FX Daily Strategy: Asia, July 30th

Australian CPI Likely Treads Lower

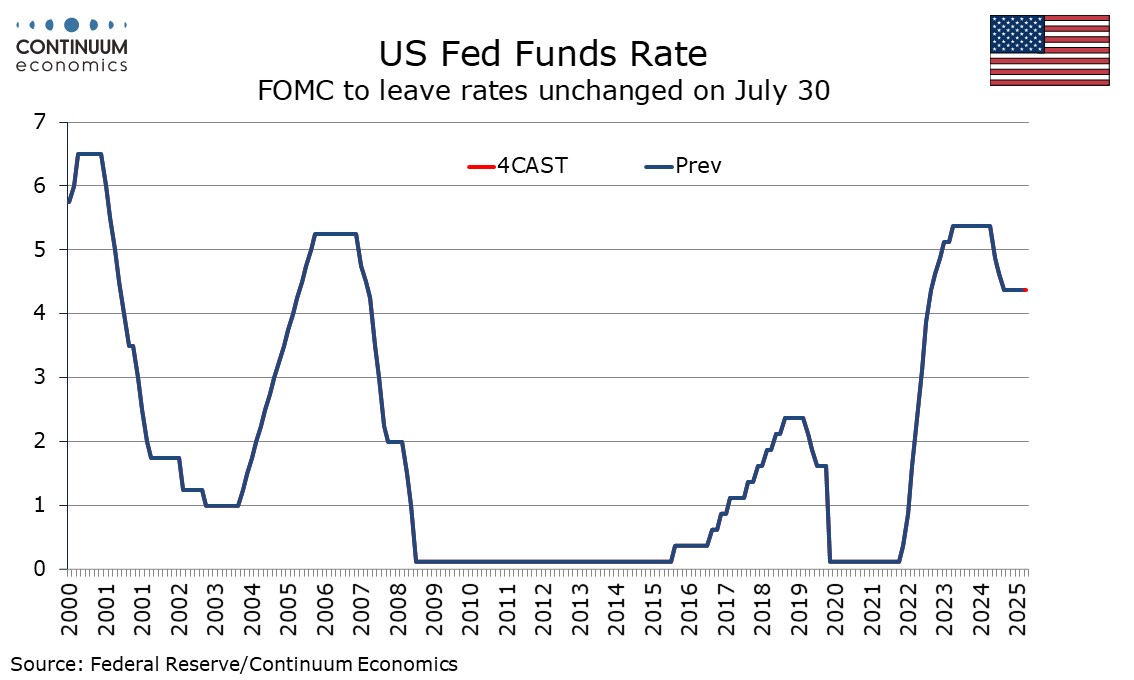

No change given uncertainty on tariffs for FOMC

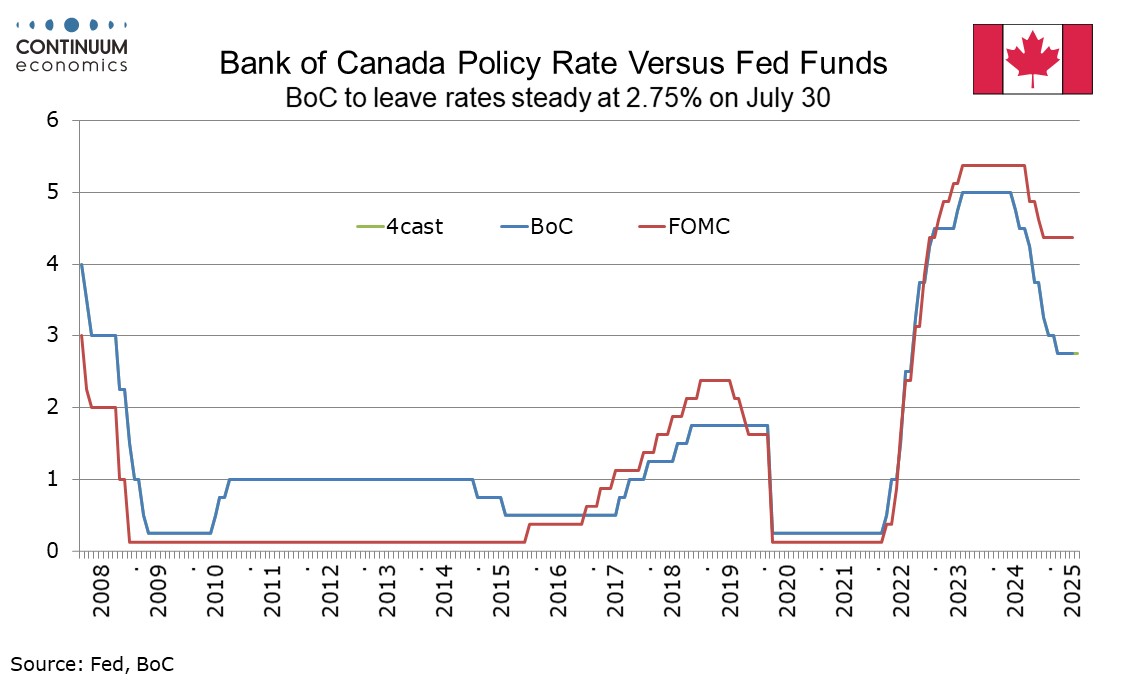

Bank of Canada Hold after firm data with uncertainty high

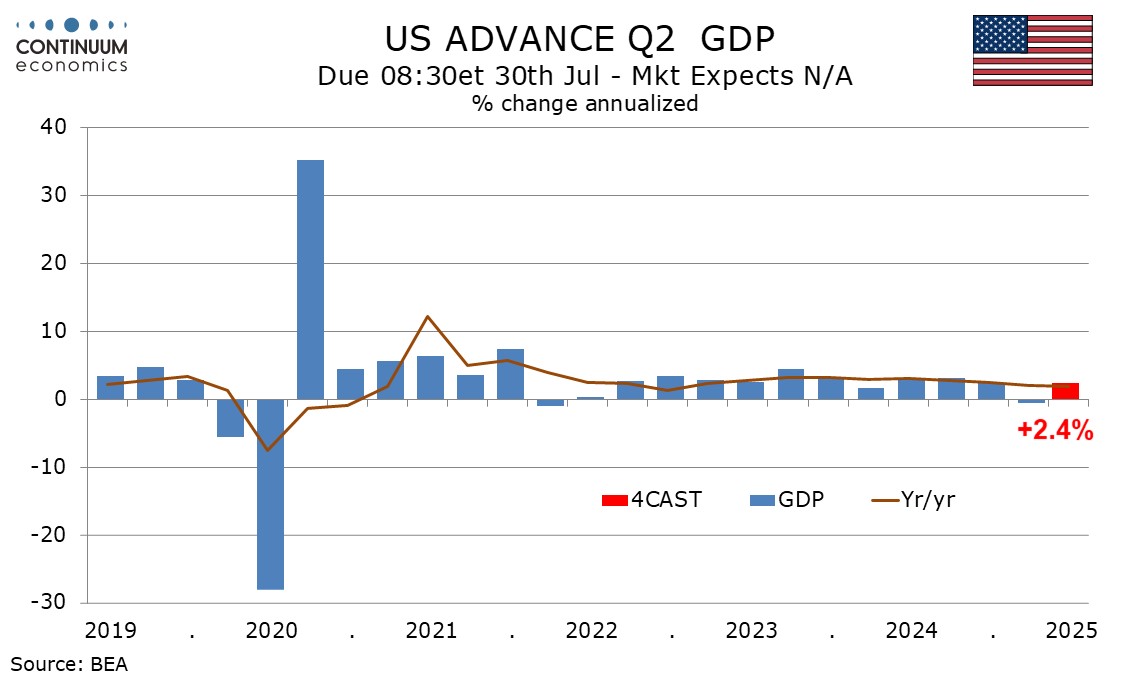

U.S. Q2 GDP Rebounding from a negative Q1

While key economic decisions are to be made in the New York session, Wednesday will be kicking start with Australian Q2 CPI. It is likely headline CPI will continue to tread lower while trimmed mean CPI steadily above 2.5% y/y. Inflationary pressure eases further in Q2 on most items but is expected to see transitory spikes, previewed by RBA's warning in the last meeting. Trimmed mean CPI will be capturing RBA's attention more as they view it to be a more accurate representation of the broad inflationary picture. The Aussie could potentially slip further if we don't see a solid trim mean CPI.

On the chart, cautious trade has given way to the anticipated test of congestion support at 0.6500. Daily readings continue to track lower and broader weekly charts are under pressure, highlighting room for further losses in the coming sessions. A close beneath here will open up further congestion around 0.6450, with room for continuation down to 0.6400. Meanwhile, resistance remains at congestion around 0.6600. A close above here is needed to turn sentiment positive and extend April gains to fresh 2025 year highs towards strong resistance at the 0.6688 monthly high of 7 November and the 0.6700 Fibonacci retracement.

The FOMC meets on July 30 and recent data suggests no reason to move rates from the current 4.25-4.50% level, though Q2 GDP data due on the morning on the decision will impact the wording of the statement. This meeting will not see an update to the dots leaving focus on Chairman Powell’s press conference. This is likely to stress uncertainty over tariffs as justifying a wait and see stance. At the last meeting on June 18 the FOMC stated that although swings in net exports have affected the data recent indicators suggest economic activity has continued to expand at a solid pace. Minutes from that meeting showed that Q2 GDP was expected to rise after a marginal drop in Q1, with continued growth in real private domestic final purchases. Net exports are set to bounce from a pre-tariff decline in Q1, but inventories are likely to provide some offset. If Q2 GDP surprises, the FOMC will need to reflect that in the statement, though underlying details will matter as well as the headline.

On June 18 the FOMC stated that unemployment remained low and labor market conditions remained solid. June’s employment report, where unemployment slipped to 4.1% from 4.2% sustains that. Inflation was described as remaining somewhat elevated. June CPI saw the core rate edge up to 2.9% from 2.8%. While the core rate was subdued on the month at 0.2%, there were signs of tariff-pass through in goods excluding autos, and with fresh tariff decisions due on August 1 the risk of future tariff-induced inflation remains significant. Indeed, a reference in the June statement to uncertainty having diminished is likely to be removed. It will continue to be described as elevated and may even be described as having increased.

The Bank of Canada meets on July 30 and what had been seen as a close call between a 25bps easing and unchanged now looks likely to leave rates unchanged at 2.75%. Continued above target core CPI data and a strong employment report for June argue against easing, though uncertainty remains high with increased US tariffs scheduled for August 1. We do not believe the BoC is done with easing. This meeting will see the BoC deliver a quarterly Monetary Policy report. The last MPR released in April saw the BoC, rather than doing its usual forecast, deliver two separate scenarios, one in which most tariffs are negotiated away but the process is unpredictable, and a second scenario where uncertainty persists and more US tariffs are added. With fresh tariffs scheduled for August 1 but far from certain given a history of Trump climbdowns, the BoC may continue to present two separate scenarios.

Since April’s MPR was produced, Q1 GDP at 2.2% annualized came in a little above the BoC’s forecast but this was offset by a downward revision to Q4, with yr/yr growth as forecast at 2.3%. Q2 appears to be heading for an outcome closer to the flat projection of scenario 1 than the 1.3% annualized decline from scenario 2. This assumes May GDP will see a second straight 0.1% decline in line with a preliminary estimate made with April data but June will see a modest increase given a surprisingly strong June employment rise of 83k. Inflation has been stronger than the BoC projected, with Q2 seeing CPI average 1.8% versus a 1.5% April projection and the average of CPI-Median and CPI-Trim being 3.05% in Q2, above a 2.9% or 3.0% April projection depending on tariff scenarios. CPI ex food and energy rose by 0.3% seasonally adjusted in each month of Q2.

We expect a 2.4% annualized increase in Q2 GDP, which after a 0.5% decline in Q1 would leave the first half of the year rising at a pace close to 1.0%. A similar pace may be seen in the second half of the year if tariffs persist. Our Q2 forecast has been lifted from 1.4% on a generally improved tone to June data to date. We expect final sales to domestic buyers (GDP less inventories and net exports) to rise by only 0.5% after a 1.5% increase in Q1, also averaging near 1.0%.

We expect consumer spending to rise by 1.6% after a 0.5% increase in Q1, with April and May having produced subdued data but retail sales picking up in June. We also expect firmer services data in June, but this will leave services up by only 1.1% in Q2, matching the pace we expect from non-durables. We expect a 5.1% rise in durables, correcting from a Q1 decline. We expect consumer spending to underperform real disposable income, where we expect a rise of 2.7% after a 2.5% increase in Q1. Anxiety over the impact of tariffs may have encouraged consumers to save more. Business investment was very strong in Q1 with a 10.3% rise which appears to reflect pre-tariff front loading. We expect a 3.8% decline in Q2. Non-residential structures are likely to extend a 2.4% dip seen in Q1, we expect by 6.0%, but corrections in equipment, falling by 5.1%, and intellectual property, by 2.4%, are likely to be moderate compared to respective Q1 gains of 23.7% and 6.0%.