USD, JPY, EUR flows: JPY slips after Ueda comments

USD/JPY moved higher after Ueda speech, but BoJ December rate hike remains a close call. EUR/USD may have modest scope for recovery.

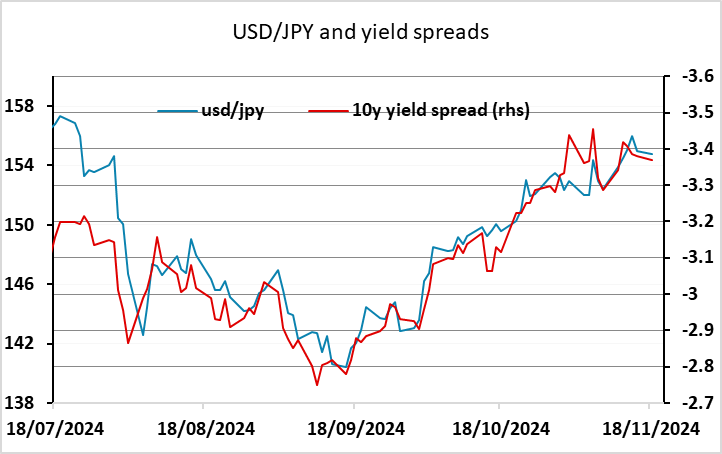

A typical quiet Monday calendar suggests we won’t see much FX movement over the day. The main event of the day has probably already happened, with BoJ governor Ueda’s speech to business leaders in Nagoya. The JPY fell after the speech, with USD/JPY rising a big figure to 155, as Ueda didn’t provide any clear indication that he BoJ would hike rates in December as many had hoped. But realistically this has not been his style, and a hike in December remains possible. Indeed, a 25bp rate hike remains priced as a little better than a 50% chance, and 2 year JGB yields have continued to rise, helped by Ueda’s indication that the plan to gradually raise rates remained in place, and that delaying a rate hike might mean sharp hikes later. USD/JPY continues to look broadly consistent with the correlation with yield spreads seen in the last few months, while still substantially above the levels associated with the longer term correlation with yields.

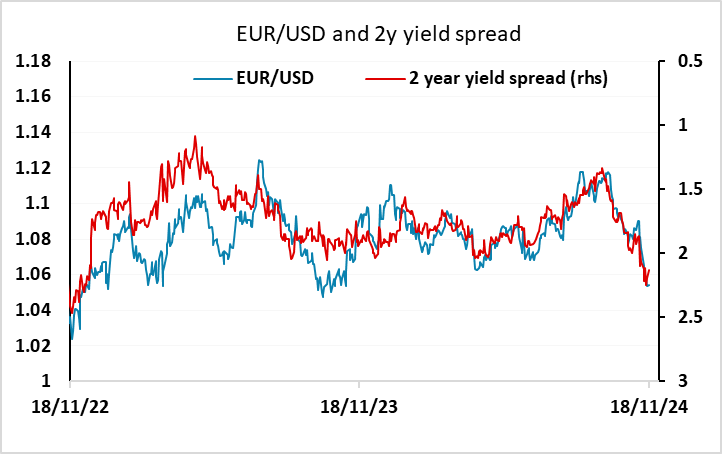

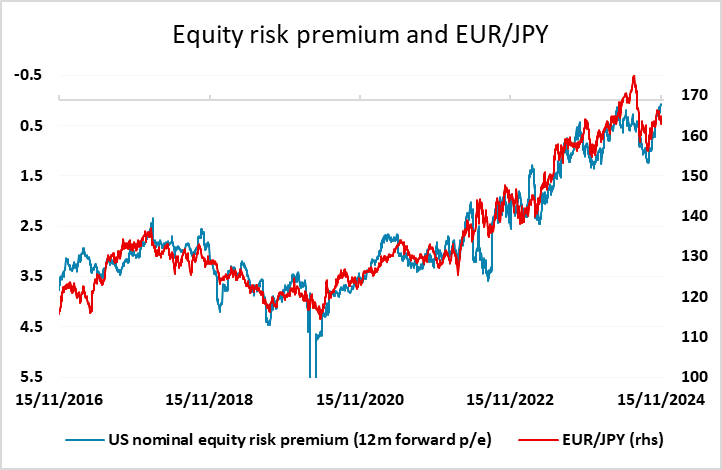

With Eurozone yields edging a little higher this morning and equities performing a little better EUR/USD looks likely to find some support. EUR/JPY has continued to underperform relative to the usual correlation with equity risk premia, and while USD/JPY looks unlikely to move far, there may be some potential for a EUR/USD recovery towards 1.06 in the short term.