FX Daily Strategy: APAC, March 14th

Downside risks seen for UK January GDP

EUR/GBP risks mainly on the upside

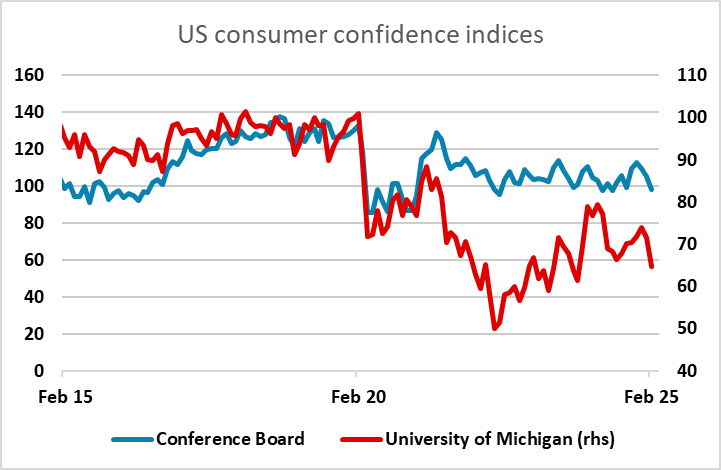

More focus than usual on University of Michigan confidence data

USD remains vulnerable to softer numbers, even if inflation expectations rise

Downside risks seen for UK January GDP

EUR/GBP risks mainly on the upside

More focus than usual on University of Michigan confidence data

USD remains vulnerable to softer numbers, even if inflation expectations rise

Momentum Recovering Despite Continued Downside Risks From Surveys?

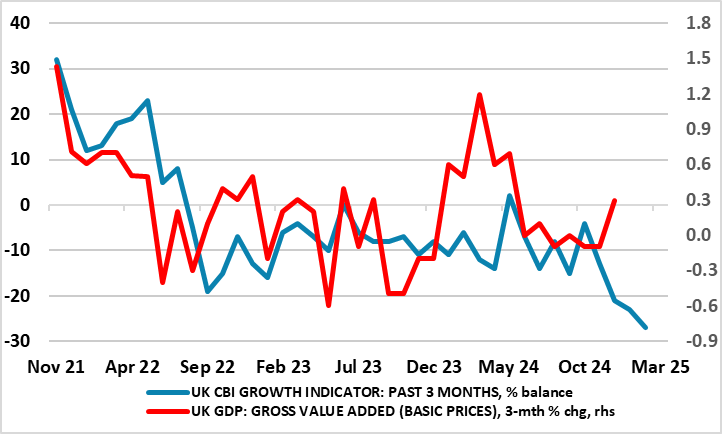

UK January GDP data is first up in Europe on Friday. After upside surprises in December, the odds are increasing that current quarter GDP will be decidedly positive, which contrasts with a much softer impression from surveys, which now showing weakness spreading into hitherto strong construction. Regardless, and despite a clear bounce in retail sales for the month, we think that corrections in other parts of services and continued weakness in industry will cause a small m/m drop in January of around 0.1% m/m. But upside risks stem not just from the sales data, but also cold weather boosting already below-par utility output as well as what may be changing seasonal factors post pandemic which may mean the UK economy in early 2025 sees similar but short-lived strong growth as seen in in the same period of last year. Our forecast is clearly below the market consensus of a 0.1% m/m rise so suggests downside risks to GBP.

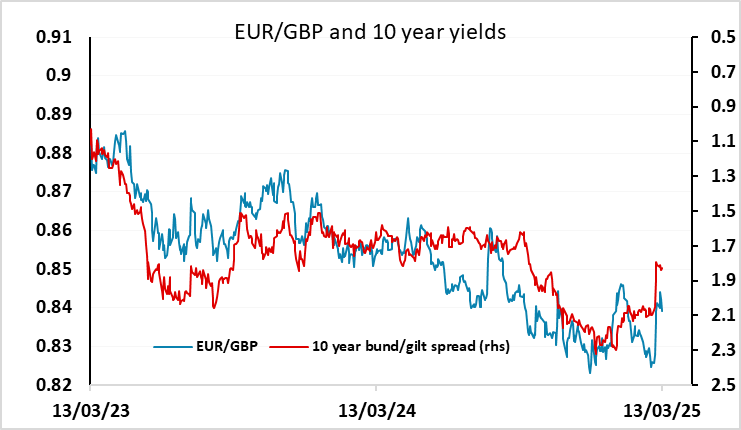

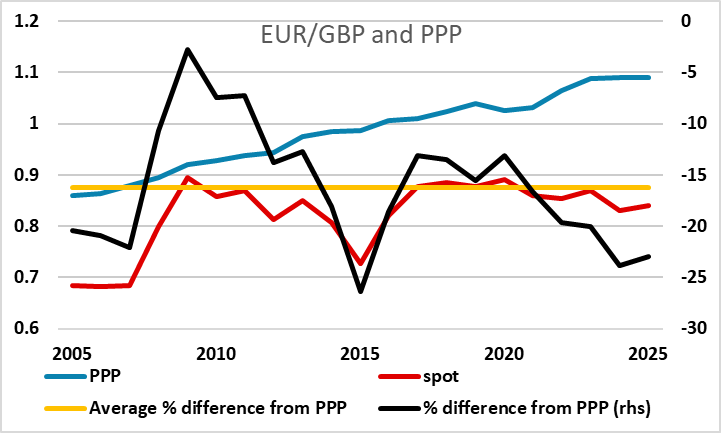

GBP has recovered slightly against the EUR in the last couple of days, helped by some expectations that the UK will be less affected by US tariffs than the EU. Even so, EUR/GBP has risen quite sharply in the last couple of weeks on the back of expectations of a boost to Eurozone spending on defence and infrastructure, which has pulled up Eurozone yields. Whether the rise in yield spreads is sustained will depend on how quickly the new spending comes on board and whether it will offset any drag to growth from the imposition of US tariffs. It is likely that the main impact of the new spending isn’t felt until 2026 and beyond, while the impact of tariffs on export demand could be felt more quickly. Nevertheless, EUR/GBP remains at quite low levels near 0.84, and if the January GDP data is on the soft side as we expected, there is scope for a move up towards 0.85.

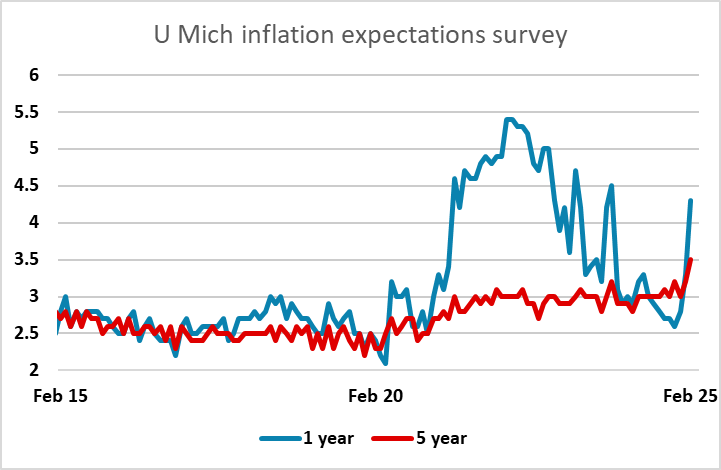

The only US data of note is the University of Michigan consumer sentiment survey. This is not normally a major market mover, but takes on greater significance because of the current concerns about the US economy and the dips in confidence and rise in inflation expectations seen in recent months. The market consensus looks for some further decline in sentiment, which could trigger renewed USD losses after the stabilisation seen for much of this week. Higher inflation expectations have historically tended to be USD positive because of the expected Fed response, but with confidence slipping and the Fed potentially prepared to look through short term tariff related inflation increases and focus on demand and the labour market, higher inflation expectations are less likely to be USD favourable.

We continue to see USD/JPY as having the most potential for declines if we do see any further weakness in US confidence, with Japan looking out of step with most of the rest of the developed world in trying to manage increases in wages and a higher yield profile. But with the USD seeing less of tendency to benefit from weaker equities in recent weeks, softer US data could see the USD weaken across the board. We continue to see the AUD as having significant potential for gains if Asian equities prove resilient to any decline in the US markets.