FX Daily Strategy: Asia, January 11th

US CPI the focus with marginal risks for a weaker number

But USD downside looks quite limited given aggressive Fed easing priced in

CHF/JPY looking obviously overvalued

US CPI the focus with marginal risks for a weaker number

But USD downside looks quite limited given aggressive Fed easing priced in

CHF/JPY looking obviously overvalued

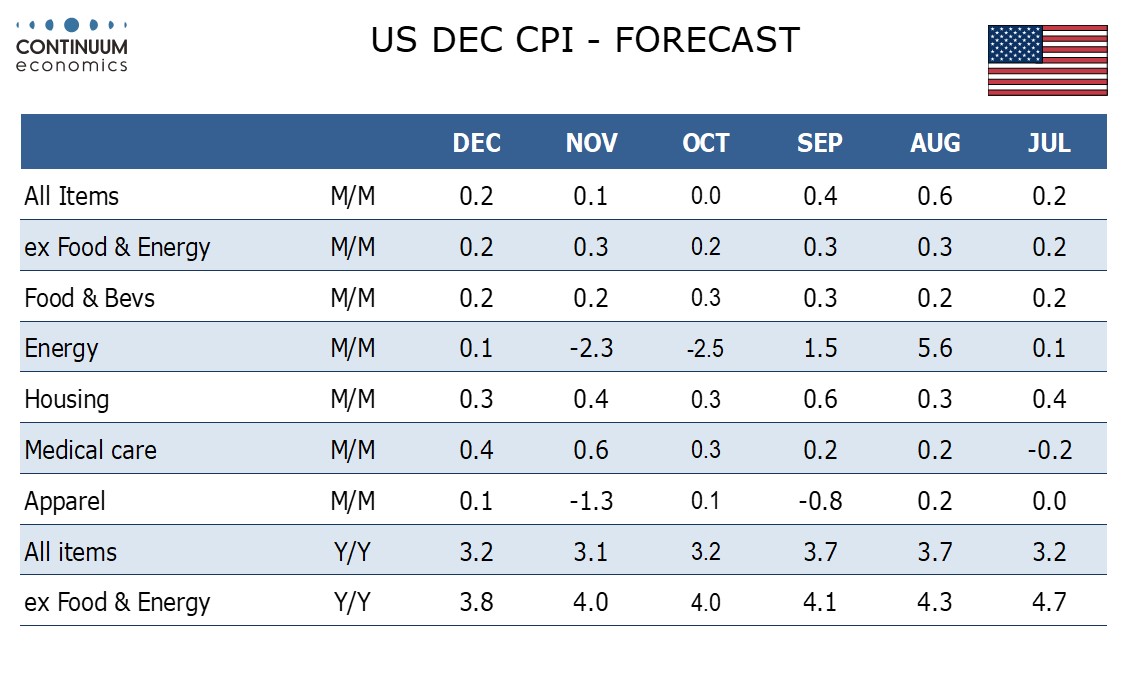

US CPI data is the primary focus on Thursday, with not a lot else to interest the market except for the usual Thursday jobless claims data. We expect December CPI to increase by 0.2% overall and ex food and energy, with risk being for higher rather than lower, with our forecasts before rounding being 0.22% overall and 0.24% ex food and energy. Our forecast for the core rate would represent a slowing from 0.3% (0.285% before rounding) in November, though similar to October’s outcome of 0.227%. Market consensus is 0.3% for the core, so marginally higher than our forecast, suggesting an outcome in line with our forecast would be USD negative.

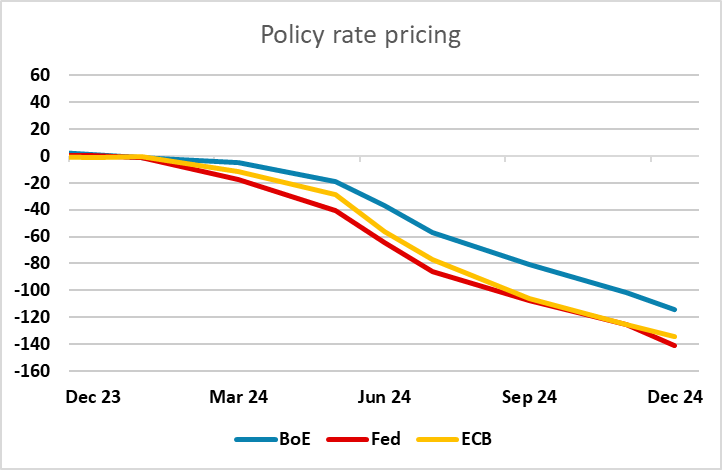

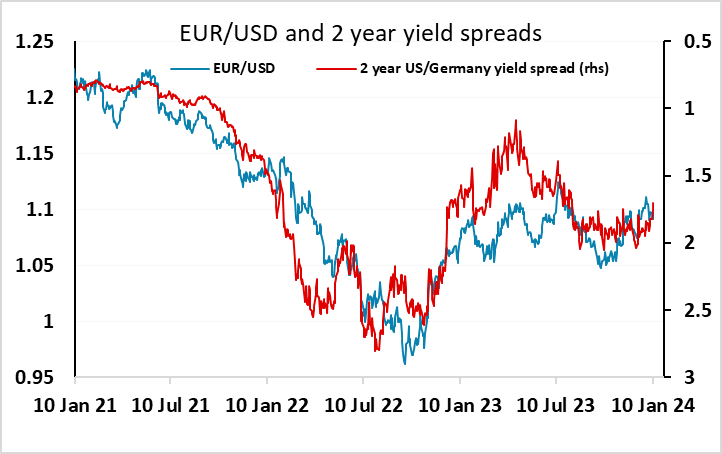

As it stands, the market is pricing around 140bps of easing from the Fed this year, taking the policy rate below 4% by year end. While this looks quite aggressive, there is little reason in the long run to expect a policy rate above 3% if inflation returns to target. However, at this stage inflation numbers coming on the high side of 0.2% monthly suggest an annualised inflation rate still running close to 3%. As long as this is the case, it will be hard to justify much more easing from the Fed than is currently priced in, unless we see significant weakness in the economy and/or equity market. So unless we see a 0.1% (or lower) rise in US CPI, we wouldn’t expect a significant negative USD reaction. A more positive USD reaction might be more likely, even on a 0.3% core rise.

There is currently a similar downward path to rates expected from the ECB. Despite headline annual rates in the Eurozone still being above target, the latest CPI numbers have suggested that the underlying pace of gains has fallen and is now in line with the 2% target, based on an average of the seasonally adjusted data over the last 6 months. This could argue for a more rapid decline in ECB rates than in the US, although the lower starting point for ECB rates also needs to be taken into account. Nevertheless, a comparison of inflation trends suggests to us that there is a case for a relatively slower pace of Fed easing, and consequently an upside bias for the USD unless we see some clearly weaker data today.

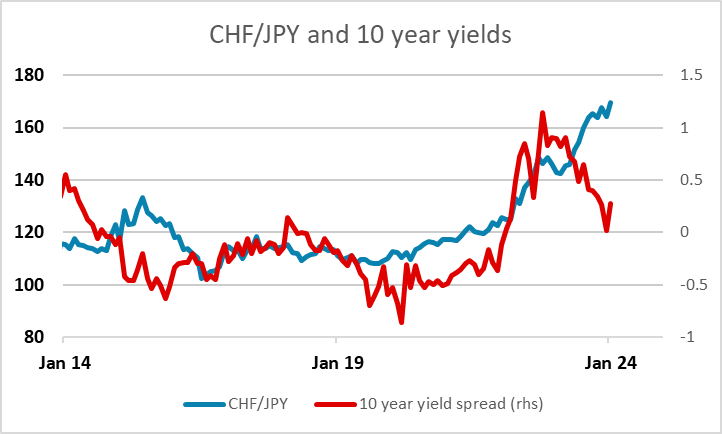

JPY weakness was a feature on Wednesday, following the soft Japanese labour cash earnings data released early in the Asian session which increased the likelihood that the BoJ will maintain their current easy policy near term. However, we retain expectations of JPY strength over the year. While yield spread narrowing is likely to be necessary to trigger significant JPY gains, we are starting from a position of major JPY undervaluation, so we would expect JPY gains even if there is little movement in spreads, although the timing of these gains will be hard to predict. Weakening risk sentiment is the most likely trigger. JPY gains against many currencies will require either spread narrowing or a recognition of the big JPY depreciation we have seen in real terms in the last few years. But CHF/JPY looks obviously out of line after a 44% gain since the beginning of 2021, with little movement in yield spreads to support it.