FX Daily Strategy: N America, March 12th

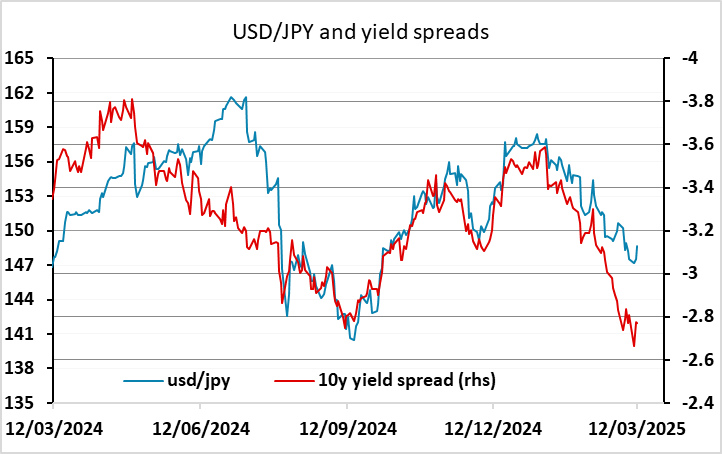

Weak equities keep the JPY on the front foot

Yield spreads already justify further JPY gains…

…but more equity weakness may be needed to break key JPY cross support levels

NOK/SEK rally on Monday may be the beginning of something bigger

US CPI likely to be in line with consensus

Market pricing quite aggressive Fed easing so risks look to be towards higher US yields

EUR/USD may top out near term close to current levels, but downside scope for USD/JPY remains

CAD risks on the downside on BoC decision

The US CPI data dominates the calendar for Wednesday. We expect February’s CPI to increase by 0.3% both overall and ex food and energy, with the gains before rounding being 0.29% overall and 0.32% ex food and energy. The gains will be less strong than in January but a tendency for early year data to be strong is likely to persist. Tariffs on China will be a modest upside risk in February. Tariffs on Canada and Mexico pose larger upside risks in the months ahead.

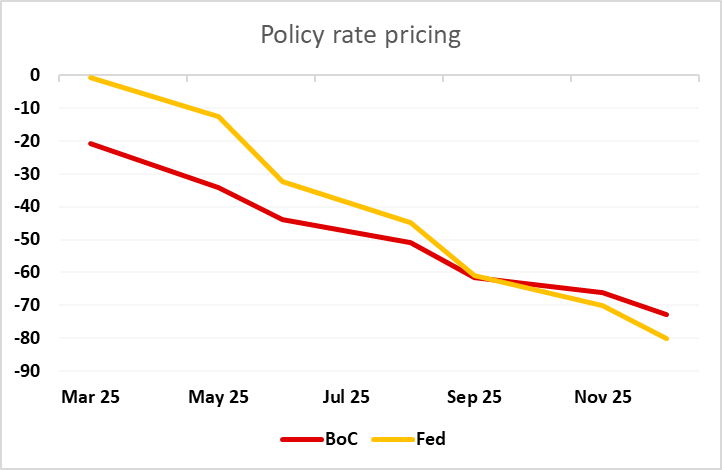

Our forecasts are in line with market consensus, so the market impact is unlikely to be large. But even without the boost that is expected from the tariffs on Canada and Mexico, core CPI has been running at a pace of around 0.3%, which is a little too high for comfort for the Fed. The recent comments from Powell indicate that currently the tone of data and policy uncertainty justifies steady Fed policy, and the Fed is waiting for some weakening in either the inflation trend or the labour market to justify further easing. The market is now priced for three more rate cuts by year end, so in the absence of surprises, the risks for rates look to be on the upside, with the current pricing reflecting some concerns about US slowdown that aren’t really supported by the data at this point.

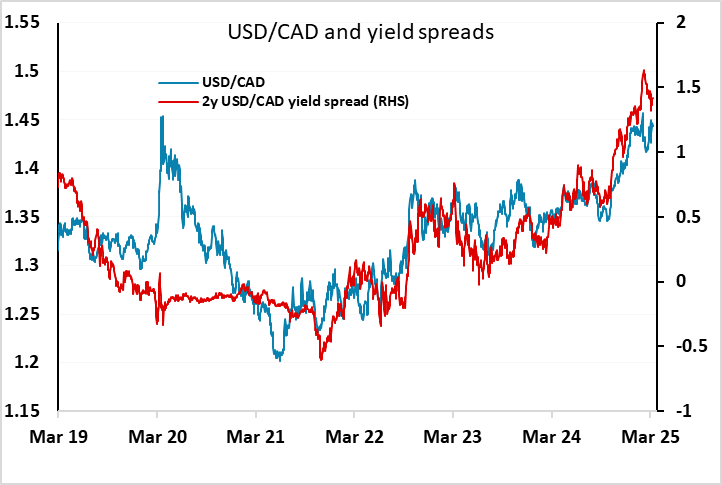

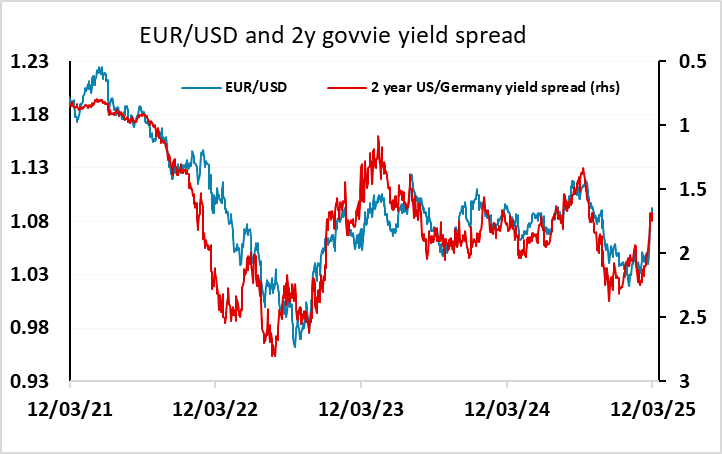

All this means that we don’t see a lot of downside for US yields at this point, since even if CPI comes in below expectations this month, the risks from the upcoming tariffs mean it will be difficult to assume any improvement will persist. The USD may therefore stabilise close to current levels after the recent declines, at least against the EUR where current levels looks to be fairly closely aligned with yield spreads. There remain greater risks of a larger USD decline against the JPY as USD/JPY remains some way above the levels suggested by yield spreads.

The other main event of the day is the BoC monetary policy decision. While the tariff picture is still anything but clear, we expect a 25bps easing to 2.75%. The economic damage done by the ongoing tension is already likely to be significant, and may become seriously so. Inflationary risks have increased, and the Canadian economy ended 2024 on a positive note. However, unless uncertainty is resolved, and that would require a long-term deal, an easing looks justified. The market is pricing a cut as around an 80% chance, so there shouldn’t be any major impact on the CAD if the cut occurs. However, it is notable that the CAD curve currently prices less easing than the USD curve over the rest of the year. BoC comments could change this if Macklem re-emphasises the recession danger from tariffs, so the USD/CAD risks look to be to the upside.