Preview: Due February 27 - Canada Q4/December GDP - A modest correction from a surprisingly strong Q3

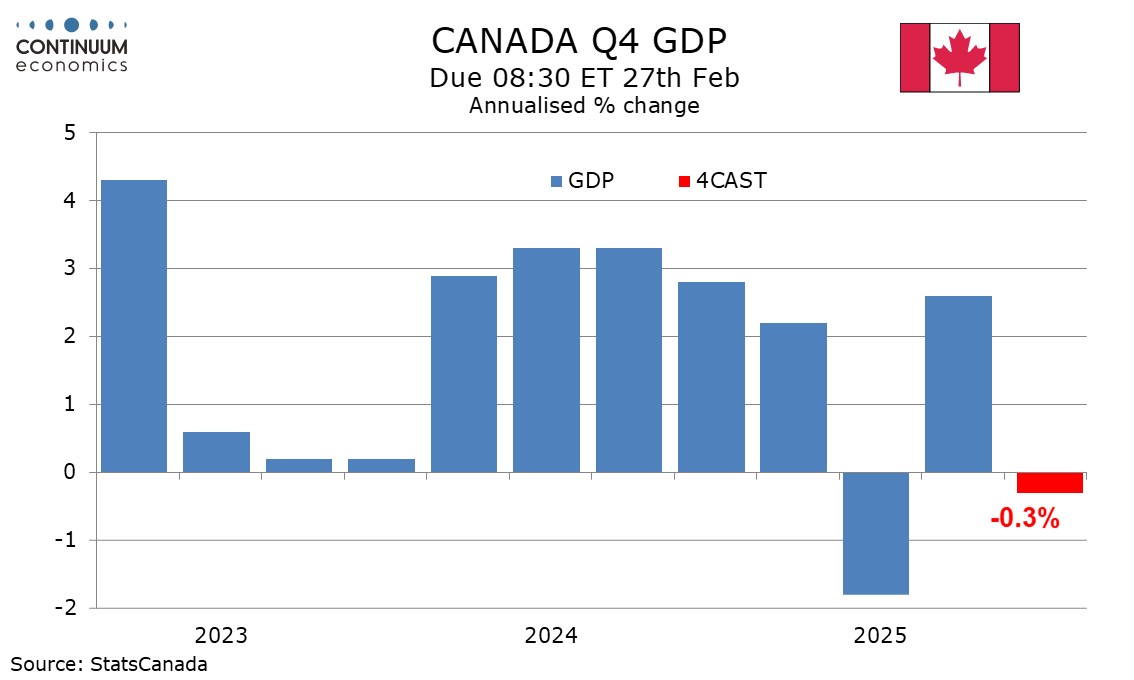

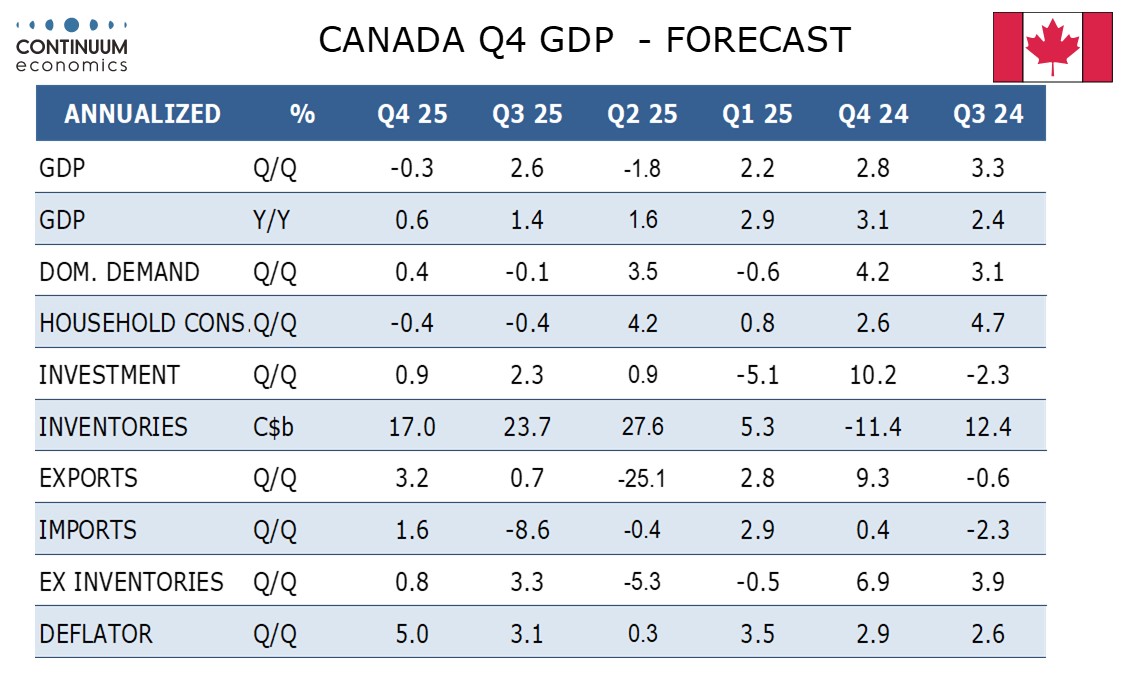

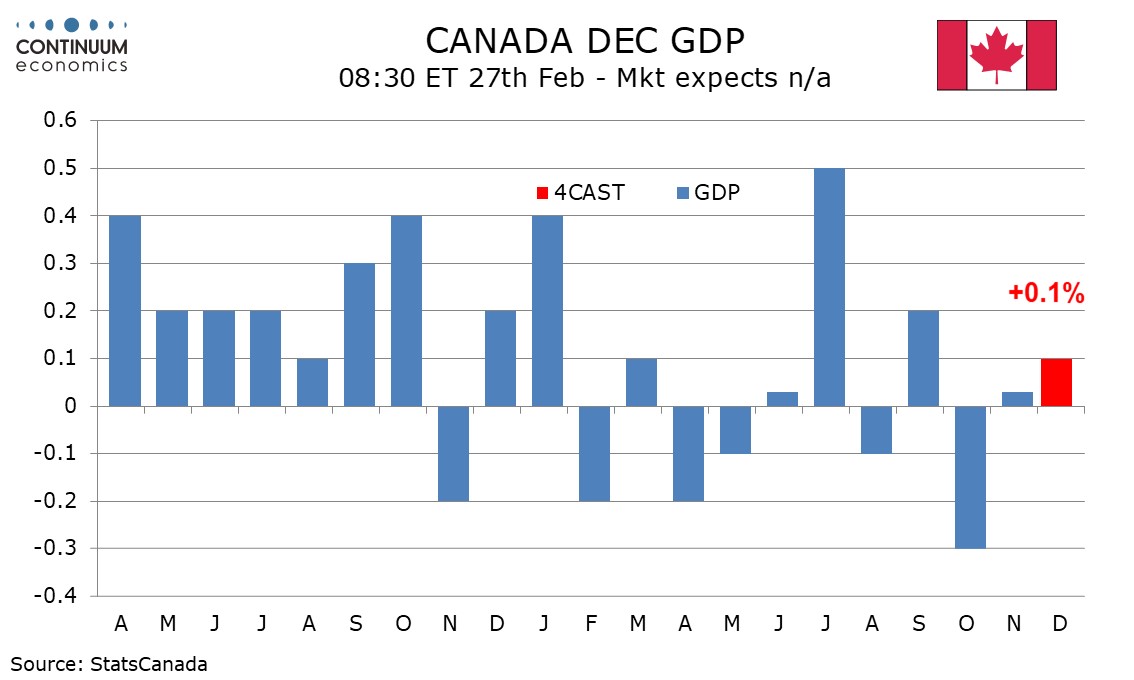

We expect Q4 Canadian GDP to decline by 0.3% annualized, marginally softer than an unchanged estimate made by the Bank of Canada with January’s Monetary Policy report. This would be consistent with December GDP rising by 0.1% as projected with November’s data.

The GDP decline would be a modest correction from a 2.6% Q3 increase that significantly exceeded expectations, though we expect Q4 to see a modest 0.4% increase in domestic demand after a 0.1% decline in Q3.

We expect household consumption to look similar to Q3 with a 0.4% decline but gross fixed capital formation to rise by 0.9%. While the latter would be a slowing from Q3 we expect Q4’s increase to come from the private sector, while Q3’s gain came mostly in government. We expect government investment to correct from the strong Q3 but government consumption to see a modest increase after a Q3 decline, though overall consumption will still be marginally negative.

We expect a modest positive contribution from net exports with exports rising faster than imports, assuming a December trade deficit similar to November’s. However, this will be outweighed by a slowing in inventory growth. We expect a 5.0% annualized increase in the GDP deflator (1.2% not annualized) supported by export prices rising faster than import prices. This will leave the deflator up by 3.0% yr/yr.

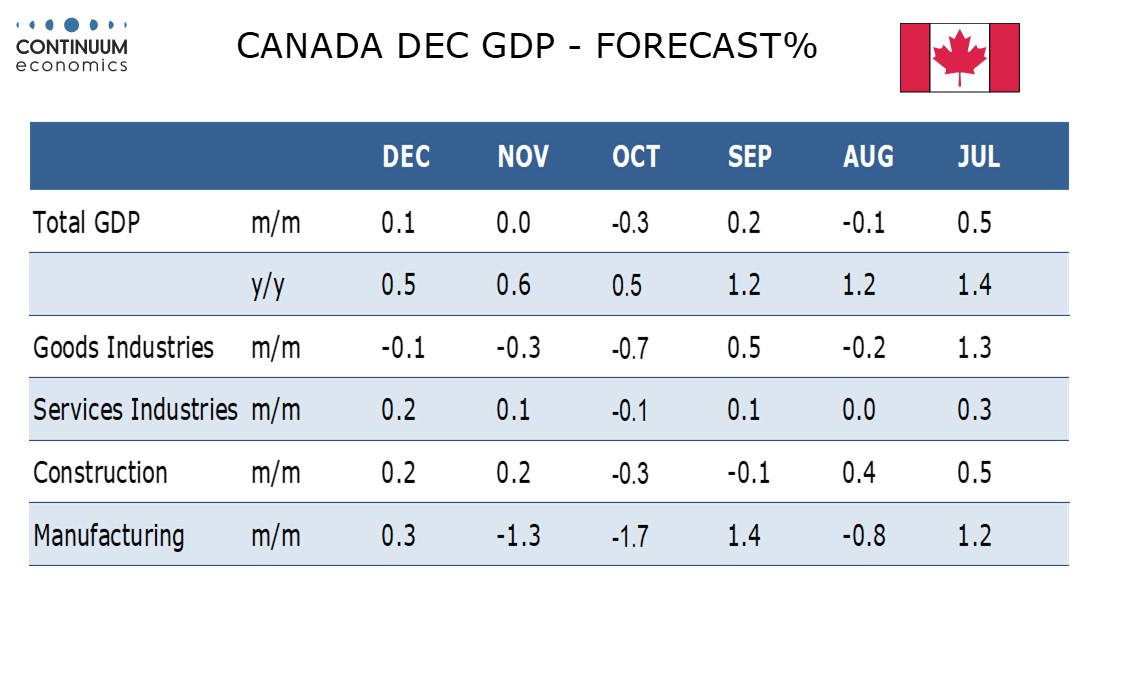

When November’s GDP report was released, reporting an unchanged month after a 0.3% October decline, it looked for a 0.1% incase in December, with gains in manufacturing and wholesale outweighing slippage in mining. Yr/yr GDP would then slip to 0.5% from 0.6%.