Preview: Due June 18 - U.S. May Retail Sales - Trend losing some momentum

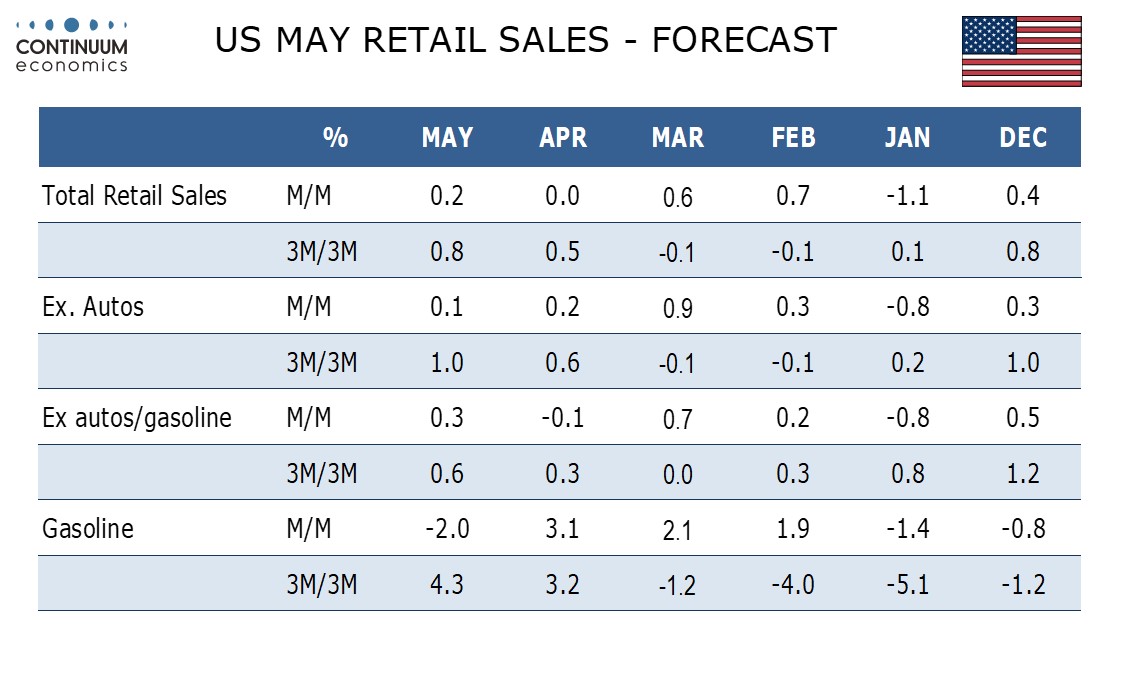

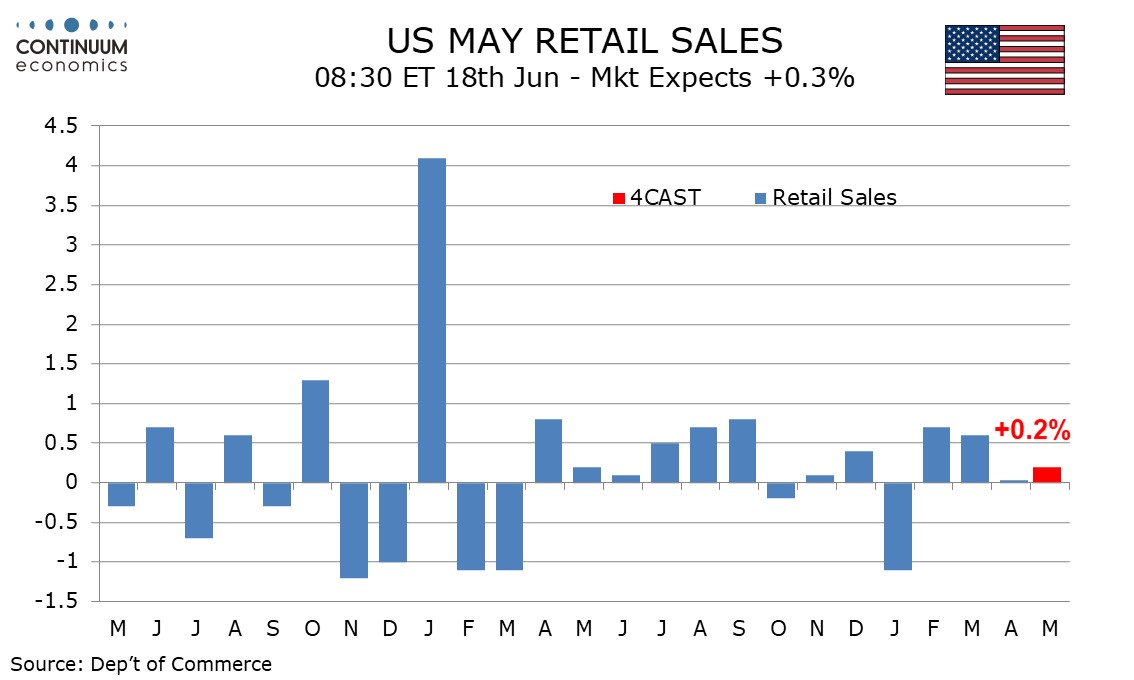

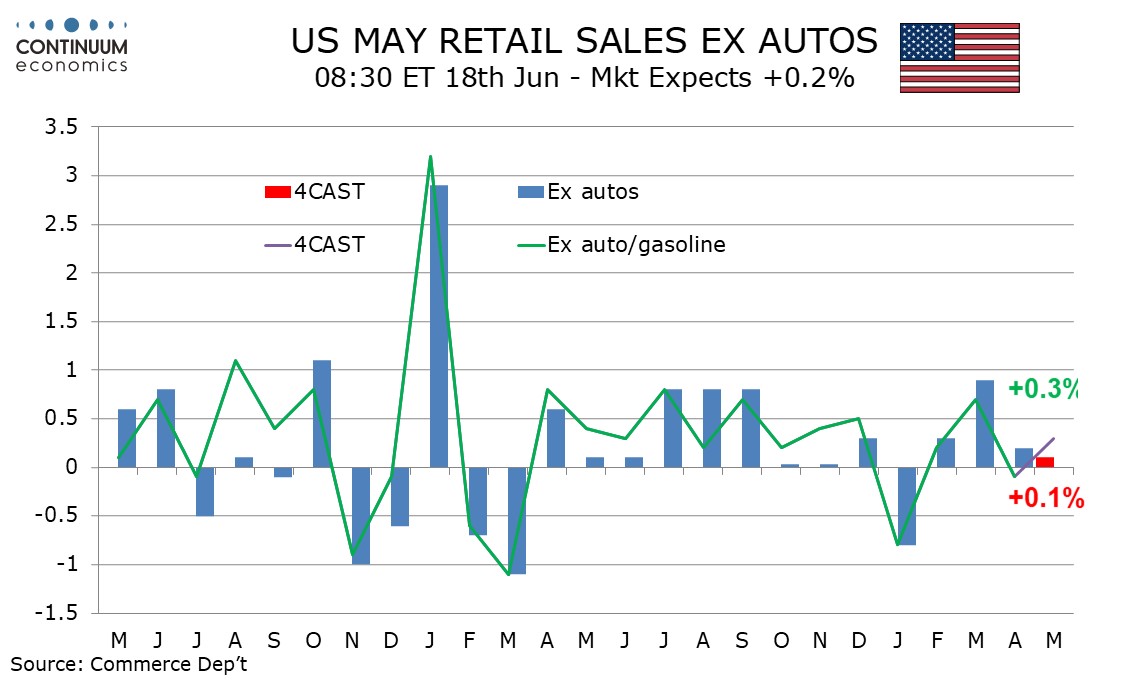

We expect a modest 0.2% increase in May retail sales with ex auto sales increasing by only 0.1%. The data will however be restrained by lower gasoline prices and ex autos and gasoline we expect an increase of 0.3%.

We believe consumer spending is losing some momentum as the fading of savings built up during the pandemic makes it harder for consumer spending to sustain recent outpacing of disposable income.

Sales ex auto and gasoline are however likely to regain some momentum after a 0.1% dip in April, which corrected a strong 0.7% rise in March. While seasonal adjustments attempt to adjust fir the timing of Easter, it is possible an early Easter flattered the March gain and consequently depressed April.

Gasoline prices will be correcting from three straight gains. Industry data shows auto sales confined to a tight range though May was near the upper end of the range, suggesting a modest boost from autos, though we expect the negative impact from gasoline to be larger.