FX Daily Strategy: North America, August 1st

US employment report likely to show another solid month

USD recovery may still have further to run

JPY weakness still related to equity market strength…

…but also reflects squeeze of speculative positions.

US employment report likely to show another solid month

USD recovery may still have further to run

JPY weakness still related to equity market strength…

…but also reflects squeeze of speculative positions.

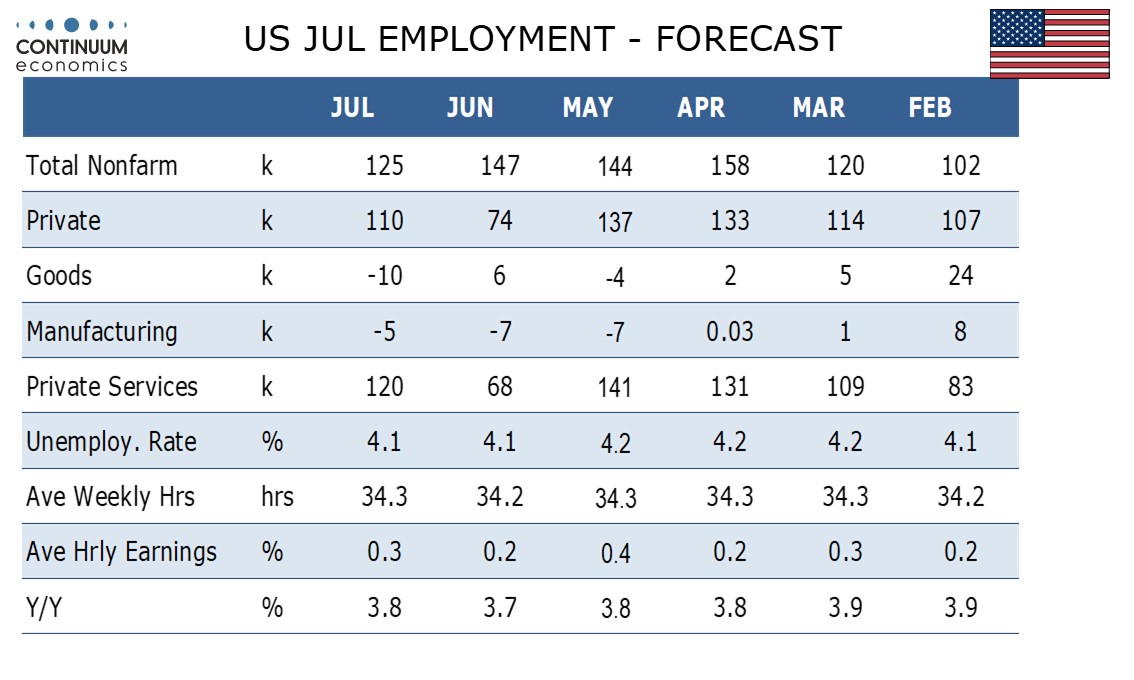

The US employment report will be the main focus on Friday. We expect a 125k increase in July’s non-farm payroll, slightly slower than in each month of Q2 but slightly stronger than in each month of Q1. We expect a 110k rise in private sector payrolls, up from 74k in June but slower than in April and May. An unchanged unemployment rate of 4.1% and a 0.3% rise in average hourly earnings will complete a mostly healthy picture. Our numbers are a little stronger than the consensus, which has a marginally lower payroll number and a rise in the unemployment rate to 4.2%. Another dip in the initial claims numbers on Thursday wasn’t related to the survey week, but the steady decline in initial claims in the last month doesn’t suggest we are about to see a significant turn lower in employment.

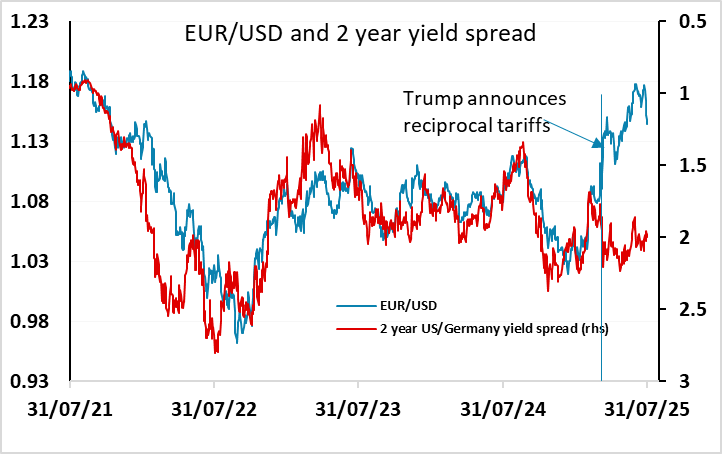

The data comes against the background of a much stronger USD in the las week, particularly against the JPY. This looks to be a consequence of the trade deal with the EU announced last weekend, which has triggered a correction to the USD decline seen since the initial reciprocal tariff announcement in April. EUR/USD had risen from around 1.09 around the announcement to above 1.18 at its peak, so we have now reversed almost half of the gains. There is scope for more if the market sees the US economy as healthy and undamaged by tariffs, although it is still the case that the impact of tariffs is likely to be seen later in the year.

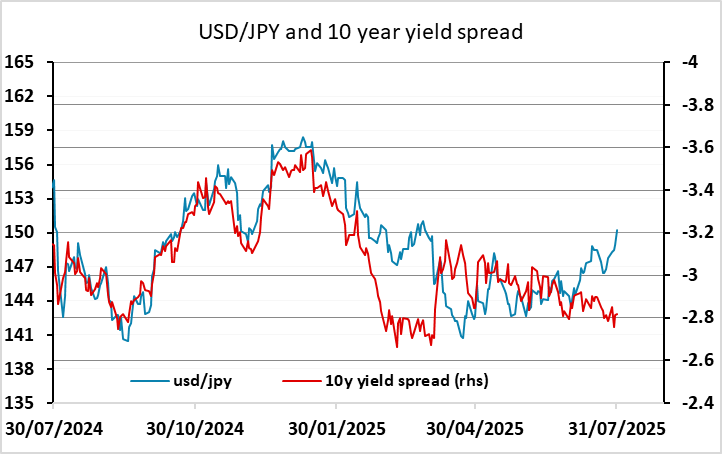

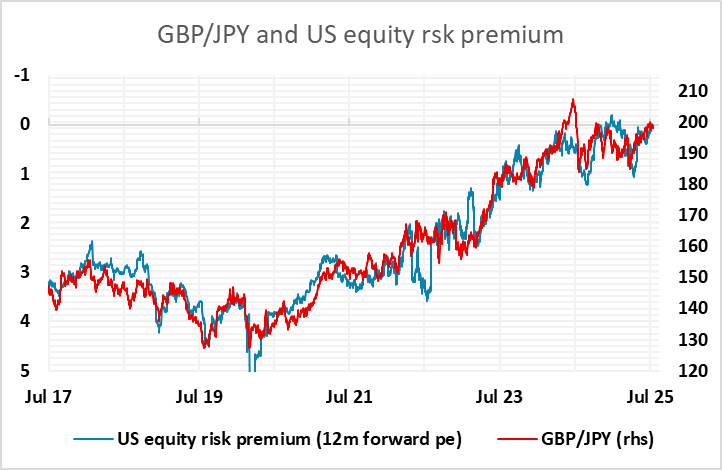

That the JPY has suffered more than anything else since the trade deals were announced is a consequence more of the equity market reaction than anything else. While the USD/JPY and EUR/USD relationships with yield spreads have been inconsistent in the last year, JPY crosses, particularly GBP/JPY but also EUR/JPY, have continued to map closely with the movements in equity risk premia. So USD/JPY has been dragged higher by the latest decline in EUR/USD, in part because we have seen a resilient equity market. Strength in equities has been bolstered this week by positive results from Meta and Microsoft, and while we still wouldn’t see these results as justifying current market pricing, we won’t see a turn lower in equities to break the current trend unless we see some actual bad news on earnings or a significant increase in US yields. Only the former could be expected to lead to a significant JPY recovery against the USD.

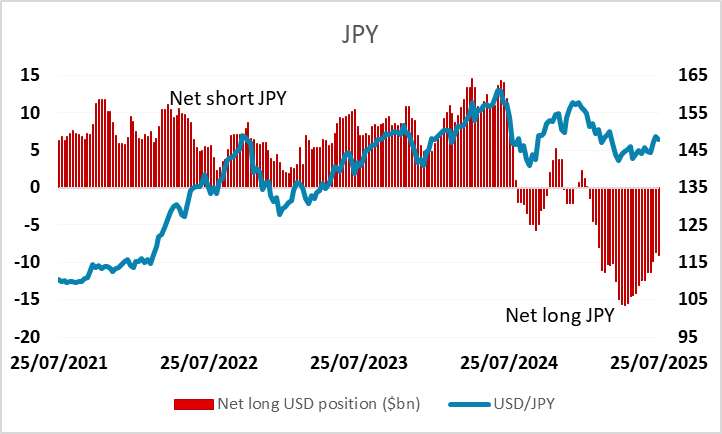

The other part of the JPY decline looks to be technical, related to the big increase in speculative positions evident in the CFTC data which started in February and peaked in late April at the same time as USD/JPY bottomed out. The increase in speculative positioning coincided with USD/JPY exceeding the decline suggested by the movement in US/Japan yield spreads. We are now seeing USD/JPY trading well above the level suggested by yield spreads, and the break above the 200 day m.a. at 149.50 might well have triggered some more squaring of speculative positions.

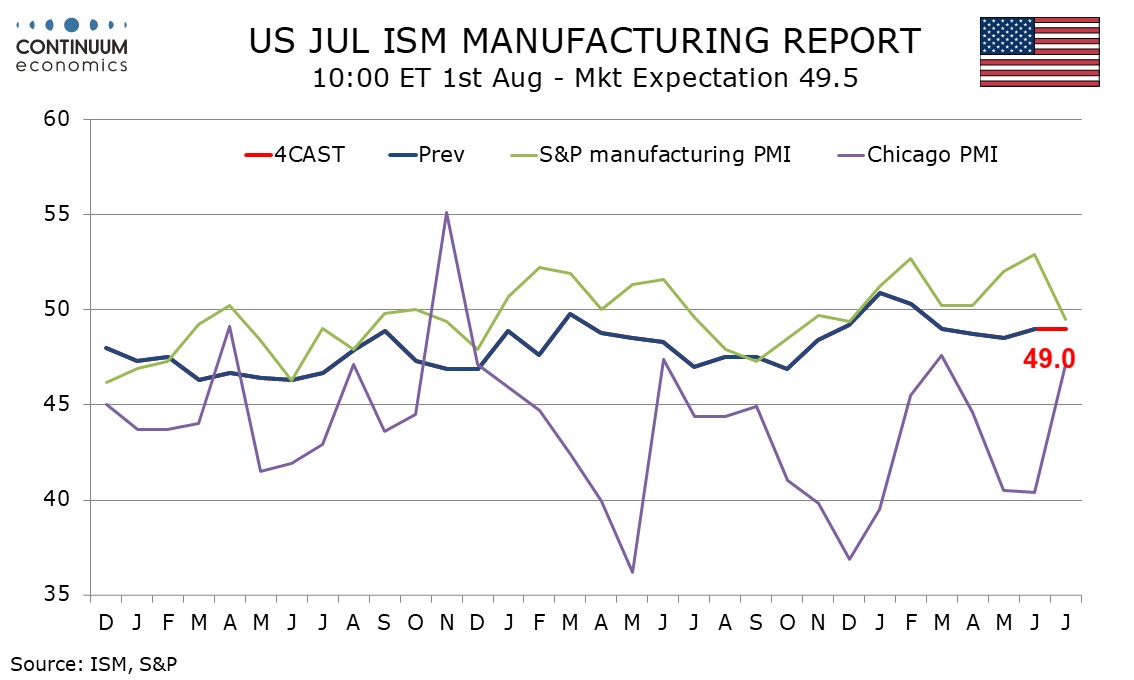

The ISM manufacturing data later in the day are unlikely to significantly alter any reaction to the employment report, with the S&P PMIs already released suggesting a solid manufacturing performance, and the market in any case typically more concerned with the services sector.