FX Daily Strategy: Europe, November 5th

USD may edge lower on ADP

ISM services likely to have minimal impact

Scope for JPY strength to extend

GBP to stay under pressure medium term

USD may edge lower on ADP

ISM services likely to have minimal impact

Scope for JPY strength to extend

GBP to stay under pressure medium term

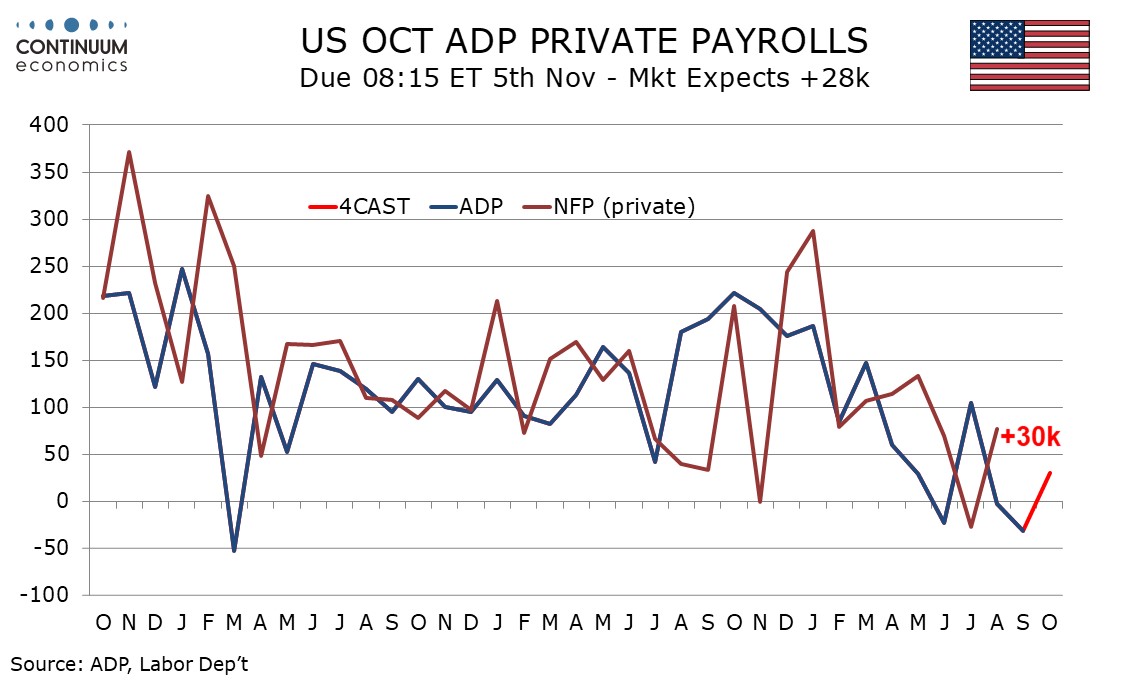

Wednesday sees the latest ADP employment data, which has gained greater attention since the government shutdown, due to the lack of official data. We expect a rise of 30k in October’s ADP estimate for private sector employment growth. Weekly data released by ADP is suggesting a modest rise. This would largely reverse a 32k decline seen in September suggesting the labor market maintains a picture of limited hiring and limited layoffs. Three of the last four ADP reports have reported declines, but a rise of 104k in July more than fully offsets declines of 23k in June, 3k in August and 32k in September. We do not expect September’s non-farm payroll, when released, to be quite as weak as the ADP report, continuing to forecast a 45k rise overall, 50k in the private sector. Our forecast is in line with then market consensus of 31k, so couldn’t be expected to have much market impact. The essentially flat trend in employment suggested by these numbers may encourage the Fed doves to seek another rate cut in December, even though the flat trend is what can broadly be expected in a full employment economy at trend growth if net immigration is zero. As such, it might be seen as marginally USD negative.

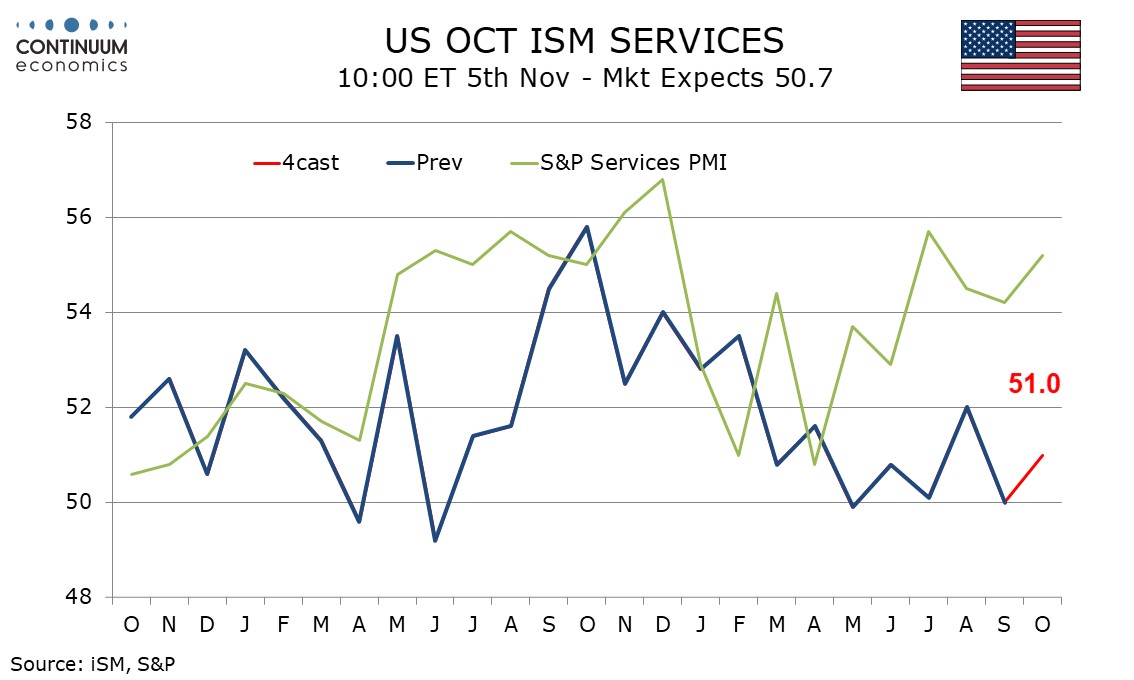

Wednesday also sees ISM services data. The manufacturing index on Monday was weaker than expected and helped to generate the slightly risk negative tine we have seen so far this week. We expect October’s ISM services index to rise to 51.0 from 50.0, supported by seasonal adjustments. This would be in line with the Q3 average of 50.7 and the Q2 average of 50.8. Our forecast is slightly above the market consensus of 50.7, but a bigger miss would be needed to have any market impact.

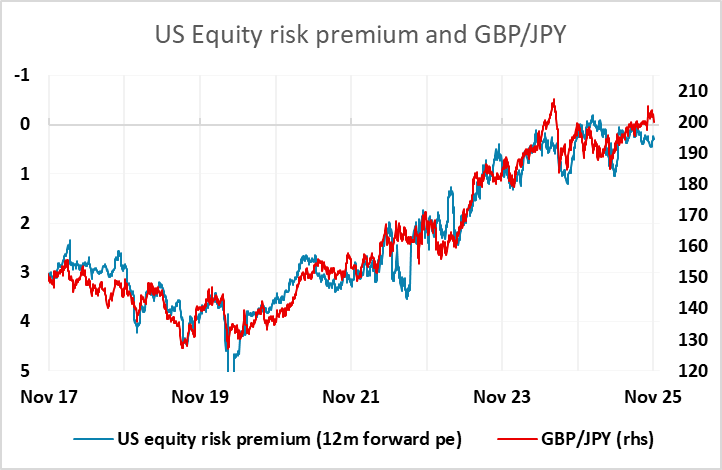

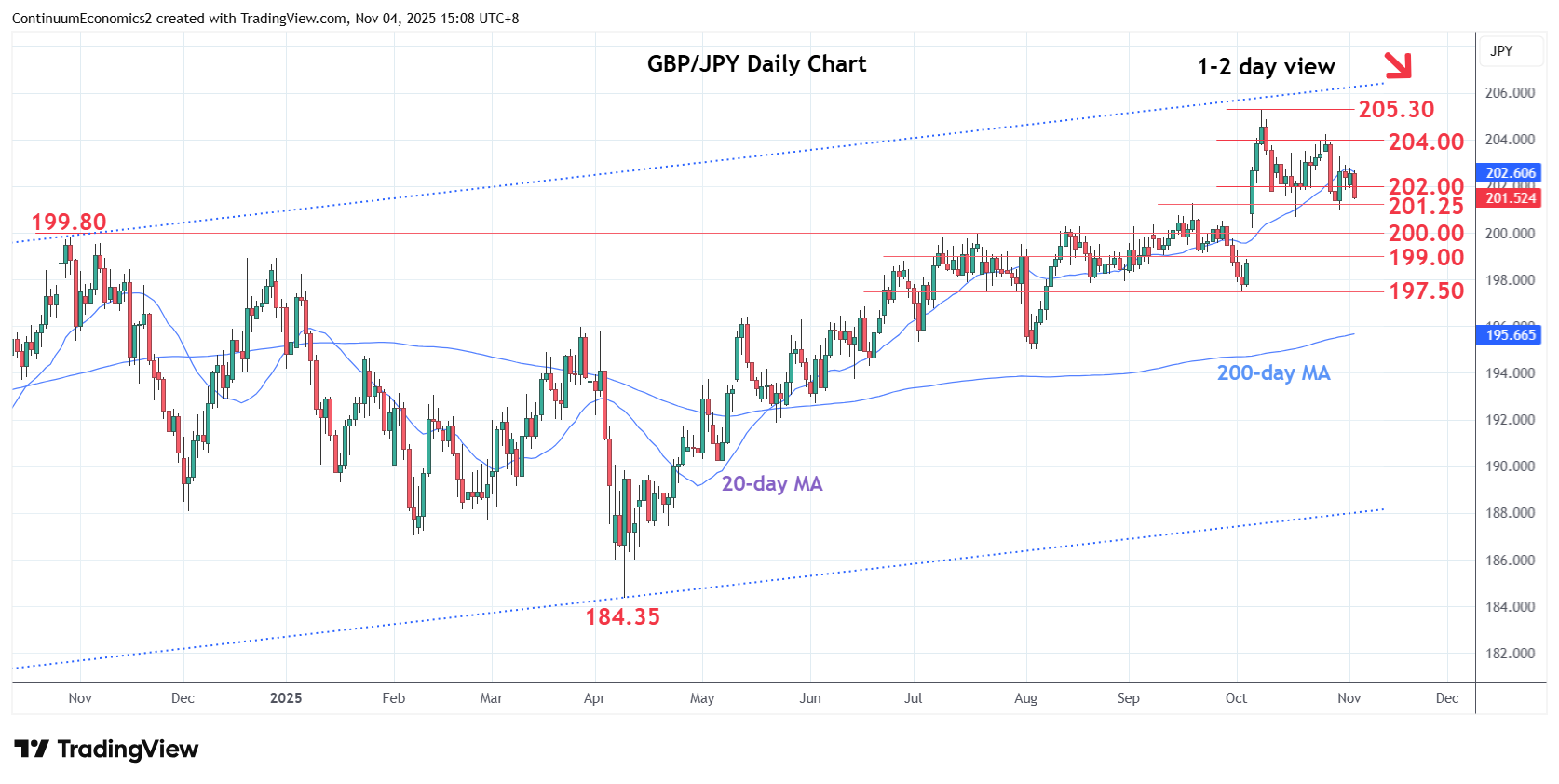

Although the USD was a little firmer on Tuesday against the riskier currencies, it lost ground against the JPY, and that trend could continue if we see equities continue to slip. EUR/JPY hit its lowest in two weeks on Tuesday and GBP/JPY moving into the gap created at the election of Takaichi as LDP leader. In recent weeks, EUR/JPY has moved fairly closely with US equity indices, but previously – in the last 8 years or so – JPY crosses had been closely correlated with US equity risk premia rather than equity prices. Arguably, this makes more sense, although this too has little fundamental basis. In any case, the relationship with risk premia started to break down around August, but saw a clearer break on the election of Takaichi. The closest correlation was with GBP/JPY, and Tuesday’s decline takes this cross closer to the old relationship, but there could still be scope for a move to the mid-190s. A more fundamental assessment focusing on yield spreads would suggest scope for much greater declines. However, this would likely require a bigger turn in risk sentiment. For now a move down to the bottom of the “Takaichi gap” at 198.80 should be the initial target.

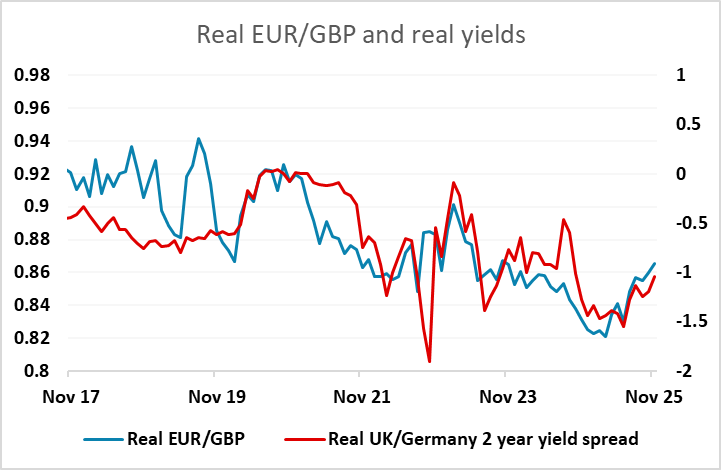

Final PMIs in Europe seems unlikely to affect things significantly, but there is likely to be increased focus on GBP ahead of the BoE decision on Thursday. The statement from Chancellor Reeves on Tuesday made it clear that the UK Budget on November 26 will include significant tax increases, but the BoE MPC is technically unable to take this into account at this stage, so we still expect policy to stay on hold. The market prices around a 35% chance of a 25bp cut on Thursday, and a 65% chance of a 25bp cut by December. This suggests we may see a modest GBP bounce on an MPC decision to leave rates unchanged this time, but we also think that the chances of a December cut are greater than currently priced if the Budget is as contractionary as we expect. Indeed, there could be a case for a 50bp move. So we would expect GBP to stay under pressure medium term, even if we see a mild recovery on Thursday.