FOMC Minutes from September 17 - No dramatic divisions revealed

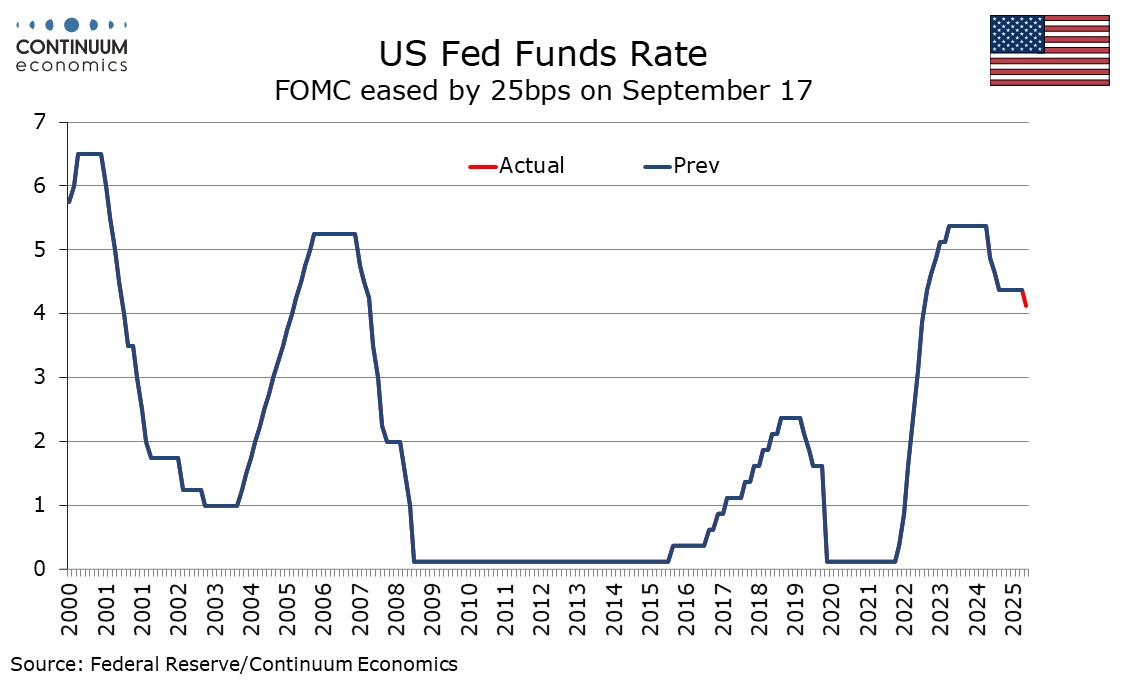

FOMC minutes from September 17 do not show a clear split between two camps, despite Fed speakers since the meeting showing some with clearly hawkish concerns and others significantly less so. This reflects a broad consensus to ease by 25bps at this meeting. While future decisions are not set in stone, most expected further easing in the remainder of this year.

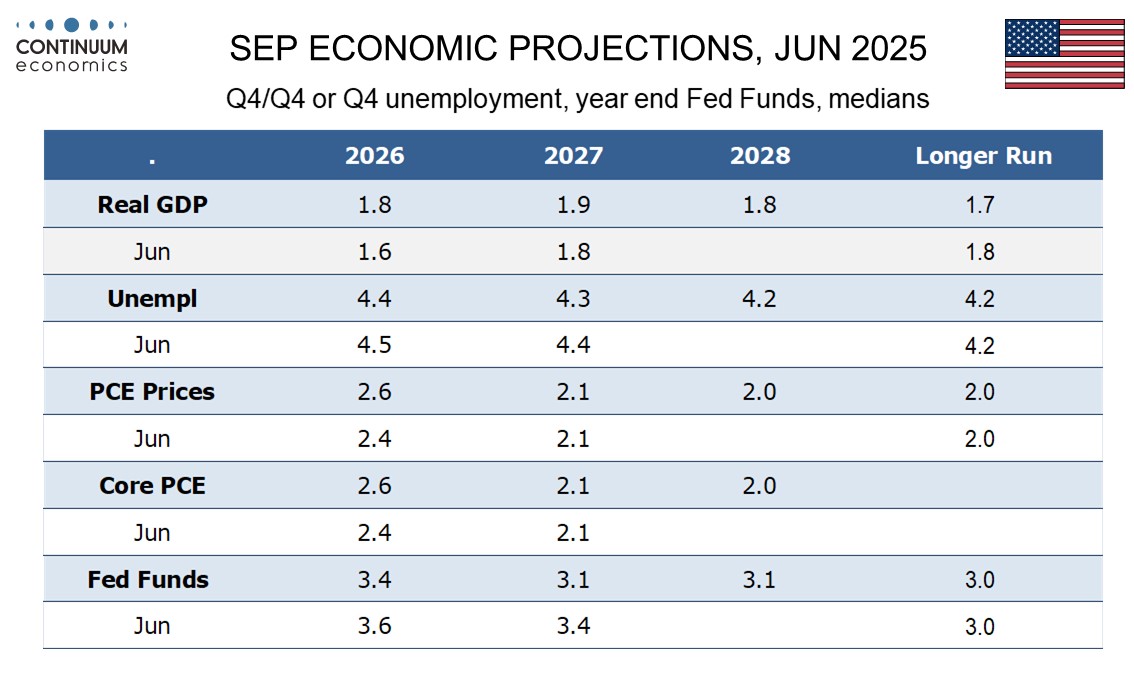

A majority emphasized upside risks to their outlooks for inflation though the tone is not starkly hawkish. Some remarked that they perceived less upside risk than earlier in the year with some seeing the impact of tariffs as somewhat muted relative to expectations. Most expected tariff impacts to be realized by the end of next year, suggesting uncertainty will persist for some time.

Slowing job growth was seen as reflecting supply and demand. Participants generally assessed other labor market indicators did not show a sharp deterioration. However most judged that downside risks to employment had increased while upside risks to inflation had either diminished or not increased. The 25bps easing that was delivered was seen reflecting a shift in the balance of risks.

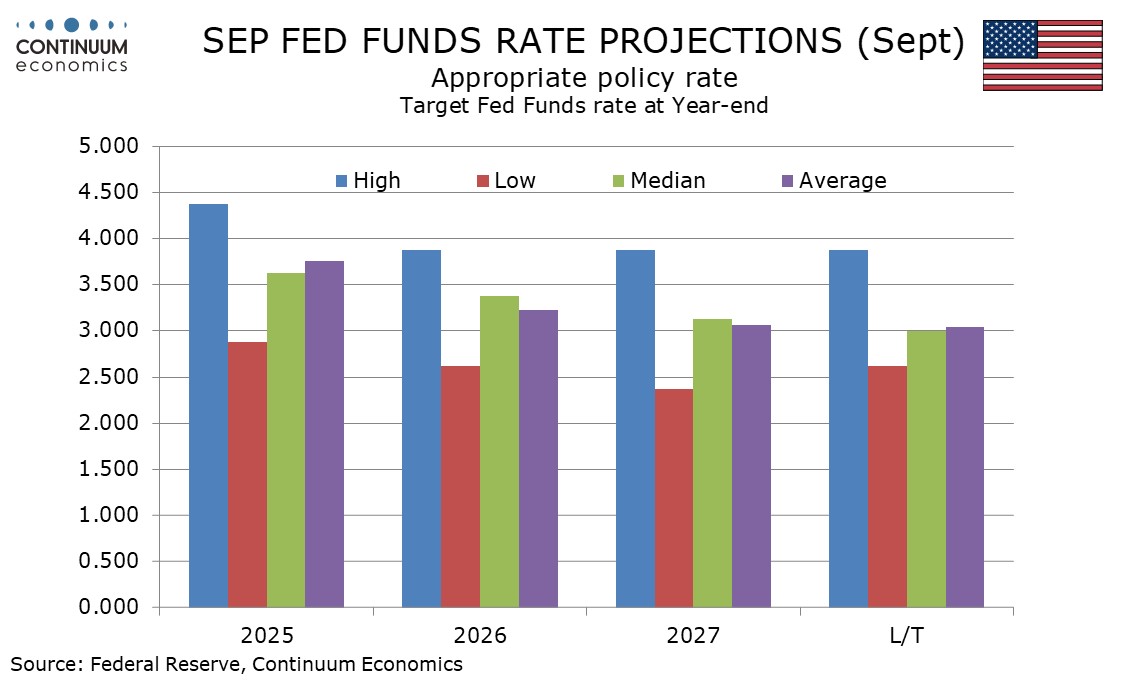

Almost all participants supported this 25bps ease though one (Miran) voted for a 50bps move and a few stated there was merit in keeping rates unchanged. Most judged that it would be appropriate to ease further over the remainder of this year. Risks of easing too much and too little were both noted, and the importance of taking a balanced approach was noted.

There is little in these minutes to argue against expecting the FOMC to deliver the two more 25bps easings this year that the meeting’s dots imply. However the meeting took place before an upward revision to Q2 GDP was released, and it is uncertain how the absence of key economic data, if the government shutdown persists through the next meeting on October 29, will impact the FOMC’s willingness to act.