GBP, CHF, JPY flows: GBP a little softer, CHF and JPY strength could be challenged

GBP edging lower more on the dip in risk sentiment than weak CPI. CHF and JPY remain strong, but CHF strength may fade if equity ranges hold

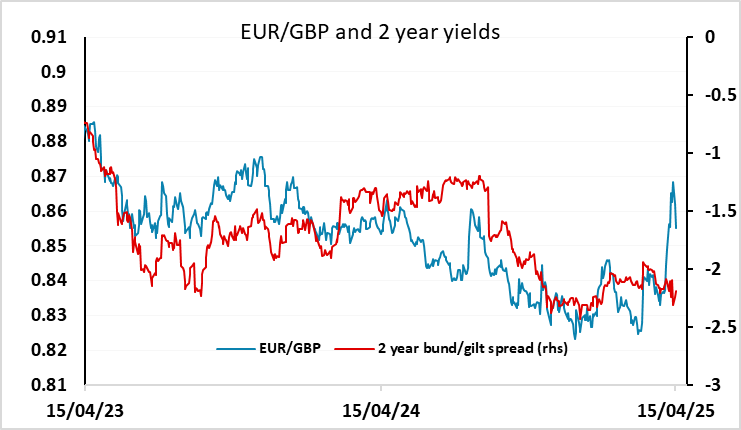

UK CPI has come in a little weaker than expected, but EUR/GBP is focusing more on the risk downturn seen overnight as China talks tough on trade. After managing a modest recovery through the first couple of days this week, EUR/GBP is heading back higher, but the rise is unrelated to the slightly softer CPI. The March data is of limited significance in any case, as the April numbers are much more likely to deviate from expectations. A series of energy, utility, post office and some other regulated and service price rises are due in April, albeit now possibly offset somewhat by a fall in petrol prices if the slump in energy prices persists. Even so, we wouldn’t expect EUR/GBP to advance much further without a more serious turn lower in risk sentiment. Although the S&P 500 is lower overnight, it is in the middle of the 4800-5800 range seen since the tariff wars began near the end of March, and as long as this range holds, we should see volatility edge lower and riskier currencies regain some composure.

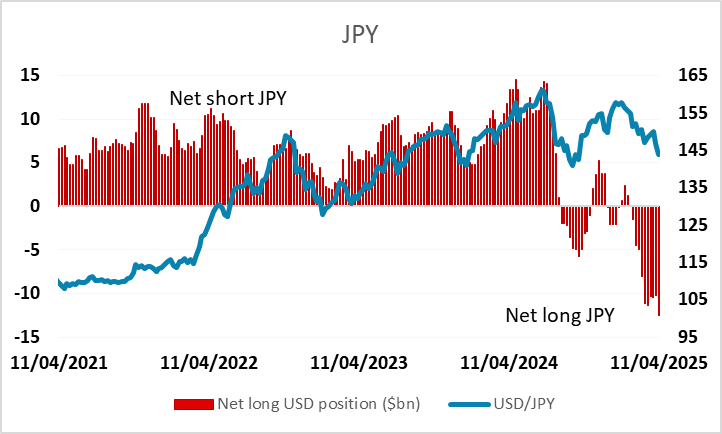

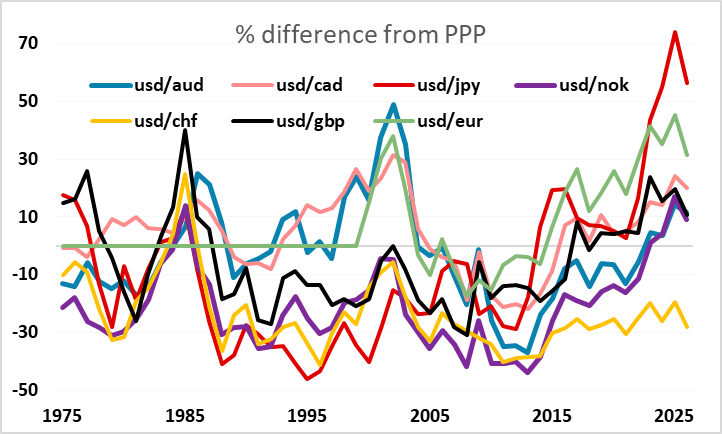

However, the USD itself remains under pressure, in part due to its high starting point and the growing concern that the world is no longer keen to invest in the US on the expectation of US growth outperformance. But the CHF has been the best performer in the last few weeks in spite of a very high starting point, and we would expect the CHF to fall back on the crosses if we see volatility edge lower. Talks beginning later on Wednesday between Japan's economy minister Ryosei Akazawa and Treasury Secretary Scott Bessent could have a significant impact as there is speculation the countries agree on a stronger yen. Positioning, however, as of last week's data, showed the largest net yen long on record stretching back to 1986, meaning there could be a sharp reversal if there are signs the talks do not go well.