U.S. Initial Claims remain low but Continued Claims higher, Q3 Productivity and Costs reflect GDP revisions

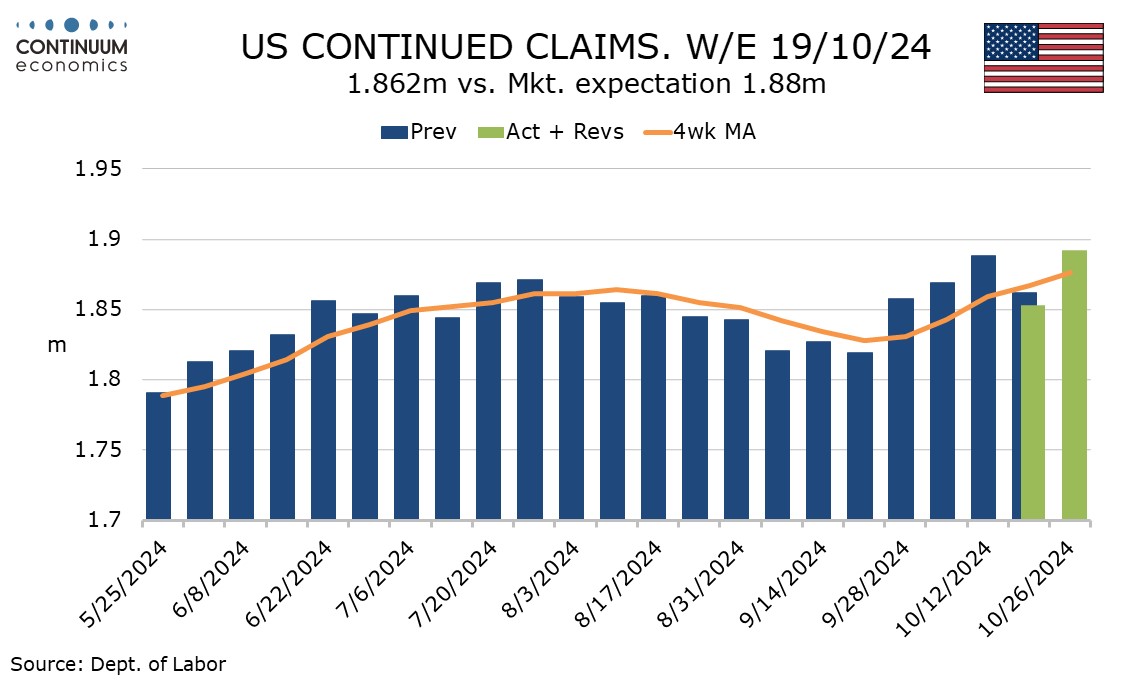

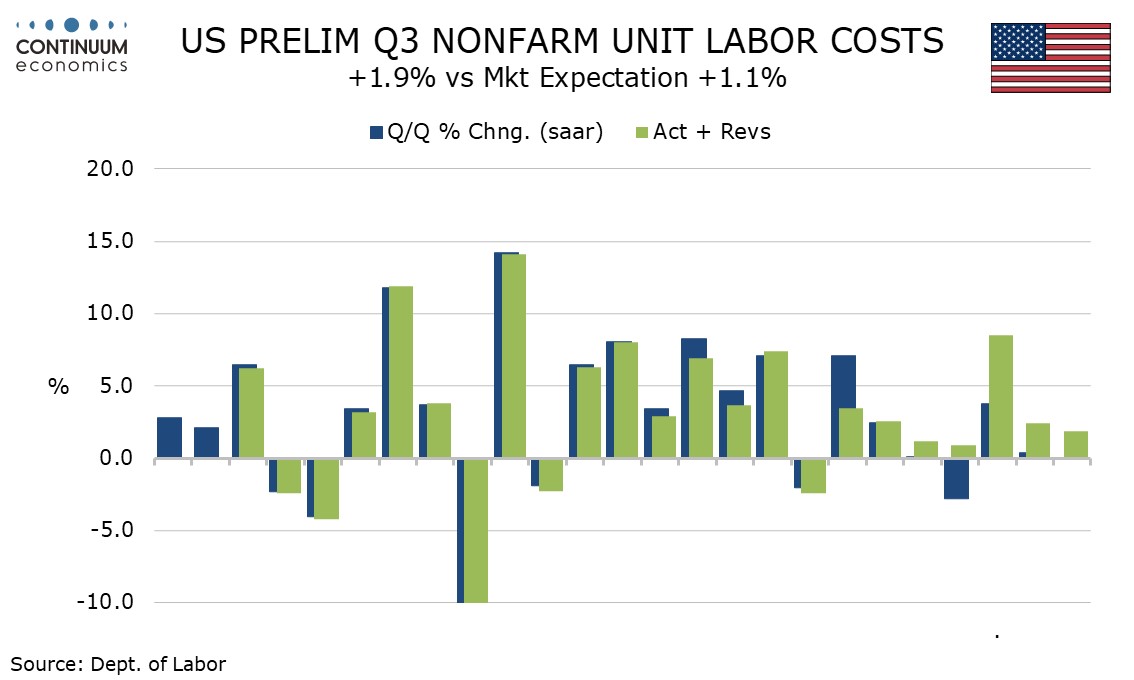

Weekly initial claims with a rise to 221k from 218k (revised from 216k) are in line with expectations and still low. However a rise in continued claims to 1.892m from 1.853m is disappointing and suggest that job losses from recent hurricanes may be persisting. Q3 non-farm productivity with a 2.2% increase remains healthy and unit labor costs at 1.9% are quite subdued on the quarter, but with upward historical revisions.

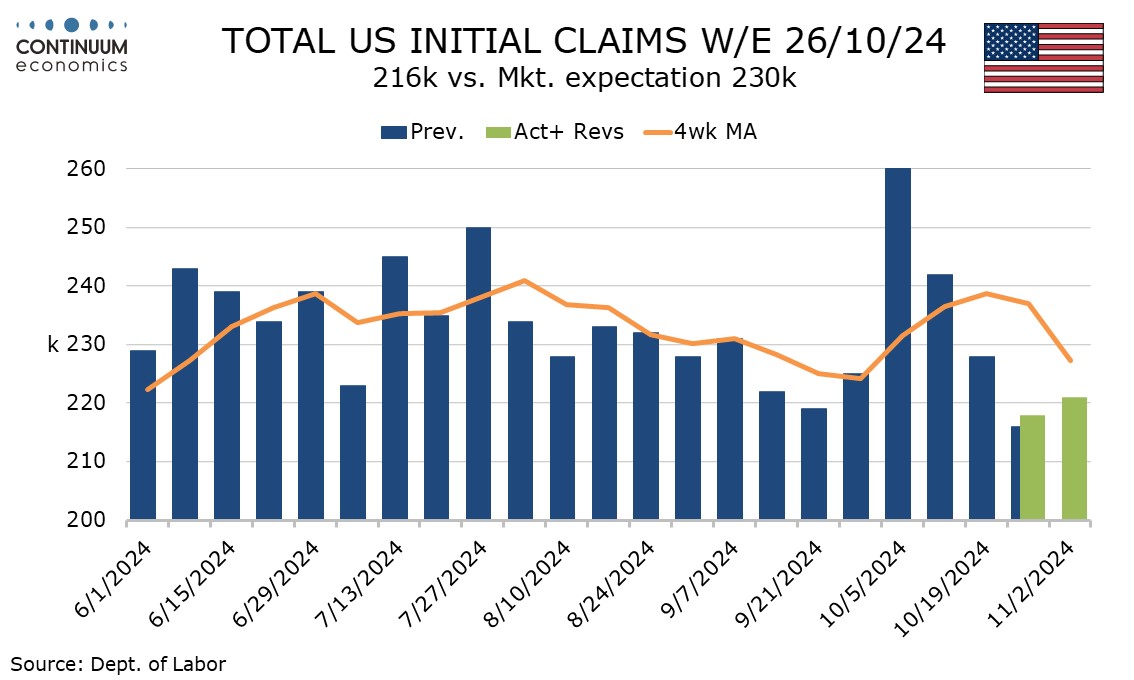

Jobless claims bounced to a high of 260k in the aftermath of Hurricane Helene and were kept high the next week by Hurricane Milton, bit have now returned to a subdued pre-hurricane trend, and near where claims were in September where payrolls saw a strong gain.

While initial claims appear to be pointing to a strong November non-farm payroll, continued claims, with a 39k rise after a 35k decline, have surprisingly moved back higher after appearing to have seen their post-hurricane peak. This hints that some of those who lost their jobs due to recent hurricanes, or others who have lost jobs elsewhere, are struggling to find fresh work.

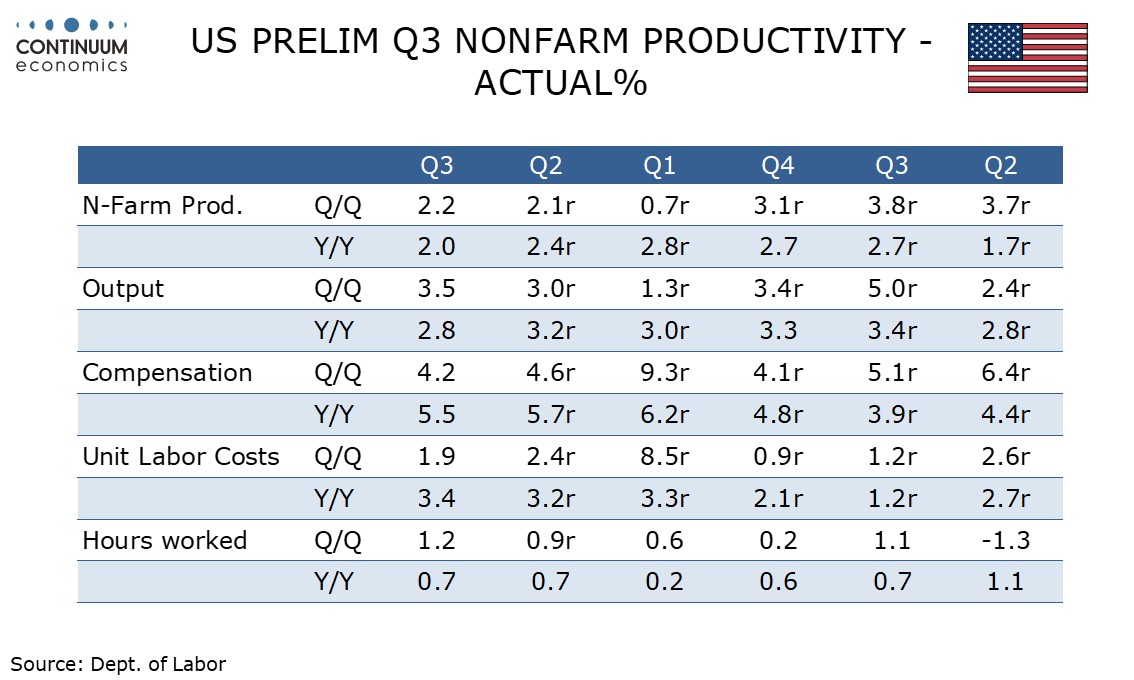

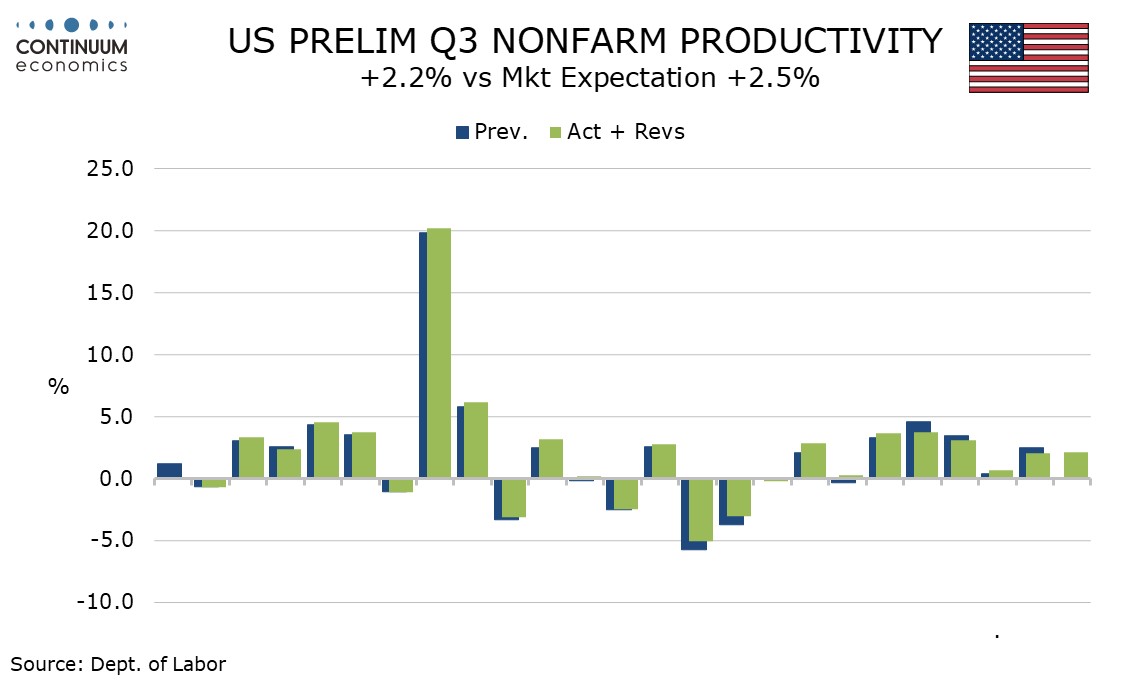

Q2’s 2.2% increase in non-farm productivity comes from a 3.5% increase in non-farm business output, a four quarter high, and 1 .3% rise in hours worked, this a six quarter high but not enough to prevent continued solid productivity growth given the strength in output.

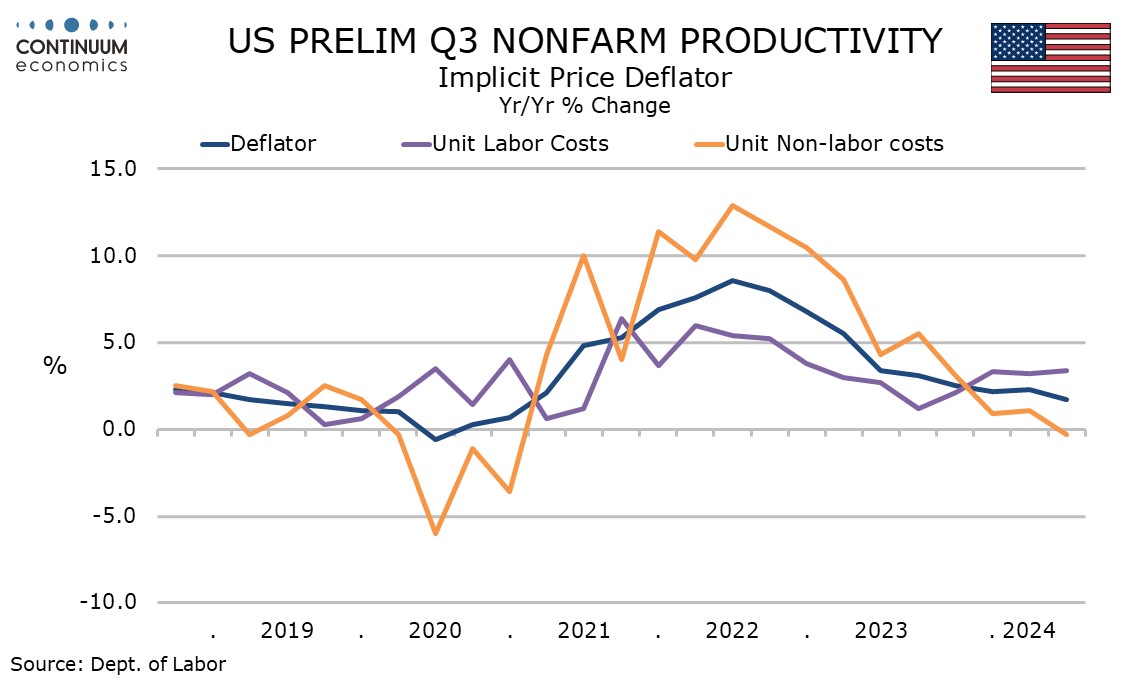

Hourly compensation rose by 4.2%, which given the productivity gain saw a 1.9% increase in unit labor costs. Non-labor costs fell by 0.4% leaving the overall deflator weak at 0.9% in the quarter.

Historical revisions with the Q2 GDP data are incorporated in this report. The most notable revisions with the GDP data were to upward revisions to income, and that is reflected in upward revisions to compensation. Compensation is up by 5.5% yr/yr versus 5.7% in Q2 which was revised up from 3.1%.

Unit labor costs are up by 3.4% yr/yr, up from 3.2% in Q2 which was revised up sharply from 0.3%. However non-labor costs have been revised down, and with a weak Q3 the overall deflator is up by a moderate 1.7% yr/yr, down from 2.3% in Q2 which was unrevised. The deflator appears to be consistent with inflation near the Fed’s 2.0% target.