U.S. November Michigan CSI - Rise reflects pre-election sentiment

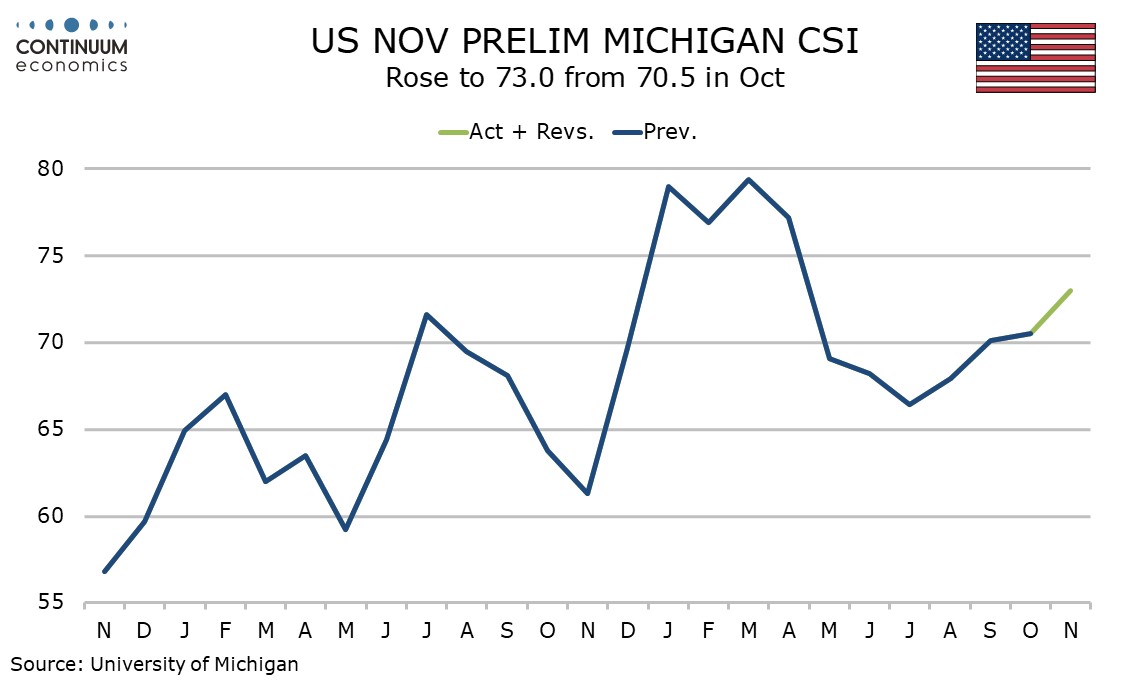

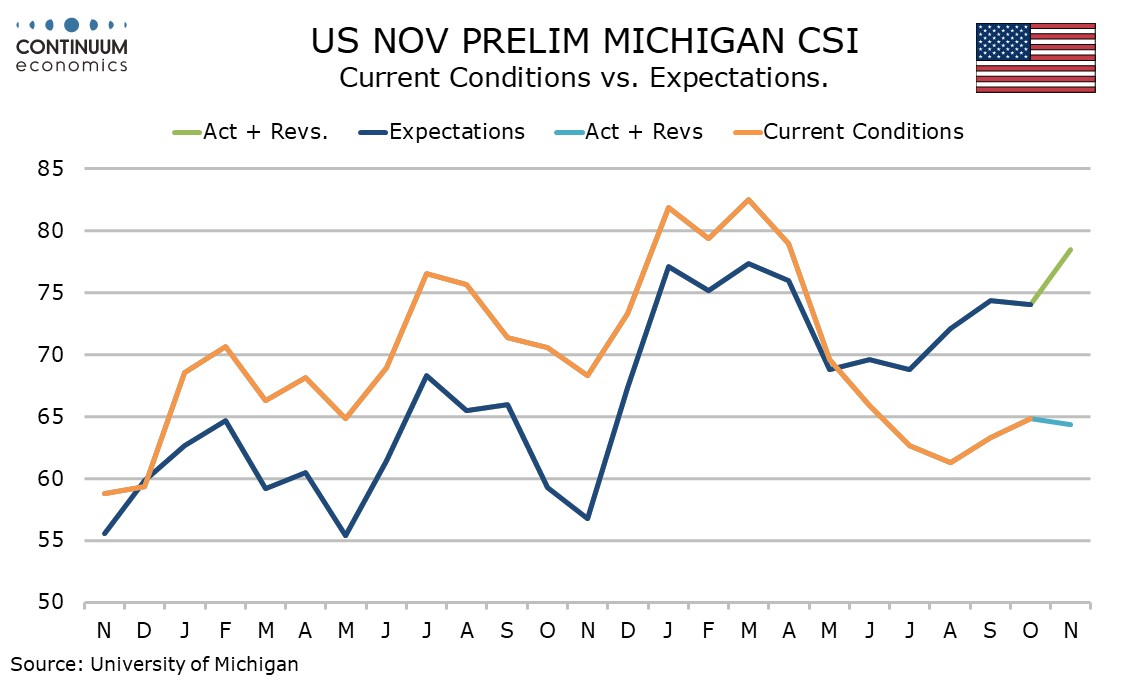

November’s preliminary Michigan CSI was surveyed before the election and shows consumers getting more optimistic, with a rise in the index led by future expectations at 68.9 while current conditions moved lower. The optimism may reflect supporters of both candidates expecting victory and if so may be difficult to fully sustain.

Overall sentiment rose to 73.0 from 70.5 to reach its highest since April. Current conditions slipped to 64.4 from 64.9 but remain stronger than in each month of Q3.

Expectations at 78.5 from 74.1 are at their highest since July 2021. There are other potential reasons for optimism other than political, notably Fed easing and the general strength of the economy.

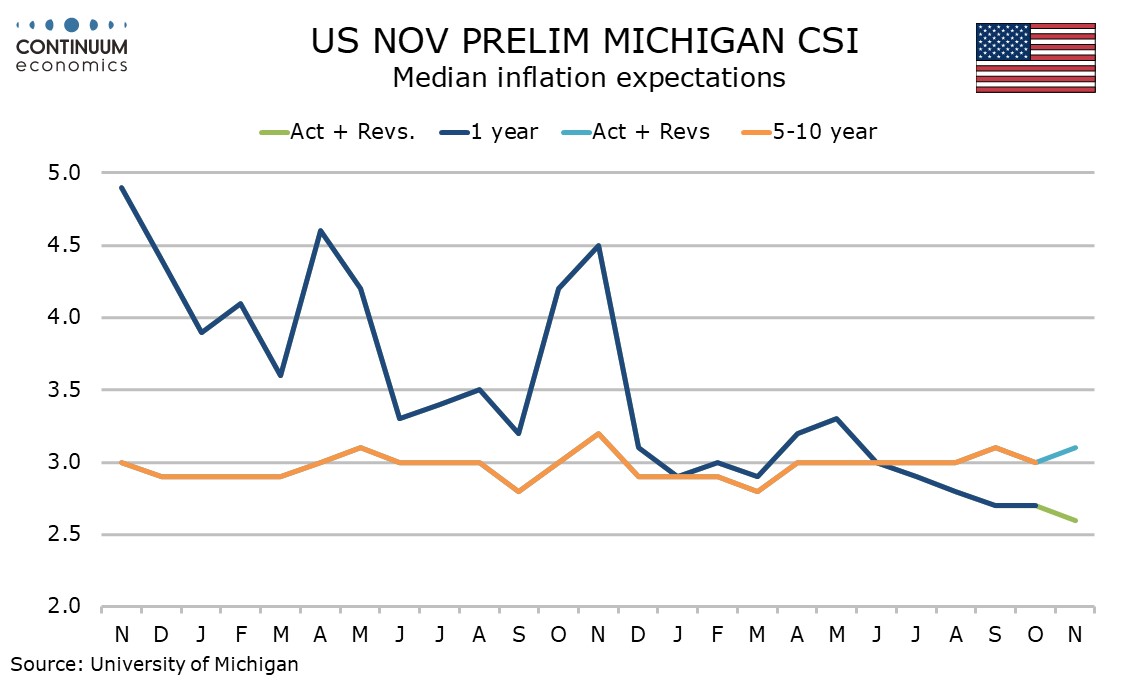

The one year inflation view slipped to 2.6% from 2.7% and is now at its lowest since December 2020. However the 5-10 year view increased to 3.1% from 3.0%, putting it on the high end of what remains a tight range.