USD flows: USD softer after CPI, JPY leads

US CPI and retail sales data marginally on the weak side of consensus. Softer USD tone continuing

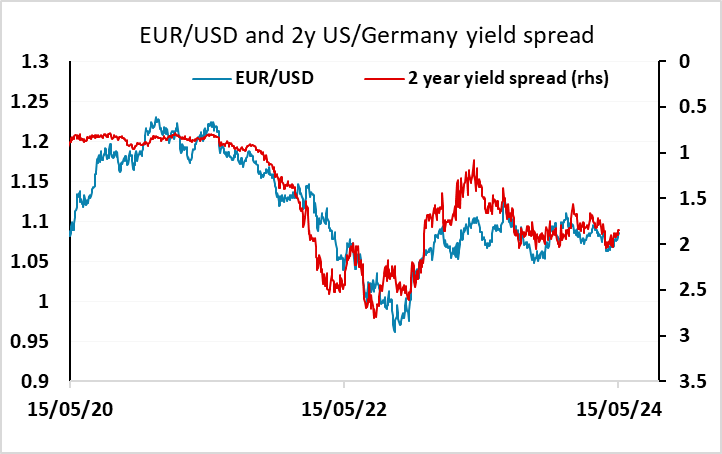

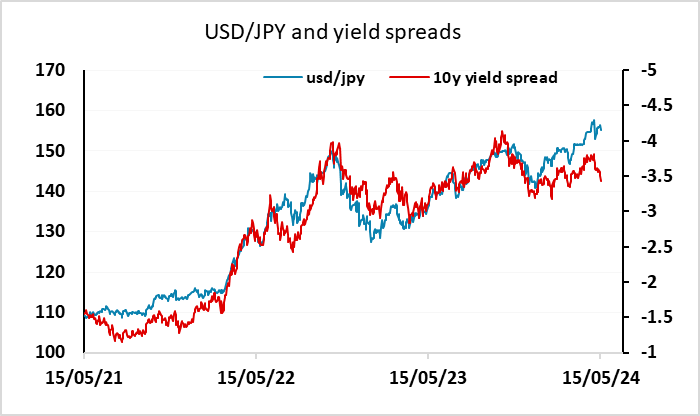

CPI headline came in below expectations at 0.3% but core is as expected at 0.3%. Headline retail sales also weaker than expected at flat on the month, but ex-autos as expected at 0.2%. Although the numbers are only marginally on the weak side of expectations, we have had a run of softish US data in the last couple of weeks, and these numbers do nothing to dispel the impression of a softening economy and encourage expectations of a potential Fed rate cut in September. A July cut is also now starting to seem possible, priced as almost a 40% chance. USD/JPY is the most extended USD pair and has already been on the back foot this morning in Europe, and could now pick up some downside momentum. Yield spreads still indicate a move below 150 is possible, but for that to happen we are likely to need more general USD weakness or significant deterioration in equity sentiment. For now, a modest negative USD tone looks likely to persist, with the JPY having the most potential for gains, but progress ids likely to be slow, with EUR/USD likely to struggle to break above 1.09.