FX Daily Strategy: APAC, November 18th

USD firm as December Fed easing expectations fade

JPY weakness extends further, but intervention risks rising

EUR/JPY looks overextended on all measures

AUD should find good support despite equity dip

USD firm as December Fed easing expectations fade

JPY weakness extends further, but intervention risks rising

EUR/JPY looks overextended on all measures

AUD should find good support despite equity dip

USD/JPY broke to new post-February highs once again on Monday, with the USD seeing some general strength, although it is most pronounced against the JPY. EUR/JPY stopped just short of the all time EUR/JPY high of 179.97 seen last week. Some mildly hawkish comments from the Fed’s Jefferson, who is typically on the dovish side, may have been the trigger for the move, although the market continues to price a Fed ease in December at around a 40% chance. This week’s September employment report, now due on Thursday, will be the main focus for the market in assessing the chance of an ease in December, but it is looking like it will need to be weak if the Fed is going to ease, judging by recent comments. This should mean that ahead of Thursday, the USD is likely to stay on the front foot.

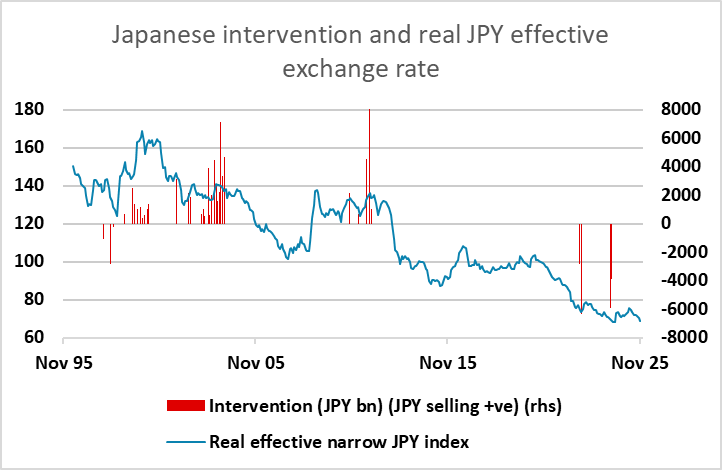

As far as the JPY is concerned, proposals for a more aggressively expansionary fiscal package overnight from Goushi Kataoka, a government adviser, were seen by some as a reason for more JPY weakness, as he also said he didn’t see the need for higher rates until well into next year. But he added his voice to that of Finance Minister Katayama in saying excessive JPY declines were undesirable, adding that the pace of recent falls in the currency had been rapid, and urging FX intervention if necessary. Certainly, the risk of intervention has increased with the break above 155, and given that it is hard to find a real rationale for current JPY weakness, we would see a significant risk of action this week if there is no reversal.

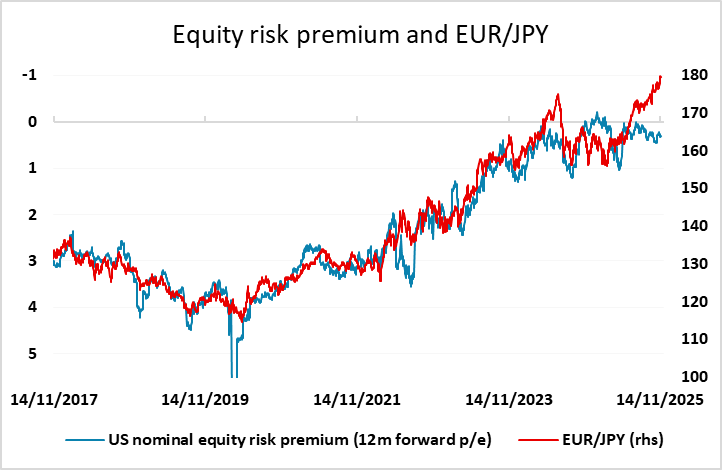

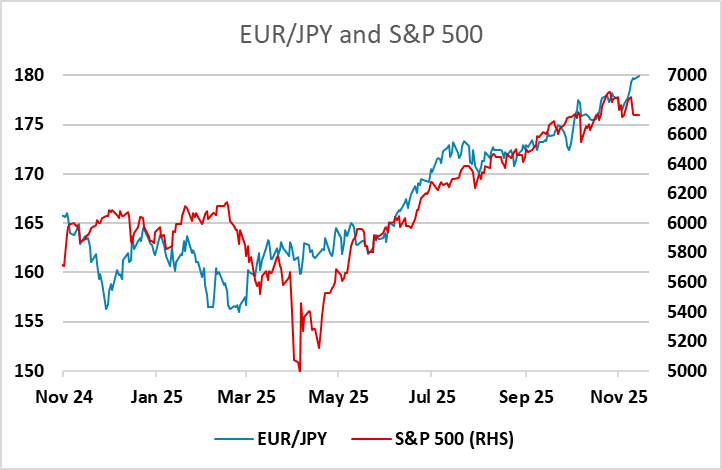

The declining chances of a Fed ease are starting to weigh a little on the equity market, although underlying sentiment remains positive with equity risk premia still very low and stable. JPY weakness on the crosses has typically been associated with declining risk premia, but on this measure already seems to have gone too far, and even based on the simple correlation with equities, EUR/JPY now looks overextended. A JPY cross recovery therefore looks possible if equities continues to edge lower, even if USD/JPY holds near the highs. Nvidia results on Wednesday are a big focus for tech stocks this week, and combined with the employment report suggest we could see some volatility Wednesday-Thursday.

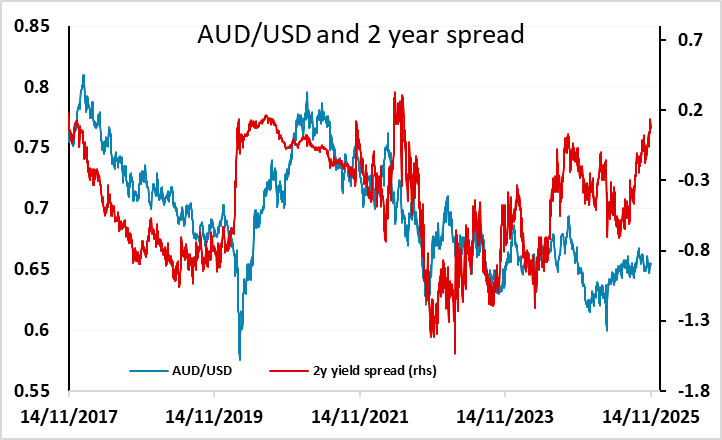

Tuesday lacks significant data or events, with the RBA minutes unlikely to alter market expectations of near term steady RBA policy after recent solid Australian data. AUD fell back a little on USD strength on Monday, but AUD/USD continues to look low relative to yield spreads and unless equity weakness gathers momentum we would expected AUD/USD to find good support below 0.65.