EUR, JPY flows: EUR cheered by German election, JPY stll firm

German election result seen as positive for German economy and the EUR. Narrowing yield spreads suggest more JPY strength to come

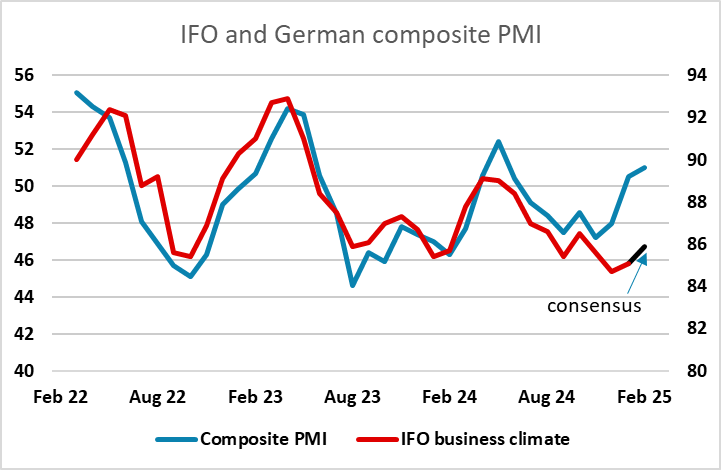

EUR/USD has performed well overnight, helped by the CDU/CSU victory in the German election. Although the right wing AfD reached second place with 20.9% of the vote, the fact that the CDU/CSU ill be able to form a government with the SPD was seen as positive, with the market expecting increased fiscal spending, led be defence. EUR/USD advanced above 1.05, but has settled back in early European trading, as any economic impact of the result will be some time coming. Further strength in European equities looks necessary to extend EUR gains, and this may prove difficult if the weakness of the US composite PMI on Friday and the dip in the University of Michigan consumer sentiment index are genuine indicators of some slowing in the US economy that will hold back the US market. The German IFO survey today has risks on the upside after the stronger PMIs seen in the last two months, suggesting the EUR can remain firm.

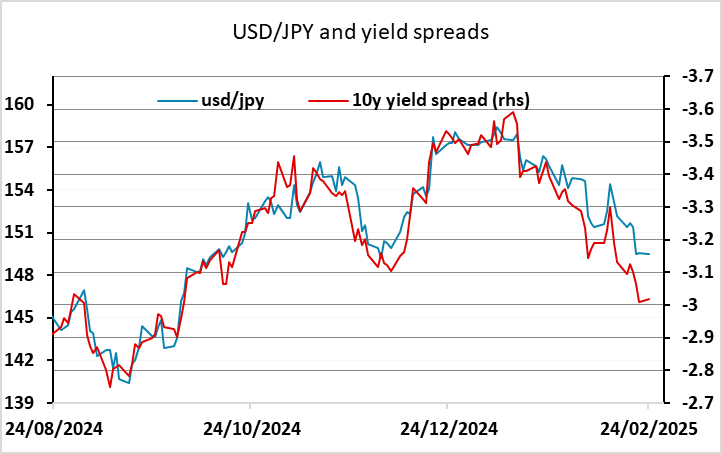

Otherwise, there isn’t much change from Friday’s closing levels. USD/JPY continues to look heavy, with yield spreads continuing to point lower, but a better equity tone this morning is helping to limit JPY gains along with some significant technical support levels. AUD/USD continues to be restrained by resistance at 0.64.