FX Daily Strategy: N America, February 21st

The JPY remains well bid but is approaching important resistance levels

AUD can also outperform if Asian equities are resilient

The JPY remains well bid but is approaching important resistance levels

AUD can also outperform if Asian equities are resilient

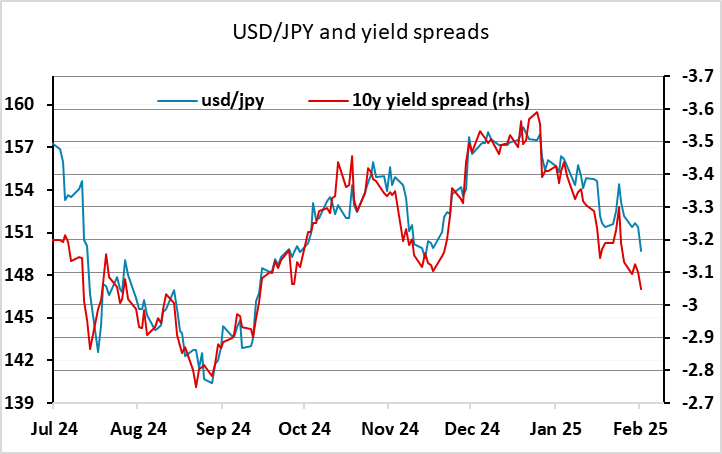

The USD was soft on Thursday despite a lack of news, with the JPY performing particularly strongly helped by some tariff induced weakening in risk sentiment. Threats of tariffs on pharma, cars and semiconductors as well as the reciprocal tariffs already promised cover all the US’s trading partners, and the net impact on currencies is likely to be less about which country suffers most from tariffs than what the impact s on global growth and risk sentiment. There seems little doubt that any tariff imposition will be negative for risk and thus positive for the JPY. But even without much weakness in risk appetite, yield spreads have narrowed sufficiently to justify USD/JPY progress sub-150. Even so, we are hitting some key technical levels in USD/JPY and JPY crosses so further downside may require some clear news.

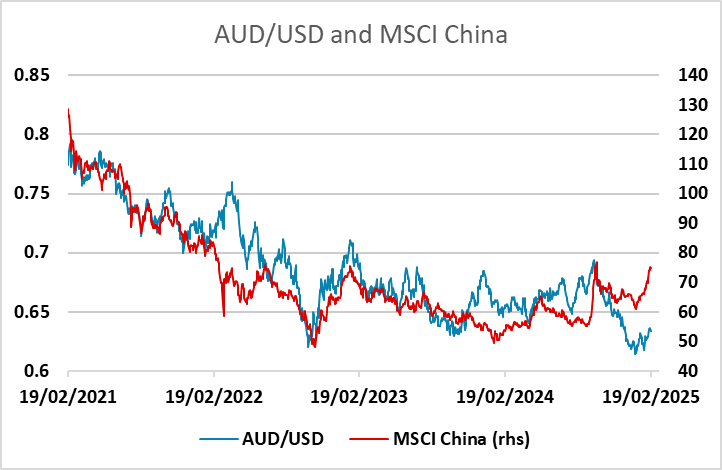

Along with the JPY, the AUD continues to make good progress and hit another new high for the year on Thursday. Of course, the AUD will tend to require positive rather than negative risk sentiment if it is to advance, and is also close to important resistance at 0.64. But there is much less good news priced into Asian equities than US equities, and if these prove resilient yield spreads remain at levels that suggest scope for AUD gains.