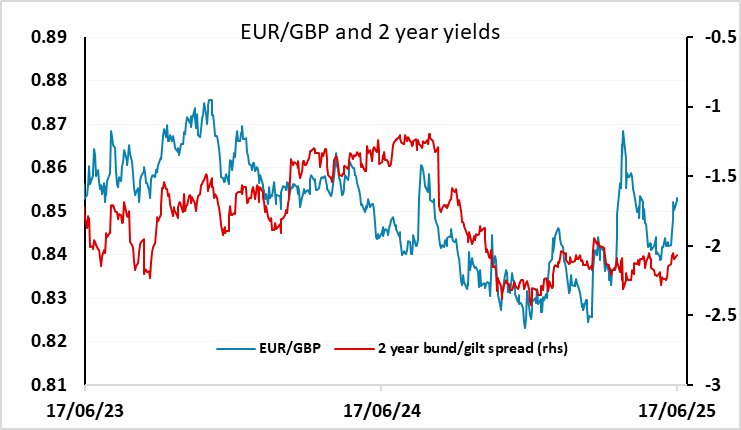

The BOE is likely to leave rates unchanged but the hawks are likely to have to moderate their previous concerns about a ‘tight’ labor market. We see two dissents in favour of a 25 bp rate cut but the statement is likely to repeat the need for policy to be framed carefully as well as gradually, also repeating that monetary policy will need to continue to remain restrictive for sufficiently long. The two hawks are still some way from thinking of another rate cut at this stage, but we wouldn’t rule out one of the more neutral members moving to the dovish camp. The market consensus concurs with our view of tow votes for a cut, so any further votes would be negative for GBP. But EUR/GBP has traded higher in the last week, exceeding the move implied by yield spreads, and may dip on an as expected decision unless the statement is more clearly dovish.