FX Daily Strategy: APAC, Sep 18th

BoE to leave rates unchanged but cut back gilt selling

GBP risks remain mainly to the downside

AUD still has potential to extend gains if employment data solid

US data focus on jobless claims

BoE to leave rates unchanged but cut back gilt selling

GBP risks remain mainly to the downside

AUD still has potential to extend gains if employment data solid

US data focus on jobless claims

The Bank of England MPC meeting is the main European focus on Thursday. That the BoE will keep Bank Rate at 4% is all but certain. The MPC majority has indicated that the recent regular quarterly pace of easing seen so far in the cycle may be slowed or paused amid price persistence concerns. This reflects the MPC majority’s complacency regarding what we think is a rapidly deteriorating labor market that warrants the further circa-75 bp of rate cuts we have pencilled in by mid-2026. Last month, the widely expected 25 bp Bank Rate cut (to 4% and the fifth in the current cycle) duly arrived although the anticipated three-way split on the MPC was not quite as expected. It is puzzling how policy makers, faced obviously with both the same array of data and the same remit, can think so relatively disparately. This partly reflects the alternative scenario building that now lies at the heart of policy thinking and which effectively demotes the baseline inflation projection’s importance. The policy outlook is clouded even more than normal as the updated and somewhat higher CPI forecast it offered last month cannot encompass several likely downside risks, most notably a likely fiscal tightening that will impact over the next 1-3 years. So we still think the risks to rates are on the downside, even if there is little in today’s statement to support it.

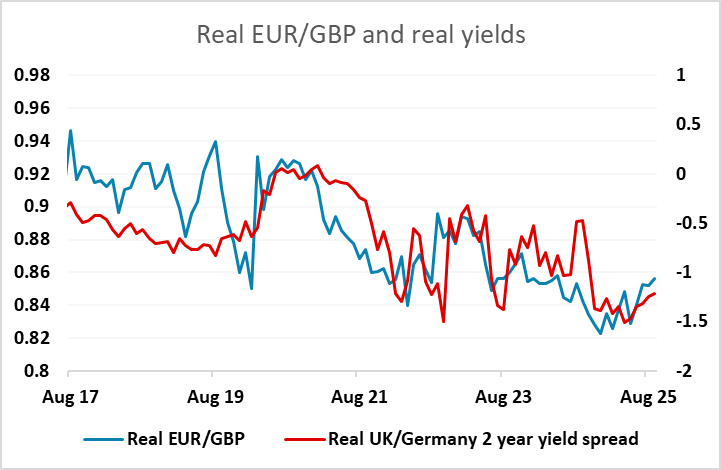

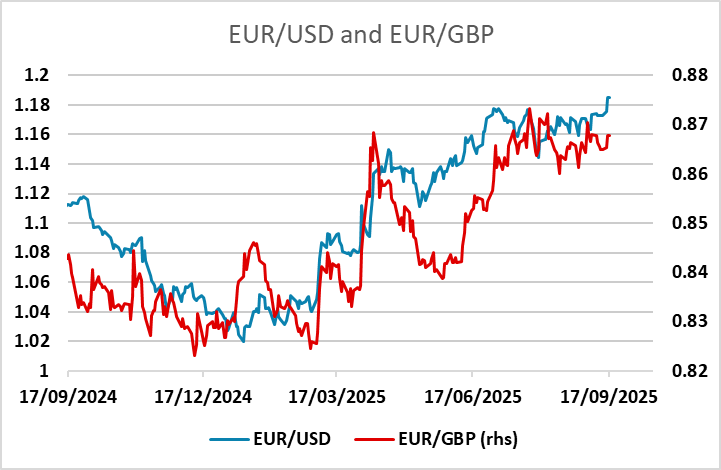

This month’s meeting may be more to do with unconventional policy with the BoE carrying out its (now) annual update of its planned gilt rundown and sales as it continues to shrink its balance sheet. Along with the consensus, we see the annual rundown of gilts being slowed from GBP100bln pa to GBP75bln, but the MPC may suggest both that it may shift the maturity of some gilt sales and also alter the rationale behind the decision too. This could have the effect of boosting the longer end of the gilt market (reducing longer term yields) as the supply burden it has faced in recent months is reduced. If so this could prove negative for GBP, although in practice movements in short term real yield spreads remain the main driver for EUR/GBP, and these are unlikely to be much affected. In the short run, EUR/GBP has also been impacted by movements in EUR/USD, with EUR strength against the USD tending to translate into strength against GBP. On this basis, there is scope for EUR/GBP to test the upside above 0.87 if EUR/USD holds levels above 1.1850.

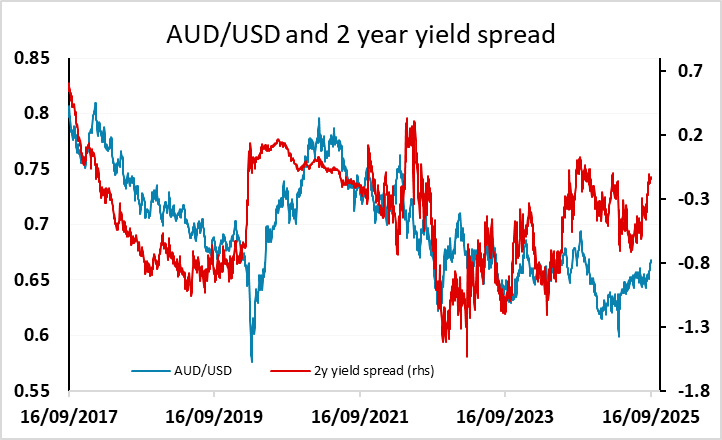

Ahead of the BoE meeting we have employment data from Australia. The AUD has been one of the best performers in recent days, breaking to new high from the year above 0.6650, and with yield spreads having moved significantly in the AUD’s favour, there looks to be more scope for AUD gains if risk sentiment remains positive. The consensus for the Australian employment data is a very similar report in August to that seen in July. If that is the case, we would favour the AUD upside provided that risk appetite hasn’t been undermined by the FOMC decision.

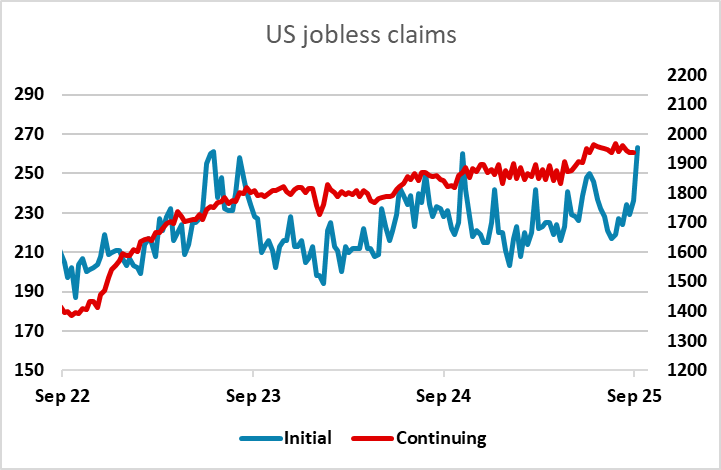

US jobless claims and the Philadelphia Fed survey are the US numbers for Thursday. There continues to be significant interest in the claims data as a potential leading indicator for the employment report, as weakness in US employment look like the main risk to the US economy. The sharp rise in initial claims last week had a negative USD impact, but a recovery is expected this week. The risk seems to be that the recovery doesn’t come, in which case expected renewed USD weakness.