FX Daily Strategy: APAC, July 11th

Equities firm despite tariff threat

JPY sees modest recovery after recent sharp losses

EUR and CHF may be more at risk from tariff announcements now

Potential for a NOK/SEK rally

GBP at risk from weaker GDP

Hard to justify current CAD levels given relative US/Canada performance

USD looking generally better bid as tariff announcement awaited

After a week largely devoid of significant data, Friday offers a couple of releases of a bit more interest. UK May GDP comes early in Europe, with the market looking for a 0.1% increase after the 0.3% decline in April. However, we see clear downside risks to this, with another GDP decline on the cards in our view. GBP would certainly be vulnerable to this outcome, as this would further undermine confidence in the UK economy and also increase the likely need for fiscal tightening in the Budget, suggesting more aggressive rate cuts from the BoE would be necessary.

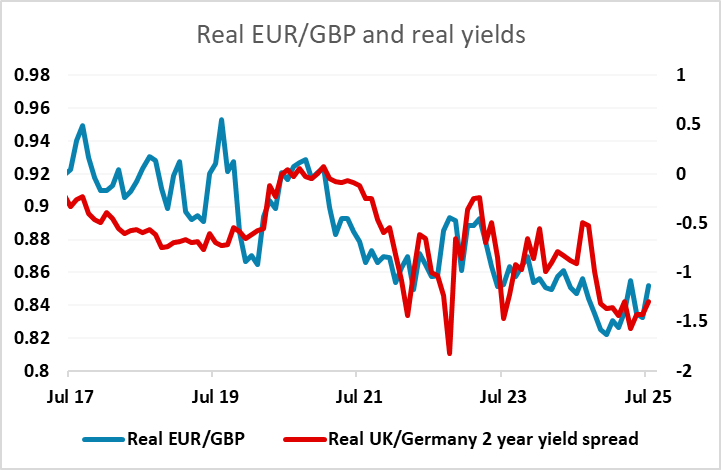

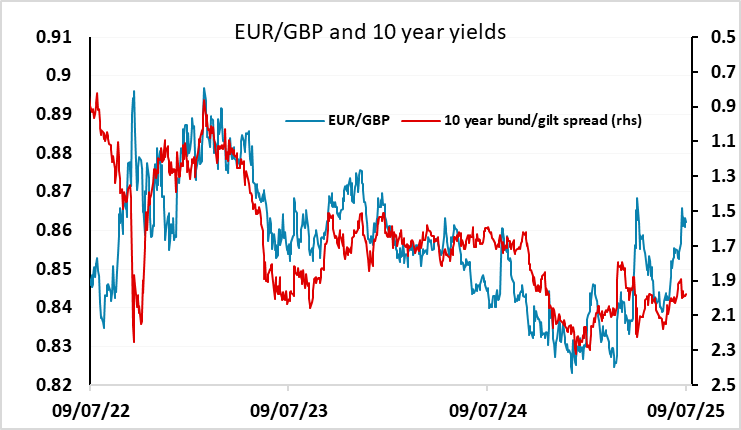

EUR/GBP has held above 0.86 in spite of the UK being seen as being less threatened by US tariffs than other areas, with concern about the UK fiscal position after the government failed to enact spending cuts being a significant factor. EUR/GBP looks a little high relative to nominal yield spreads, but the correlation with real yields over the longer run suggests it is currently close to fair at current levels. In the longer run, short term real yields are likely to move close to Eurozone levels, suggesting scope for a EUR/GBP rise above 0.90, and this could happen more quickly than expected if GDP weakens sharply.

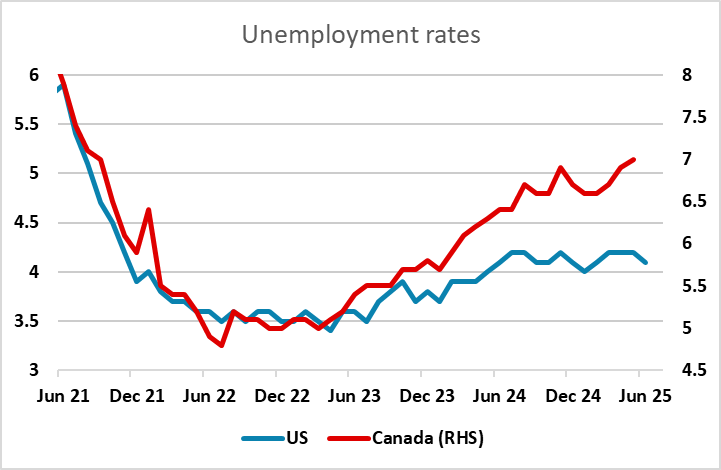

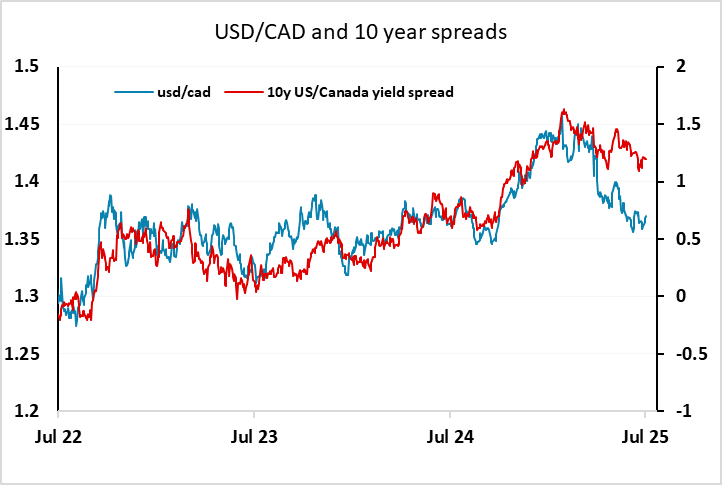

The other main release is the Canadian employment report, with the consensus looking for only a very marginal rise. The underlying trend is now quite flat, with the trend in the unemployment rate clearly higher. Despite this, the CAD has held up well against the USD in recent months, gaining ground along with most other major currencies after the US announcement of reciprocal tariffs in early April. But as the Canadian economy continues to underperform the US, the risk is that we see a reversal of the recent outperformance and a reconnection with yield spreads. The market is currently pricing one more BoC cut and two Fed cuts this year, but given the current evidence on relative economic performance, it seems unlikely that the BoC will cut less than the Fed despite its lower starting point.

In general, the USD showed a firmer tone on Thursday helped by another dip in the initial claims data. It now looks increasingly like we will se an extended correction to the USD decline we have seen since April, with the European currencies looking the most vulnerable, both because they have made the biggest gains and because they are at most danger from tariff news. Additionally, the current positive view of the European economy may start to be challenged by weaker data in the coming months, as uncertainty around tariffs has seen some weakness in lending growth.