FX Daily Strategy: APAC, April 10th

US CPI and ECB meeting may conform to expectations

Ranges may therefore remain intact in EUR/USD and USD/JPY

CHF may see renewed weakness if there is no significant risk negative event on the weekend

US CPI the focus

Neutral data likely to favour carry trades

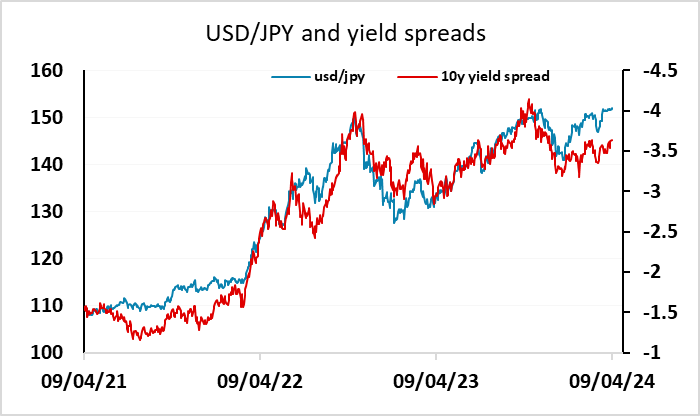

Strong numbers may lead to a test of the BoJ’s resolve

NZD could manage a recovery after RBNZ

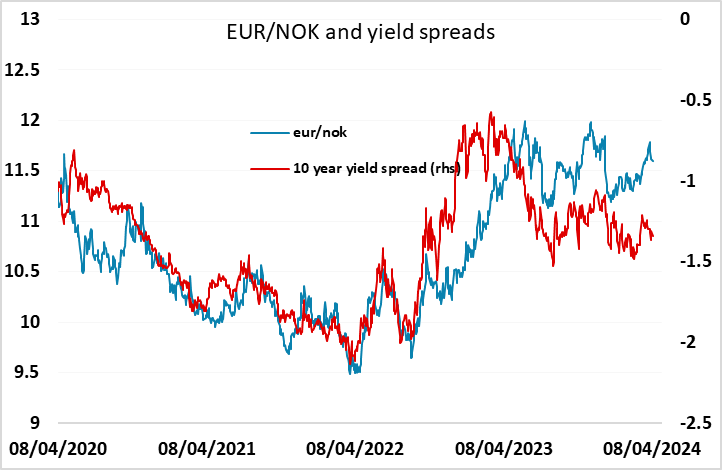

NOK still favoured medium term but may dip on Norwegian CPI

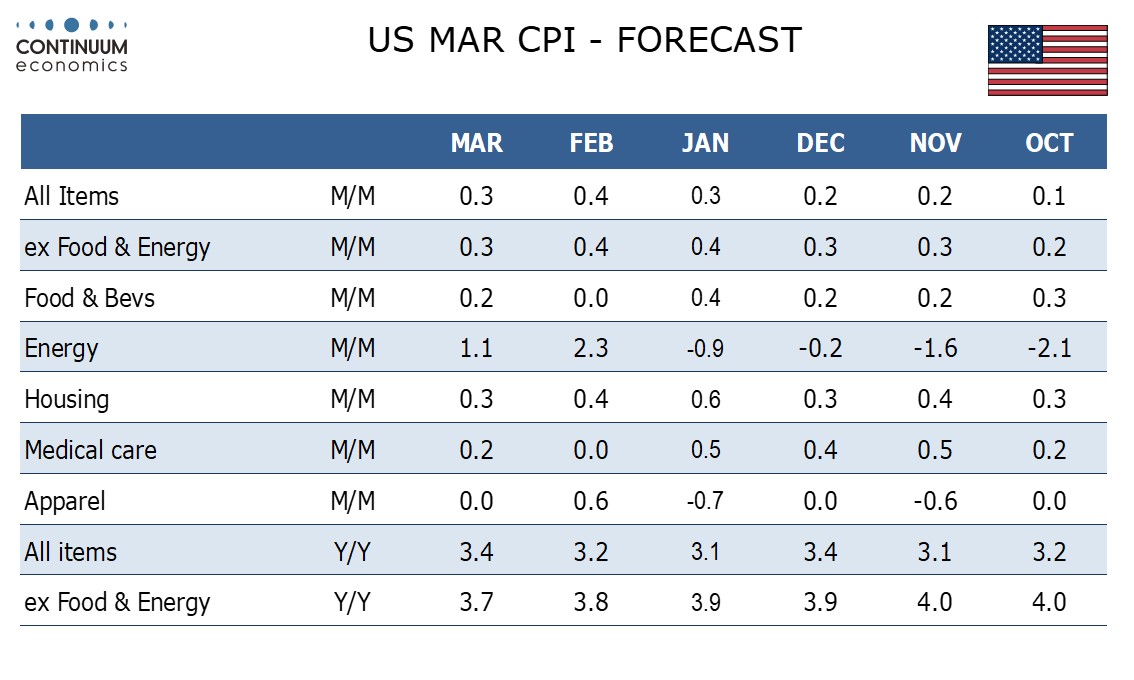

US CPI is the main focus for Wednesday. We expect March CPI to rise by 0.3% both overall and ex food and energy, though before rounding we expect the headline at 0.31% to exceed the core rate at 0.27%, the latter a return to trend after two straight disappointing 0.4% gains seen in January and February. Our forecast is in line with the consensus, and while it wouldn’t make a Fed rate cut in June any more or less likely, it would probably restore the more risk positive tone seen earlier in the week after the dip seen near European close on Tuesday. The market’s default position in the last week or two has been to favour the carry trade in relatively quiet, low volatility conditions, but there has been little net movement as we have seen the generally positive tone succumb to a couple of sharp corrections (as is often the case with carry trades).

Weaker than expected CPI would clearly favour the risk positive tone, although the USD could also be expected to slip lower against the lower yielders if US yields fell in response to weaker numbers. The converse is also true, and the response to a stronger than expected number would probably be more interesting, as it would renew upside pressure on USD/JPY and ask the question of the Japanese authorities as to whether they are prepared to intervene to oppose USD strength. But if the data is as expected, the AUD would probably be the biggest beneficiary among the G10 currencies.

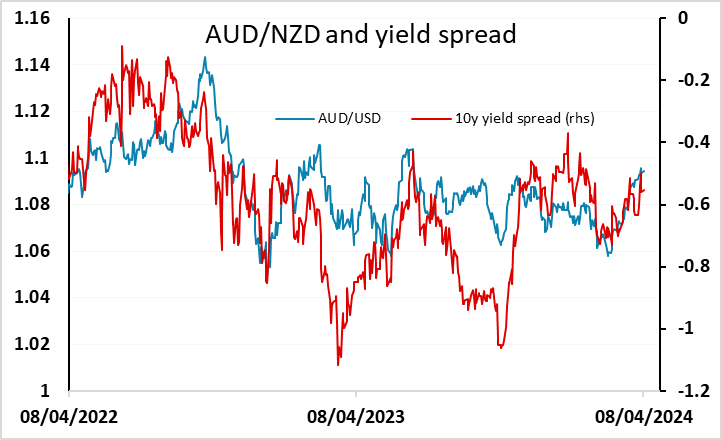

Ahead of the US data there are a couple of events that might attract attention. The RBNZ meets, but no change in rates is expected, with nothing priced into the market and all forecasters calling for no change, so it’s quite hard to see a significant reaction. The NZD has been on the back foot against the AUD in the last month, trading up more than 3 figures, but AUD/NZD is close to the top of its recent range and it makes sense for the NZD to perform a little better in a carry friendly environment, so the risks are now to the AUD/NZD downside.

In Europe there is Norwegian March CPI, with the consensus anticipating a drop in the y/y rate to 4.2% headline and 4.7% core. We look for a slightly weaker outcome than the market, and this may mean the NOK comes under some short term downside pressure. However, we still see the NOK as undervalued here against the EUR and the SEK, so provided a mild risk positive tone is maintained after the US CPI data later in the day, we would look for EUR/NOK to fall back after any post-data rise.