USD flows: USD slightly lower on broadly neutral data

US CPI data broadly as expected, with core a tad firm. USD generally lower

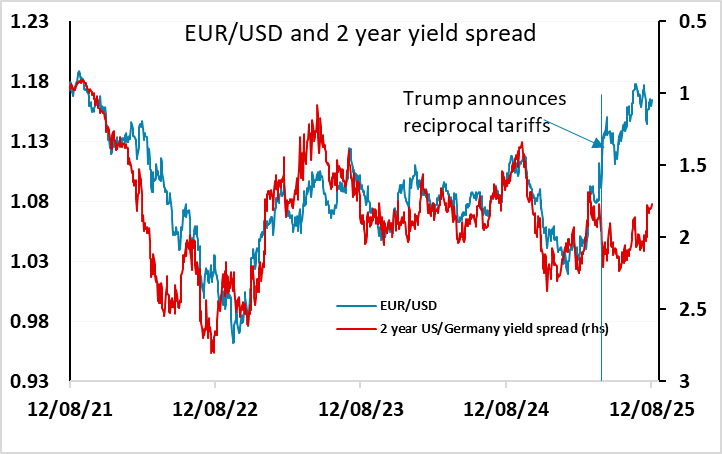

The USD has fallen back a little across the board on the US CPI data, which is objectively broadly in line with consensus with core at 0.3% and headline 0.2%. However, the core y/y rate was higher than expected at 3.1% and the headline lower than expected at 2.7%. The cire m/m rate was 0.32% before rounding, so if anything the data loos slightly on the strong side of expectations, but not significantly away from consensus. Inasmuch as the core is stronger than expected, it looks to be down to services so probably not tariff related.

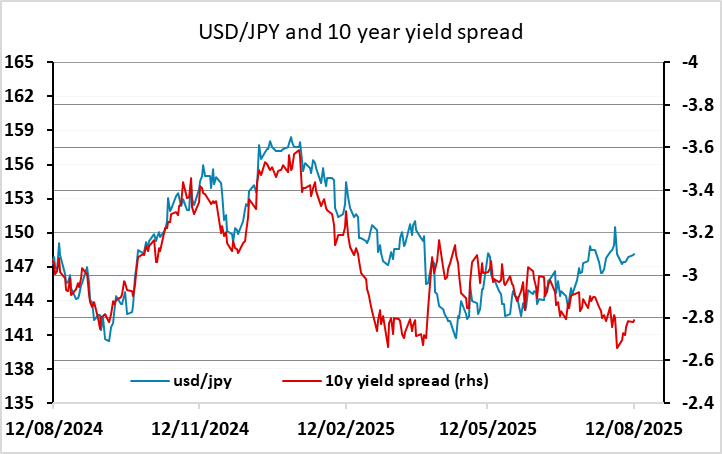

Front end US yields and the USD are a little lower, perhaps indicating relief that the data weren’t stronger. The general USD dip is fairly even across currencies and seems unlikely to extend far on the basis of this data. Lower yields and higher equities suggest little change in the equity risk premium and JPY crosses are consequently unlikely to move far.