JPY, USD, EUR, CHF flows: JPY the big loser overnight, PMI data of interest

JPY loses ground across the board overnight. Preliminary June PMIs of interest in the absence of escalation of the Middle East conflict

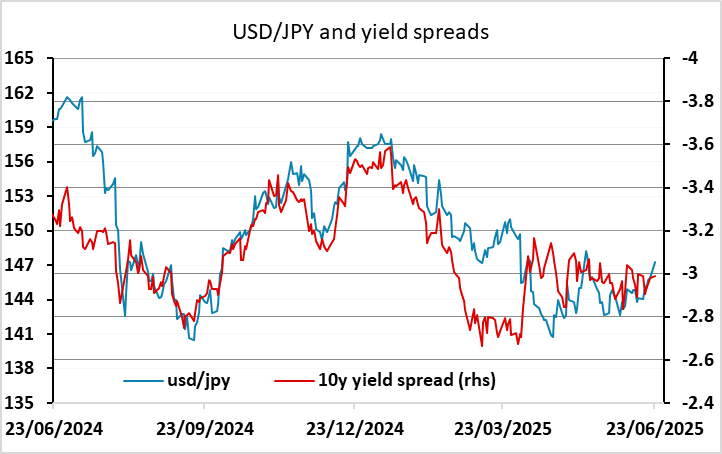

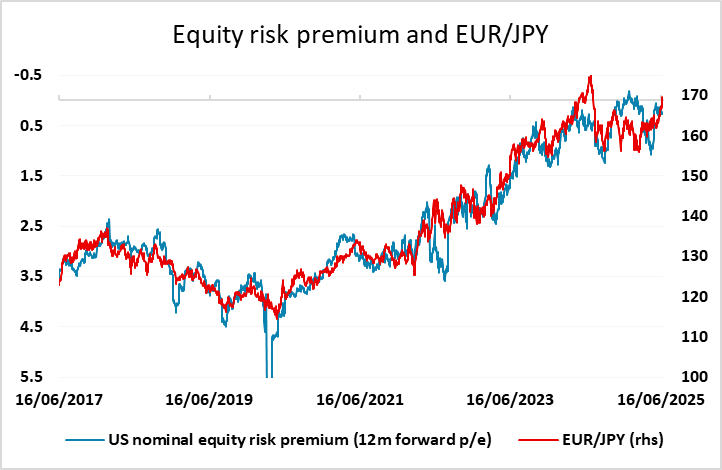

JPY weakness has been the main theme overnight. The USD initially made general gains on the back of the US attack on Iran, but most USD pairs reversed the early move, while USD/JPY held onto nearly all its gains. Consequently, EUR/JPY has made a new 1 year high at 169.66 and CHF/JPY a new all time high at 180.33. This is hard to square with the mild negative tone in equity markets, which would normally be favourable for the JPY on the crosses. The rise in the oil price on the news may be seen as JPY negative, but even though the oil price has risen $15 from its lows at the beginning of June, it follows a sharp decline in April and is little changed on the year, and still towards the bottom end of the range seen in the last few years. In any case, a higher oil price may favour USD/JPY (and possibly CAD and GBP against the JPY), but is not clearly positive for EUR/JPY. Gains in EUR/JPY consequently look a little anomalous, but may reflect the unwinding of some long held long JPY positions, which the CFTC data out on Friday showed were still substantial as of last Tuesday. Even so, we would favour a JPY recovery over the rest of the week.

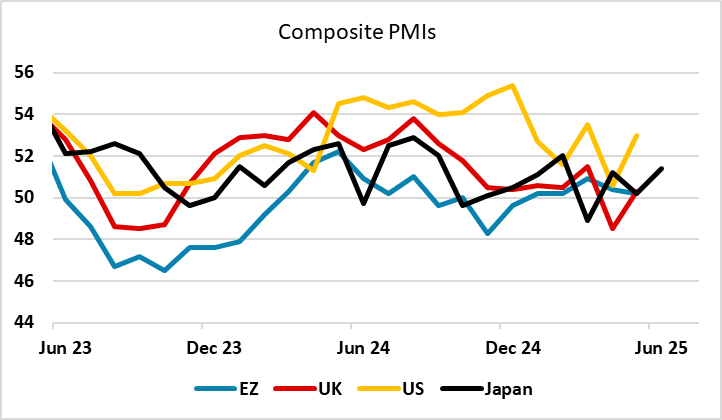

For this morning, the Middle east situation may still dominate, but there will also be interest in the provisional June PMI data, with a consensus of modest improvements in the European indices while the US numbers are expected to slip a little lower. If this is correct, the EUR and GBP may gain some support over the day if there is no escalation in the Middle East.